Bitcoin has to fall this low for Michael Saylor’s Strategy to lose money

![]() Stocks Mar 10, 2025 Share

Stocks Mar 10, 2025 Share

Strategy (NASDAQ: MSTR) – formerly known as MicroStrategy – has been suffering from a period of stock market decline in recent trading.

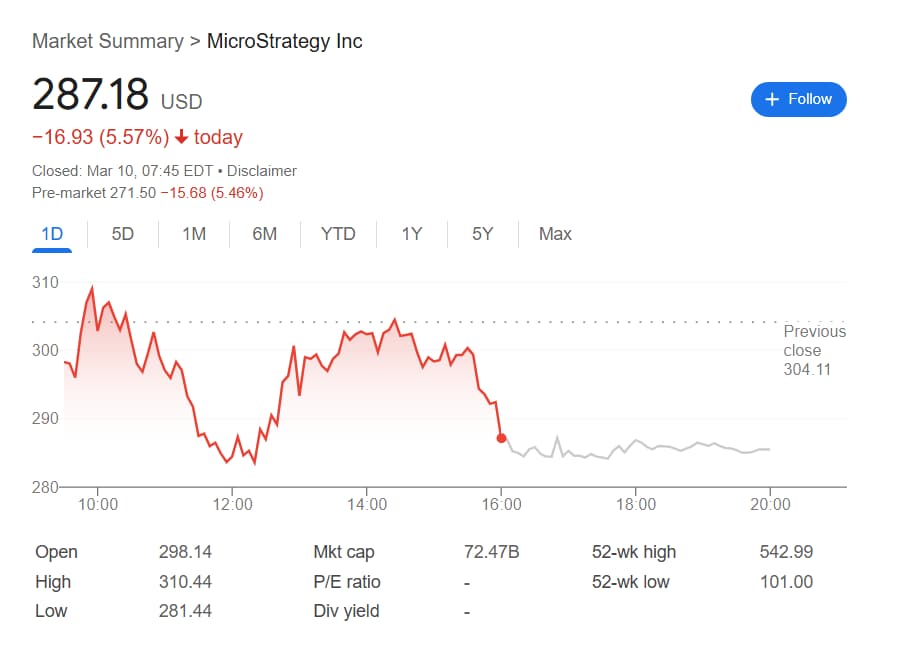

Specifically, MSTR shares experienced a 5.57% drop on Friday, March 7, to their latest closing price of $287.18, and an equally sharp collapse of 5.46% in the extended session, leading to the Monday pre-market value of $271.50.

MSTR stock 1-day and Monday pre-market price chart. Source: Google

MSTR stock 1-day and Monday pre-market price chart. Source: Google

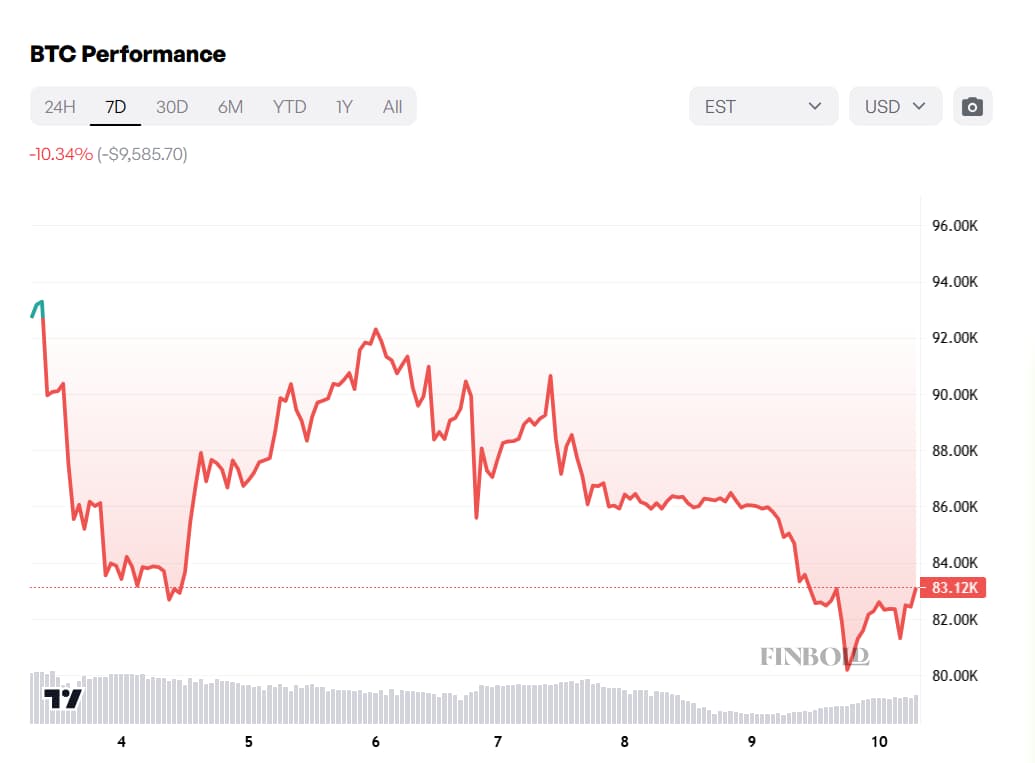

With Michael Saylor’s company facilitating investor exposure to Bitcoin (BTC) via vicarious ownership, it should come as no surprise that BTC’s own decline from $86,773 on Friday to $83,126 at press time has been one of the main reasons behind the stock price drop.

Picks for you

Bitcoin just made the biggest weekly price drop in history 10 mins ago Investors alert: Will Trump's 'fiscal detox' spark a wealth renaissance? 17 mins ago No-brainer Silver ETF to buy for 2025 1 hour ago Is Bitcoin price set to plunge below $75,000 3 hours ago

How safe is Strategy from a Bitcoin unrealized loss

Still, despite Strategy making numerous headlines in recent months thanks to its buying of a vast quantity of Bitcoin near the cryptocurrency’s all-time high (ATH), shareholders do not yet have to fear that the company would face losses due to the coin’s price decline.

Indeed, Michael Saylor’s firm has, essentially, been dollar-cost-averaging (DCA) into its vast BTC treasury and, though there is some variance between sources, has significant room before taking an unrealized loss on its digital assets.

Strategy’s average Bitcoin purchase price is estimated as within the $62,473 – per BiTBO – and $66,357 – per Lookonchain.

Given that BTC is changing hands at $83,126 at press time, an unrealized loss remains relatively distant for Strategy despite the $9,585 weekly drop, hinting that a risk does exist.

BTC one-week price chart. Source: Finbold

BTC one-week price chart. Source: Finbold

Why Bitcoin price is falling

Bitcoin’s drop – a key driver behind MSTR’s stock price fall – can be linked to several external factors.

Cryptocurrencies have been relatively reactive to macroeconomic news. President Donald Trump’s escalating and ever-shifting trade war has, so far, generated multiple bloodbaths.

Furthermore, the selloff in the stock market appears to have reinforced the decline of digital assets.

Simultaneously, despite being anticipated to be a bullish catalyst, the issue of a strategic Bitcoin – or crypto more broadly – reserve has only deepened the downturn.

After making promises that led the community to hope a reserve would be established in the first weeks of the administration, President Trump issued little more than additional vague promises.

The latest of these has seemingly been particularly damaging as, despite the decisive wording, a lack of an actual buying mechanism means that the U.S. is no closer to stockpiling cryptocurrencies than when Trump was on the campaign trail.

Simultaneously, the matter of the reserve may have amplified MSTR stock’s drop. The firm’s equity has been susceptible to alternative ways for people to gain exposure to the cryptocurrency market and the approval of the spot BTC exchange-traded funds (ETFs) in January 2024 also triggered a selloff.

Featured image via Shutterstock