2 overbought cryptocurrencies to avoid buying this week

![]() Cryptocurrency Mar 16, 2025 Share

Cryptocurrency Mar 16, 2025 Share

The cryptocurrency market remains largely in a consolidation phase, led by Bitcoin (BTC), which is pushing to make a decisive break above the $85,000 resistance while targeting the $90,000 mark.

Despite the suppressed price movement, several digital assets are exhibiting increased buying pressure that has elevated them into overbought territory, historically serving as a precursor to price corrections.

While short-term traders might still find opportunities in such an environment, the risk of a downturn from the overbought conditions outweighs the potential rewards, hence the need to avoid the following two cryptocurrencies next week.

Picks for you

XRP ‘setting up for a bull rally to $15’, says expert 4 hours ago XRP price prediction as number of addresses hits 7 million record high 1 day ago Commodity strategist warns Bitcoin could drop to $10,000 1 day ago Expert identifies Solana's path to $4,000 1 day ago

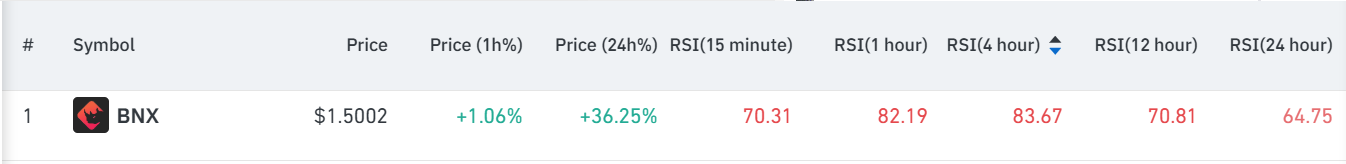

BinaryX (BNX)

BinaryX (BNX) has recently gained popularity in the cryptocurrency market, recording massive capital inflows. The token, trading at $1.49 as of press time, has seen a 37.49% rise over the past 24 hours.

Although these short-term gains might be tempting to investors, the token’s 15-minute relative strength index (RSI) of 74.78, coupled with 1-hour, 4-hour, and 12-hour RSI values of 82.13, 83.32, and 70.53, respectively, indicate that BNX is in overbought territory.

BNX price and RSI reading. Source: Coinglass

BNX price and RSI reading. Source: Coinglass

Generally, an RSI above 70 suggests an asset may be overvalued and due for a pullback.

Indeed, given the platform’s increased on-chain initiatives, there is growing activity around BNX that is making it too hot to make purchases at the moment.

In particular, the GameFi token is set to rebrand to Four (FORM), with leading exchanges like Bitget and Binance supporting the transition. The rebranding and a 1:1 token swap aim to refresh the project’s identity.

Although the short term might present increased volatility for BNX, the token’s long-term outlook remains strong, given that it has notable investment backing from entities such as Binance Labs.

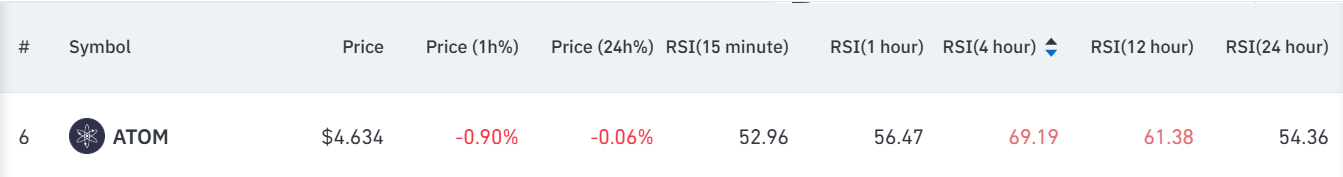

Cosmos (ATOM)

Cosmos (ATOM) has been among the standout movers amid the suppressed market conditions. For context, ATOM’s price has risen for five consecutive days, coinciding with sustainable demand as its futures open interest increased.

ATOM was trading at $4.702 as of press time, gaining 2.66% over the past 24 hours.

ATOM price and RSI reading. Source: Coinglass

ATOM price and RSI reading. Source: Coinglass

Despite this steady growth, the RSI metrics, 68.75 (15 minutes), 62.51 (1 hour), 71.14 (4 hours), and 62.62 (12 hours), suggest that ATOM is approaching overbought conditions, hinting at the possibility that the asset’s upward momentum might be overstretched.

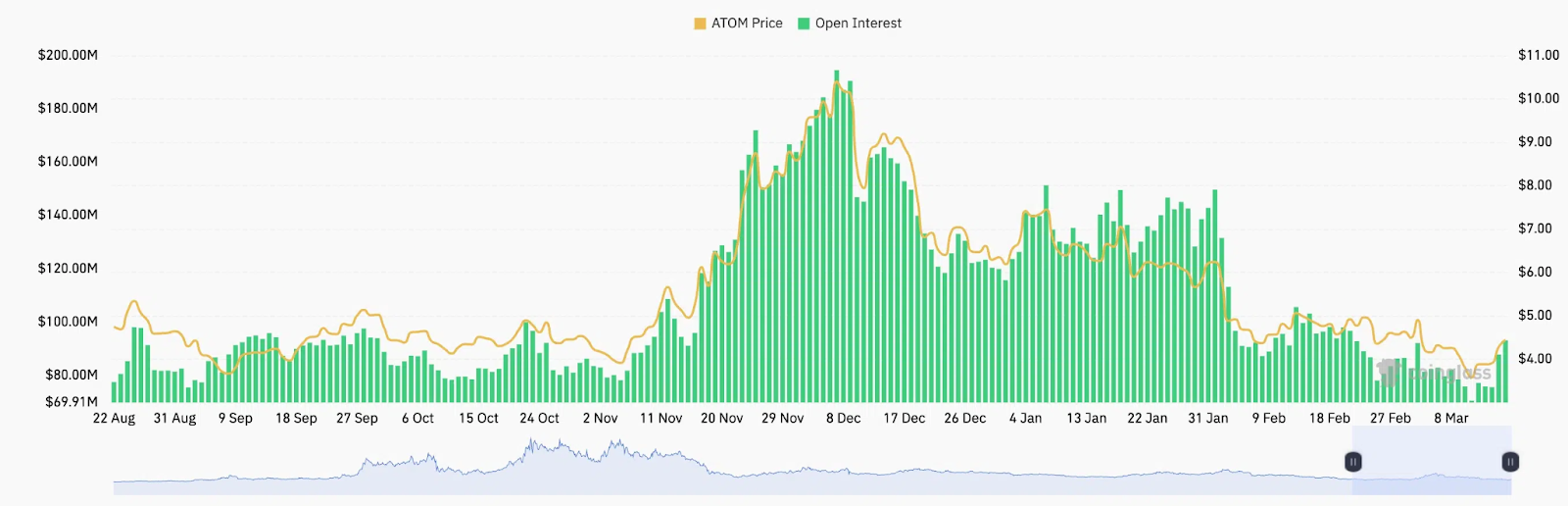

Notably, as of March 15, ATOM’s futures open interest surged to $93 million, the highest since February 2021. This metric tracks unfilled put and call orders, and rising open interest often signals a crypto rebound. However, the current overbought conditions call for caution.

ATOM open interest chart. Source: Coinglass

ATOM open interest chart. Source: Coinglass

While a high RSI suggests that the two highlighted digital assets are in overbought territory, it does not necessarily mean an immediate correction is imminent. However, it serves as a signal for caution, as historically, such conditions have preceded pullbacks.

Featured image via Shutterstock