2 cryptocurrencies to reach a $200 billion market cap in April

![]() Cryptocurrency Mar 19, 2025 Share

Cryptocurrency Mar 19, 2025 Share

The cryptocurrency market remains volatile as Bitcoin (BTC) struggles to break past the key $85,000 resistance level, weighed down by trade tensions and economic uncertainty.

However, while Bitcoin remains range bound, the altcoin market is experiencing renewed strength, supported by growing institutional interest and regulatory developments.

The global crypto market cap stands at $2.92 trillion, reflecting a 3.5% increase in the past 24 hours. Adding to the mix, the U.S. Federal Reserve’s decision to maintain interest rates could provide a mild boost to the market, setting a favorable backdrop for continued growth.

Picks for you

AI predicts Ethereum price for April 2025 8 hours ago XRP's 7-year pattern outlines path to $38 'conservative' price target 9 hours ago 48% of all 2025 unicorns work in AI sector 10 hours ago ChatGPT predicts XRP price for April 1, 2025 10 hours ago

Among altcoins, XRP and Solana (SOL) stand out, set to benefit from favorable market conditions, with analysts and investors closely watching their potential moves toward the $200 billion market cap milestone.

XRP

Currently trading at $2.19, XRP commands a market capitalization of $127.1 billion, with recent developments setting the stage for the cryptocurrency to potentially reach a $200 billion valuation in April, pushing its price to approximately $3.45.

XRP price and market cap. Source: Finbold

XRP price and market cap. Source: Finbold

A major catalyst driving this bullish outlook is the U.S. Securities and Exchange Commission’s (SEC) decision to drop its long-standing lawsuit against Ripple.

This marks the end of a four-year legal battle that, according to Ripple CEO Brad Garlinghouse, resulted in an estimated $15 billion in losses for XRP holders. The resolution of the case has restored investor confidence, removing a significant overhang on XRP’s market performance.

Following Ripple’s announcement, expectations surrounding the approval of an XRP exchange-traded fund (ETF) have intensified. According to data from prediction platform Polymarket, the odds of ETF approval have climbed to 79%, reflecting heightened optimism among traders and institutional investors.

Supporting this outlook, analysts at JPMorgan forecast that an XRP ETF could attract $3 billion to $6 billion in net inflows within its first year, injecting substantial liquidity and broadening XRP’s appeal to institutional investors.

Beyond regulatory clarity, XRP continues to expand its financial partnerships and plays a growing role in cross-border transactions. Notably, XRP’s inclusion in the U.S. crypto reserve, along with the recent accumulation of 150 million tokens by large accounts in mid-March, has further added to the optimism

Solana (SOL)

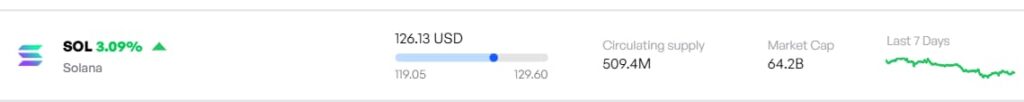

Currently trading at $126.13, Solana holds a market capitalization of $64.2 billion. For Solana to reach a $200 billion market cap, it would need to surge by over 211%, pushing its price to approximately $393.

Solana price and market cap. Source: Finbold

Solana price and market cap. Source: Finbold

A major catalyst boosting Solana’s outlook is the launch of the first-ever ETFs tracking Solana futures, marking a significant milestone for the cryptocurrency.

Asset manager Volatility Shares is set to introduce two ETFs, the Volatility Shares Solana ETF (SOLZ) and the Volatility Shares 2X Solana ETF (SOLT), which will begin trading on March 20.

While the U.S. SEC has yet to approve a spot Solana ETF, the debut of these futures ETFs highlights growing institutional interest.

According to Bloomberg Intelligence analysts, there is now a 75% chance that a spot Solana ETF will gain regulatory approval this year, a move that could unlock significant institutional capital and further solidify SOL’s position as a mainstream investment asset.

As both assets continue to expand their ecosystems and strengthen their utility, investors should closely monitor their progress, keeping an eye on potential catalysts and market shifts to capitalize on emerging opportunities in the months ahead.

Featured image via Shutterstock