AI predicts XRP price for February 28, 2025

![]() Cryptocurrency Feb 4, 2025 Share

Cryptocurrency Feb 4, 2025 Share

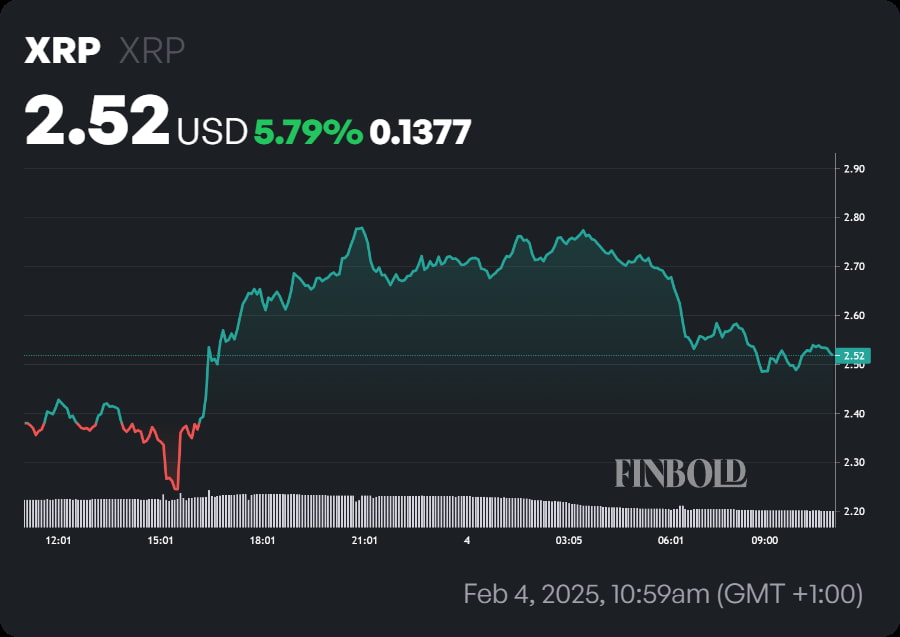

XRP is up by almost 5.8% in the last 24 hours, trading at $2.52. Nevertheless, the token is still down since last week, with a drop of almost 19% impacted by the broader cryptocurrency market sell-off in recent days.

XRP 24h price chart. Source: finbold.com

XRP 24h price chart. Source: finbold.com

AI predicts XRP price

After a significant sell-off, XRP rebounded from its recent lows, and it’s currently looking at an upward trajectory. Hence, Finbold consulted its artificial intelligence (AI) price prediction tool to find out what the XRP price will be at the end of this month—Friday, February 28.

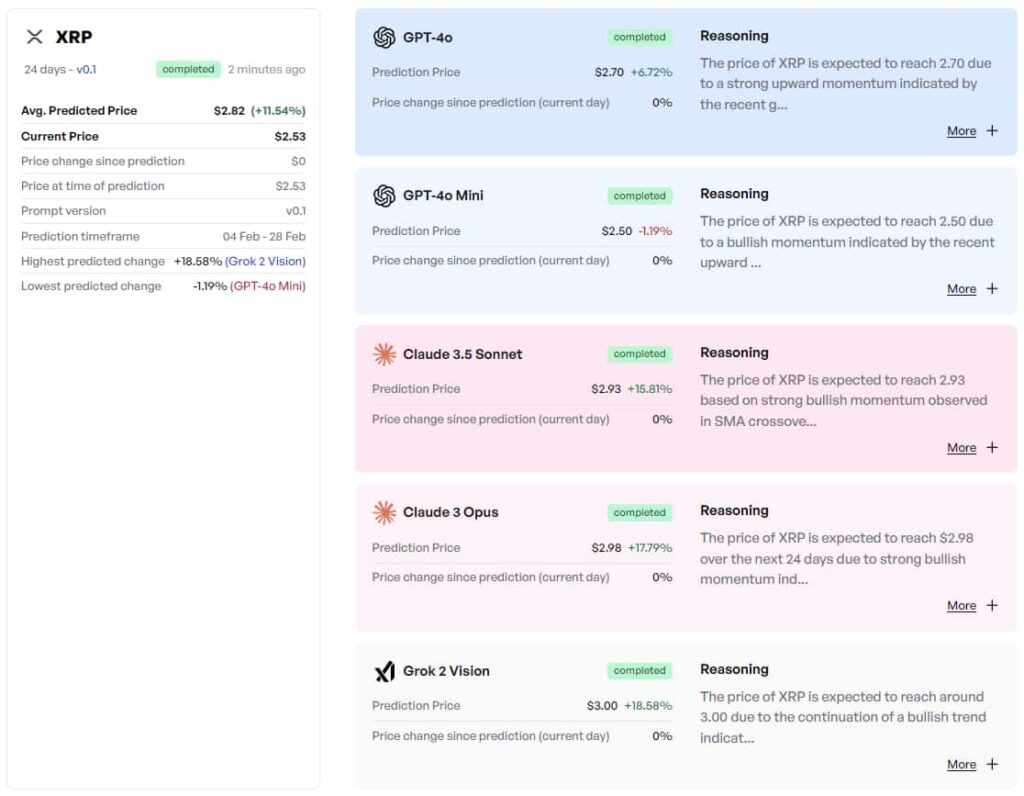

Finbold XRP price prediction. Source: finbold.com

Finbold XRP price prediction. Source: finbold.com

According to the five AI models used for prediction, XRP will experience a solid uptick, leading to an average price of $2.82 which is a jump of more than 11.5%.

Picks for you

Blaze switches from Snowlake to Space and Time 4 seconds ago DeepSeek AI predicts Ethereum price as Eric Trump says 'it's a great time to add ETH' 24 mins ago Can XRP hit $6 amid the market's current recovery wave? 3 hours ago Tesla shipped nearly 4,900 vehicles a day in 2024 4 hours ago

The highest predicted price change comes from Elon Musk’s Grok 2 Vision AI model, predicting XRP to go up by a whopping 18.58% and trade at $3.

Similarly to Grok, Claude 3 Opus is also rather optimistic, with a prediction of a 17.79% jump, resulting in a price of $2.98.

On the other hand, the only AI model that suggests a price drop is ChatGPT-4o Mini which predicts a slight drop of 1.19%, keeping XRP at exactly $2.50.

Analysts’ take on XRP price

Following a sharp downward trend, XRP surged over 25% from its recent lows and is now trading above $2.50, with analysts remaining optimistic and forecasting a potential rise to just under $6 after setting the stage for Wave 5 of its Intermediate Cycle.

Key technical indicators suggest a potential upward rally, with XRP possibly breaking past critical resistance levels and targeting new highs around $4 to $6.

Overall, while there is a positive outlook, the market remains uncertain, and investors are advised to stay alert to trading volumes and market sentiment.

Featured image via Shutterstock