The rate at which corporate and private institutions adopt the Bitcoin standard has surged extensively in the past year as the asset continues to go mainstream.

Confidence in Bitcoin has grown faster than that of any other asset class in history. The pioneering cryptocurrency has seen staggering mainstream adoption recently, mirroring that seen in the internet’s early days.

A recent report details this growing embrace of the asset, once seen as a bubble. According to the piece published by Bitcoin-only financial institution Rivers Financial, the adoption rate has increased extensively in the past two years.

Public Companies Massively Stacking Bitcoin

The Tuesday report discloses that the adoption rate among public companies has increased by an impressive 80% since January 2024, with 81 firms now holding Bitcoin on their balance sheets. Reminiscing further backward, the numbers have grown by 139% since 2023, with three Nasdaq 100 and two S&P 500 companies now adopting the Bitcoin standard.

Notably, this escalating adoption follows the burgeoning feat Strategy (formerly MicroStrategy) achieved by simply adopting Bitcoin as its primary reserve asset. For context, its stock MTSR has surged a jaw-dropping 1,752% in five years, recently entering the Nasdaq 100, due to its impressive performance.

Recently, public firms like Matador, Kurl Technology, Rumble, and Metaplanet, to mention but a few, adopted the Bitcoin standard. This bias has further indicated confidence in the largest cryptocurrency by market cap.

Top 70 Firms Holding Bitcoin

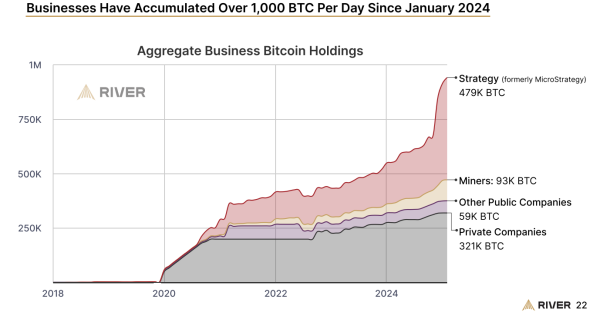

Businesses Acquiring Over 1,000 BTC per Day Since 2024

Meanwhile, the River report further highlighted the increasing number of Bitcoin acquisitions by both old and new Bitcoin standard adopters. According to the piece, businesses are acquiring 1,000 bitcoins every day since January 2024.

Strategy has led this Bitcoin-hungry pack with its incessant purchases. On Monday, the business intelligence firm acquired 20,356 BTC, bringing its stash to 499,096 BTC ($43 billion).

In total, public companies hold over 652,000 BTC, with a chunk of them in Strategy’s custody.

Bitcoin Holding per River Financial

Bitcoin Holding per River Financial

Changes in Bitcoin Ownership

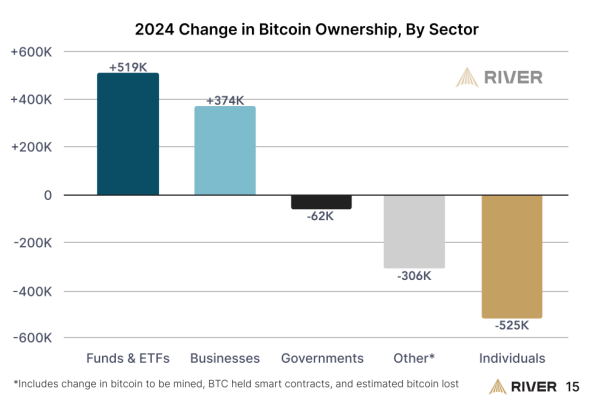

The report also highlighted a shift in Bitcoin’s distribution among entities. Businesses and exchange-traded funds (ETFs) came to the party last, substantially depreciation holdings among other groups holding the asset.

For context, institutional traction towards Bitcoin saw ETFs and other funds amass over 519,000 BTC and businesses 374,000 BTC in 2024. This distribution shift cost individuals, governments, and other entities 893,000 BTC last year.

Change In Bitcoin Ownership

Change In Bitcoin Ownership

Nonetheless, data shows there is more room for expansion. Despite the growing numbers, under 1% of publicly traded companies have gained exposure to Bitcoin, an indicator the asset has more balance sheets to enter.