5 promising cryptocurrencies Coinbase just added to the COIN50 index

![]() Cryptocurrency Dec 3, 2024 Share

Cryptocurrency Dec 3, 2024 Share

Coinbase Institutional announced it is adding five new cryptocurrencies to the Coinbase 50 Index (COIN50), suggesting these are promising investments. The index counts with a “robust methodology” to diversify with a “rigorous fundamental and eligibility screening,” as Coinbase describes it.

On December 2, the official account posted about the update on X, mentioning the five additions. As communicated, Axie Infinity (AXS), Blur (BLUR), Jasmy (JASMY), Kusama (KSM), and MultiversX (EGLD) have joined the Coinbase 50 Index.

This quarter, we welcomed five new entrants to the Coinbase 50 Index. Learn more about the index and our rebalancing process here: https://t.co/skboZ7Hdfg@AxieInfinity @blur_io @JasmyMGT @kusamanetwork @MultiversX pic.twitter.com/LVIhuFdg2l

— Coinbase Institutional 🛡️ (@CoinbaseInsto) December 2, 2024

On November 13, Coinbase announced the listing and offering expansion of six new cryptocurrencies to New York citizens, as Finbold reported. MultiversX was the common point among the listing and the COIN50 index relabancing, which indicates a promising opportunity as the bull market develops.

Picks for you

Beware: This pattern could trigger a Bitcoin crash below $90,000 2 hours ago What’s next for Terra Classic after LUNC’s 80% rally 2 hours ago Uranium.io, a uranium trading dApp powered by Tezos, goes live 3 hours ago Orbitt unveils a staking program with $2 million in rewards 4 hours ago

COIN50 performance against the cryptocurrency market and BTC

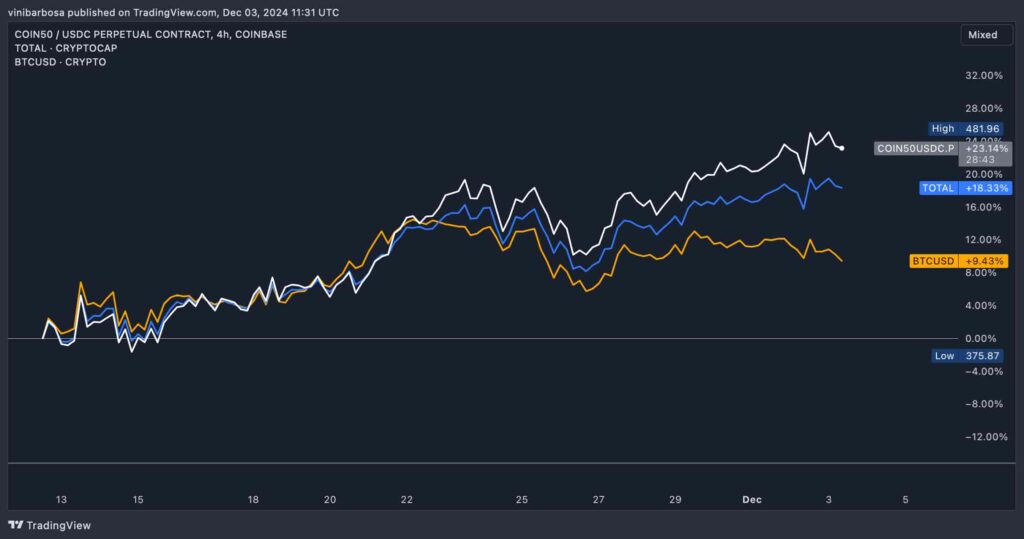

Notably, COIN50 was launched for trading on Coinbase on November 12, 2024, and is already outperforming the cryptocurrency market. Finbold looked at a comparison against Bitcoin (BTC) price and TradingView’s Crypto Total Market Cap Index (TOTAL) since its launch.

Trading at around $475 by press time, the Coinbase 50 Index is up over 23% since November 12. In comparison, TOTAL has surged by 18.33%, with a $3.38 trillion capitalization, and Bitcoin is up 9.43% while trading below $95,000.

Therefore, COIN50 perpetual contracts outperformed each by approximately 5% and 14%, suggesting a robust and promising setup.

COIN50 Perps vs. TOTAL and Bitcoin, a four-hour chart since launch. Source: TradingView / Finbold / Vini Barbosa

COIN50 Perps vs. TOTAL and Bitcoin, a four-hour chart since launch. Source: TradingView / Finbold / Vini Barbosa

How is the Coinbase 50 Index built?

With quarterly rebalances, the Coinbase 50 Index currently consists of 50 cryptocurrencies weighted by their circulating market cap. In particular, the top three assets—BTC, Ethereum (ETH), and Solana (SOL)—account for 85% of the total allocations. Each has 50%, 28.8%, and 6.4% of the COIN50 weight, respectively.

Ripple (XRP) and Dogecoin (DOGE) sum up to the top five with 2.9% and 1.4% each. The 45 other assets account for 10.4% of the index, now adding AXS, BLUR, JASMY, KSM and EGLD.

Coinbase 50 Index (COIN50) composition. Source: Coinbase Institutional / Finbold

Coinbase 50 Index (COIN50) composition. Source: Coinbase Institutional / Finbold

Interestingly, JASMY, EGLD, AXS, BLUR, and KSM rank in the 35th, 37th, 38th, 46th, and 48th positions of COIN50, respectively. Their index weights go from 0.08% to 0.03%, according to the Coinbase 50 Index fact sheet.

Comparatively, they are ranking in the 64th (JASMY), 92th (EGLD), 84th (AXS), 126th (BLUR), and 135th (KSM) positions from CoinMarketCap. Thus, surging to meet Coinbase Institutional’s rank expectations would mean a significant price increase for each of these digital assets.

While prices and, then, the market cap of cryptocurrencies can quickly change with high volatility, looking at index ranks can give investors a solid benchmark to spot over or undervalued assets to buy and build their own portfolios.

Featured image from Shutterstock.