2 signals that a memecoin is a rug pull created to get your money

![]() Cryptocurrency Oct 26, 2024 Share

Cryptocurrency Oct 26, 2024 Share

The memecoin mania is back to the cryptocurrency market with even more euphoria, more efficient tools to give traders an edge, and more elaborated scams, or rug pulls, created to extract liquidity and get people’s money.

In this context, a self-proclaimed “professional rugger puller” posted two signals memecoin traders should watch to spot and avoid grifters. A rug pull in crypto happens when a project or token is created without a long-term goal. Instead, its goal is to attract easy liquidity, get people’s money, and exit for the next scheme.

The X account, scooter, explained how identifying “sniping” and “wash trading” can help to avoid the most obvious scams in memecoins. To conclude, he explained that people should do basic research before buying anything.

Picks for you

Here’s how Cardano taps into Bitcoin’s $1.3 trillion liquidity 17 hours ago S&P 500 rallies to best 12-month performance since 1954 — What’s next? 18 hours ago U.S. government takes action after hacker returns $19 million stolen crypto 18 hours ago Tesla stock price prediction if Kamala Harris wins Presidency 20 hours ago

3) My last word of advice for surviving the current trench meta is to do basic research. A good AI is something a that takes months / years to properly develop. Realistically a good AI dev or bot will be well funded and have a good or well known doxxed developer backing it. So… pic.twitter.com/koShC7F1Yg

— scooter (@imperooterxbt) October 25, 2024

Watch out for sniping and wash trading

First, the “professional rugger puller” mentioned a high amount of “snipers” as a considerable red flag to watch out for. Sniping is a practice created in the Solana (SOL) memecoin ecosystem, consisting of using bots to buy new tokens early.

These bots scan the blockchain to spot recently created liquidity pools of new memecoins and buy them right after launch. While sniping-bot services are available to acquire on the internet, good AIs “take time to set up,” according to scooter.

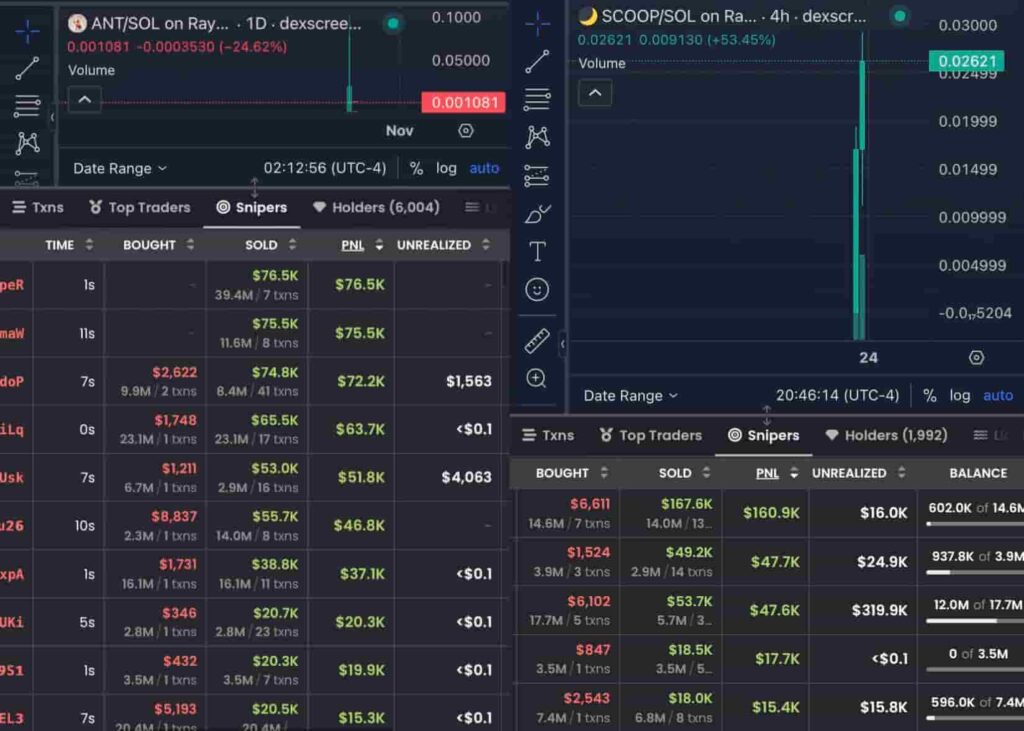

Therefore, memecoins with a high amount of very early snipers could suggest it is a ru pull, pre-planned by insiders. The anonymous grifter posted two examples of what he called “farms ran by grifters,” looking at the “Snipers” tab.

ANT and SCOOP Snipers dashboard. Source: dexscreener.com / scooter

ANT and SCOOP Snipers dashboard. Source: dexscreener.com / scooter

Moreover, scooter pointed out wash-trading indicators as an easy way to spot memecoin rug pulls. As explained, “grift teams preload funds and manipulate price and volume” to attract new buyers motivated by FOMO.

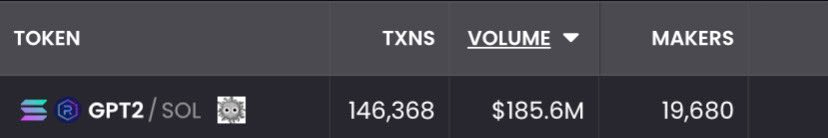

The most recent rug pulls were all from tokens with impressive volume, achieved through “volume bots” or manual wash trade. These are usually spotted through a high number of makers and transactions and a significantly large volume.

GPT2/SOL transactions, volume, and makers. Source: scooter

GPT2/SOL transactions, volume, and makers. Source: scooter

What are rug pulls in crypto and memecoins?

The rug pull concept became popular in the 2017 cycle, with the first altcoin boom that simulated legitimate cryptocurrency projects. In 2021, rug pulls reappeared for play-to-earn crypto games, pretending to be real gaming products with real long-term value.

However, this cycle’s rug pulls are surging in the memecoin boom, which brings a remarkable difference from previous cycles. The difference is that these highly speculative Solana-based memecoins are not even pretending to have any meaningful organic demand at all. Interestingly, the idea surged from an intention to create active communities and foment a collaborative culture in the crypto space, now mostly hijacked by greed.

Traders who buy into memecoins do not expect a long-term investment into promising altcoins or to have fun while earning tradeable rewards in a well-designed game. They want to be early in a “greater fool” financial scheme, to exit at a higher price later, selling to a “greater fool” than themselves.

Essentially, everyone buying into these memecoins for speculative reasons is trying to, effectively, rug-pull the next buyer, risking the same. In this highly competitive player-versus-player zero-sum game, participants try to find an edge against their opponents.

This edge can be achieved through accessible tools like sniping bots. Yet, it could also appear in arguably malicious ways, like via insider trading or influential figures openly promoting rug pulls and grifting their followers.

In closing, the best way to avoid buying into a memecoin rug pull is to rethink the goals and motivations for the purchase in the first place. If the primary goal is to sell everything as fast as possible for the highest possible gain to laggards, chances are to be joining a “greater fool” speculative bubble, risking becoming the “greatest fool” of this game.