Sell alert! Crypto expert warns XRP headed for massive crash

![]() Cryptocurrency Feb 25, 2025 Share

Cryptocurrency Feb 25, 2025 Share

Prices have been moving fast in the cryptocurrency market on February 25, with hundreds of millions of dollars erased in a bloodbath that has taken Bitcoin (BTC) below $89,000 for the first time since November and Ethereum (ETH) below $2,400 for the first time since October.

XRP, one of the most prominent tokens in the world, in no small part thanks to Ripple Labs’ long legal battle with the SEC, has not been spared either and has plunged a total of 18.50% in the last 7 days to its press time price of $2.11.

XRP 7-day price chart. Source: Finbold

XRP 7-day price chart. Source: Finbold

Furthermore, having lost its previous and critical support level near $2.30, XRP now appears poised for an even greater crash, and a prominent on-chain analyst, Ali Martinez, is now predicting a fall to lows not seen since the early days of the Donald Trump re-election rally.

Picks for you

Bitcoin falls below $90,000 – Key levels to watch for the next move 2 hours ago R. Kiyosaki ‘glad’ he bought gold at $2,900 as economist drops unbelievable new price target 2 hours ago Fetch.ai launches ASI-1 Mini large language model 2 hours ago Pundi AI teams up with Monad, T+ Wallet, and Numbers Protocol to promote AI data accessibility 5 hours ago

Is XRP set for a massive crash?

Specifically, in an X post posted in the small hours of February 25, Martinez explained that XRP is breaking out of its previously established ascending parallel channel. According to the expert, the token is now targeting $1.65, meaning that a further 22% downside is likely ahead.

$XRP is breaking out of an ascending parallel channel, targeting $1.65! pic.twitter.com/7WhTmy7mLf

— Ali (@ali_charts) February 25, 2025

Though the core reason for the downside appears not to be related to XRP itself, it is likely to have a significant impact on the cryptocurrency’s performance in the foreseeable future.

The token’s previous bullish setup — a setup that had the potential to take it back above $3 and possibly to new highs — was highly dependent on the now-lost $2.30 support level, as Finbold reported on February 24.

Still, there remains a chance that the XRP plunge will not be as severe as the token still has support near $2.08 and near $1.85, meaning there remains a possibility it will not reach its bearish target of $1.65.

Why the crypto market is crashing

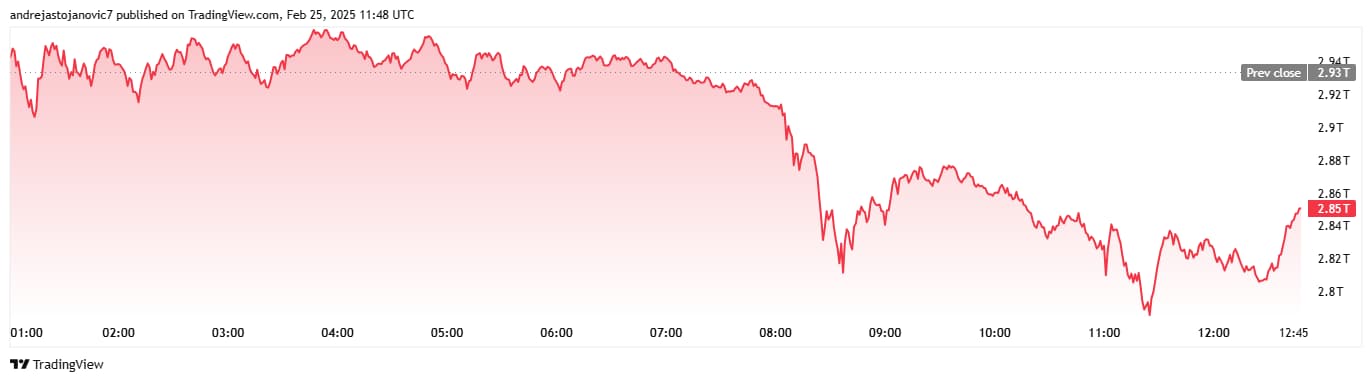

Simultaneously, it is difficult to gauge just how low XRP could collapse, given the strength of the bearish momentum affecting the entire cryptocurrency market. For example, by press time on February 25, the total digital assets’ market capitalization collapsed approximately $100 billion within just 24 hours.

Cryptocurrency market capitalization 24-hour chart. Source: TradingView

Cryptocurrency market capitalization 24-hour chart. Source: TradingView

Additionally, a lack of a clear reason behind the bloodbath also makes gauging its eventual impact difficult, though it appears likely the causes were, once again, external.

Specifically, the start of the downturn coincided with President Donald Trump’s confirmation that his planned tariffs against Mexico and Canada would be implemented after the postponement period elapses.

The situation is akin to other recent examples of digital assets having a violent reaction to seemingly unrelated events. The cryptocurrency market experienced a major wipe during the Silicon Valley plunge in the wake of DeepSeek artificial intelligence’s (AI) release in late January.

Similarly, Operation True Promise 2, Iran’s October missile attack against Israel, triggered a strong Bitcoin price drop.

Still, the fact external and seemingly unrelated events have an outsized impact on cryptocurrencies is, perhaps, not surprising. Historically, digital assets have had positive reactions to, equally apparently, unconnected happenings.

The great rally of 2024 and 2025 was, after all, driven primarily by Donald Trump’s re-election.

Featured image via Shutterstock