As the U.S. gears up to launch a Strategic Bitcoin Reserve (SBR), spurred by President Trump’s Executive Order, North Korea has slyly vaulted into the top three global holders of bitcoin. This shift comes amid suspicions that a hacking syndicate—suspected to be orchestrated by the North Korean government—has been funneling illicit gains into BTC, turning digital heists into a shadowy national savings account.

North Korea’s Climb to Third Largest Government Bitcoin Holder

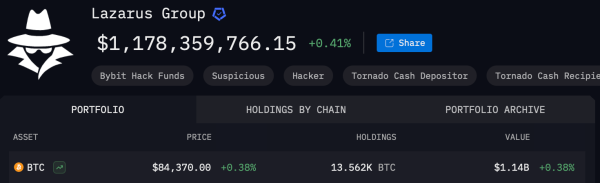

North Korea has quietly climbed the ranks to become a top government holder of bitcoin (BTC), thanks to the antics of the Lazarus Group, a hacking collective tied to the state. On Feb. 21, 2025, the group pulled off a jaw-dropping heist at Bybit, stealing over $1.4 billion in crypto—mostly ethereum—and later swapping a chunk of it into BTC. Data from Arkham Intelligence reveals the syndicate now sits on 13,562 BTC, worth a cool $1.14 billion, turning the cybercrime into a national piggy bank.

Lazarus Group BTC stash on March 16, 2025, according to Arkham Intelligence.

Lazarus Group BTC stash on March 16, 2025, according to Arkham Intelligence.

Pyongyang’s crypto stash started growing long before the U.S. floated its Strategic Bitcoin Reserve (SBR) idea. Yet, in a twist of timing, the buildup accelerated just days before President Trump teased the SBR on Sunday, March 2, 2025. He made it official by signing the Executive Order (EO) on Thursday, March 6, 2025, adding a dash of geopolitical intrigue to the digital currency drama. Arkham reports the U.S. sits pretty with 198,109 BTC—a significant $16.71 billion—making it the largest government holder of bitcoin (BTC).

The United Kingdom claims the silver medal with 61,245 BTC (roughly $5.17 billion). While the U.K. hasn’t hinted at launching its own SBR, it’s stacked up crypto spoils through criminal seizures, giving it a hefty stake in the top digital asset. This slots North Korea right behind Britain but ahead of Bhutan and El Salvador’s bitcoin caches. Bhutan’s stash, managed by Druk Holdings, clocks in at 10,635 BTC ($897.60 million). Meanwhile, El Salvador’s bitcoin stash totals 6,117 BTC, now valued at $516.11 million.

The timing of North Korea’s crypto climb—just as the U.S. unveiled its SBR—sparks curiosity. Could Kim Jong Un be angling for a seat at the digital gold rush, blending cyber-savvy with geopolitical gamesmanship? While Washington frames its reserve as strategic, Pyongyang’s playbook leans on shadows, turning stolen coins into a silent power move. Two nations, one token: a high-stakes dance of value and digits, where motives blur between policy and piracy.