3 stocks to buy if US creates strategic Bitcoin reserve

![]() Stocks Jul 30, 2024 Share

Stocks Jul 30, 2024 Share

Republican presidential candidate Donald Trump recently announced plans to create a Bitcoin (BTC) strategic reserve, a potentially monumental factor in the financial markets. Trump stated that if elected, he would ensure the United States maintains all Bitcoin it currently holds or acquires in the future as a strategic asset.

This potential policy shift could significantly impact various sectors, especially those closely linked to Bitcoin and blockchain technology. Here are three stocks that stand to benefit if the US moves forward with this plan.

Coinbase Global (NASDAQ: COIN)

As one of the largest cryptocurrency exchanges in the world, Coinbase (NASDAQ: COIN) stands to gain significantly from increased governmental and institutional adoption of Bitcoin. With the US government potentially holding a large Bitcoin reserve, the demand for secure and compliant platforms for trading and custody will likely increase. Coinbase’s established infrastructure and regulatory compliance make it a prime candidate for managing these assets.

Picks for you

2 cryptocurrencies to reach $10 billion market cap in August 10 hours ago AI predicts Solana (SOL) price post-SEC pivot on Binance case 11 hours ago Here’s why XRP could hit $18 in September, according to analysts 12 hours ago 'Rich Dad’ R. Kiyosaki reveals the only 3 cryptocurrencies worth buying 14 hours ago

It’s worth noting that Coinbase has been expanding its services, including custody solutions for large-scale institutional investors, which would align well with the needs of a national Bitcoin reserve.

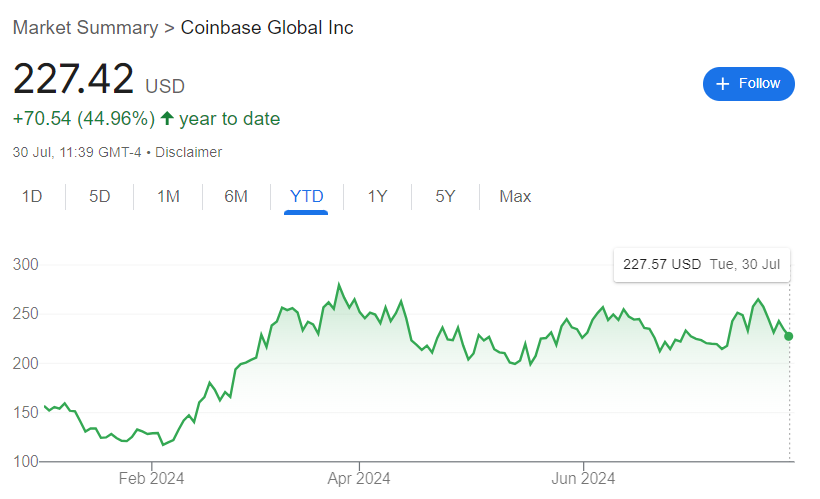

Overall, COIN has traded in a bullish zone throughout 2024, and any government involvement in Bitcoin could be a key boost for equity.

As of press time, Coinbase was trading at $227. In the short term, the stock has faced bearish sentiments, dropping over 12% in the past week, but on a year-to-date basis, COIN is up 45%.

Coinbase (NASDAQ: COIN) price chart. Source: Google Finance

Coinbase (NASDAQ: COIN) price chart. Source: Google Finance

MicroStrategy (NASDAQ: MSTR)

MicroStrategy (NASDAQ: MSTR), a business intelligence firm, has been a notable institutional investor in Bitcoin. Its former CEO, Michael Saylor, is a prominent Bitcoin advocate, and the company has accumulated substantial Bitcoin holdings as part of its treasury strategy.

If the US adopts Bitcoin as a strategic reserve asset, it could validate MicroStrategy’s investment approach, potentially boosting its stock value and encouraging other firms to follow suit.

Notably, MicroStrategy continues to purchase Bitcoin, reinforcing its position as a leader in corporate Bitcoin adoption. The company’s stock often moves in tandem with Bitcoin prices, which would likely surge under the proposed strategic reserve policy.

In the meantime, MSTR is up over 135% in 2024, trading at $1,613 as of press time.

MicroStrategy (NASDAQ: MSTR) price chart. Source: Google Finance

MicroStrategy (NASDAQ: MSTR) price chart. Source: Google Finance

Marathon Digital Holdings (NASDAQ: MARA)

Marathon Digital (NASDAQ: MARA) is one of the largest Bitcoin mining companies in North America. A government move to hold Bitcoin as a reserve asset would likely lead to increased demand for newly mined Bitcoin and potentially higher prices. Marathon’s significant mining operations would benefit from any rise in Bitcoin’s value.

At the same time, Marathon has been expanding its mining capacity and holdings. The company recently added $100 million worth of Bitcoin to its reserves, positioning itself to capitalize on any upward movement in Bitcoin prices.

Among the stocks, MARA is the only one to experience a negative 2024. By press time, the stock was trading at $20, down 12% in 2024.

Marathon Digital (NASDAQ: MARA) price chart. Source: Google Finance

Marathon Digital (NASDAQ: MARA) price chart. Source: Google Finance

In conclusion, the potential establishment of a Bitcoin strategic reserve by the US could revolutionize the financial landscape and drive significant growth in companies directly involved with the asset. In this line, Coinbase, MicroStrategy, and Marathon Digital are well-positioned to benefit from such a policy change, making them compelling options for investors looking to capitalize on this development.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.