In the last couple of days, Bitcoin (BTC USD) has seen its price fluctuate between a low of $102,335.72 and a high of $106,428.81.

The price action makes it look like BTC has stagnated within this price range, unable to retest its all-time high (ATH) of $109,114.88.

Despite Bitcoin’s price being less than 3% away from this historic peak, it appears stuck.

This has fueled speculations in some quarters that Bitcoin might have been overbought and might not record further growth.

What Bitcoin’s Mayer Multiple Indicates

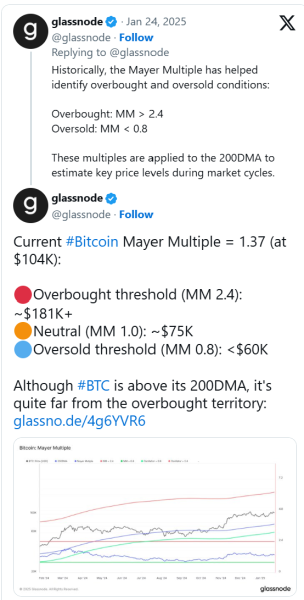

Glassnode, a leading on-chain and financial metrics platform, has addressed these concerns.

Relying on Bitcoin’s Mayer Multiple (MM) indicators, Glassnode noted that Bitcoin is not oversold yet.

– Advertisement –

It said the price would need to exceed $181,000 before falling into the overbought zone.

Other analysts have even projected a higher price range between $145,000 and $249,000. These relied on Bitcoin’s price multiplier trends.

For clarity, the Mayer Multiple (MM) is a popular metric created by Trace Mayer. It helps assess whether Bitcoin has been overbought, oversold, or traded in a neutral zone.

This is usually benchmarked against its historical price pattern.

Source: X

Source: X

It is obtained by dividing the current price of Bitcoin (BTC USD) by its 200-day moving average. Depending on the value obtained, analysts could determine if Bitcoin is either overvalued or undervalued.

It is worth mentioning that the tool does not indicate if an investor should buy, hold, or sell Bitcoin.

The current Bitcoin MM value as the asset’s price hovers around $104,000 is 1.37. This indicates that Bitcoin’s price is 1.37 times its 200-day moving average.

It signals positive momentum for the digital asset as it remains within the neutral zone and not yet in the overbought territory.

Bitcoin (BTC USD) Path to $181,000: Bull Run Just Beginning?

The Bitcoin MM indicator provides insight into the likely price trajectory for the world’s leading digital coin.

The MM level has to rise above 2.4 or $181,000 for BTC to flip into the overbought zone. At that level, it implies that the Bitcoin market has become overheated and may crash.

As of this writing, Bitcoin price trades at $106,123.90, representing a 1.18% increase in the last 24 hours.

The current price level shows Bitcoin (BTC USD) still has about $74,000 to expand per the MM indicator.

Experts suggest that Bitcoin’s bull run has not commenced, given the huge price gap between its current and projected prices.

They maintain that while Bitcoin’s price has risen above the 200-day moving average, it is still far from being overbought.

This is because the current MM value of 1.37 is well below the overbought threshold of 2.4.

It suggests that Bitcoin’s market remains healthy and performing well, with potential for further growth.

Bitcoin Key Support Levels

Bitcoin in the broader crypto market has managed to stay above the psychological level of $100,000.

The coin has found support at $100,700 as it has not dropped below this level in the last four days.

Market observers say BTC must find support above the $104,000 price mark to record higher performance.

Additionally, investors need to revive their interest in the asset as trading volume has dipped significantly.

As of this writing, Bitcoin’s trading volume has suffered a 13.74% decline to $71.97 billion.

Analysts opine that a rebound in investors’ confidence and broader market dynamics could set Bitcoin on an upward journey toward the $181,000 price projection.