AI predicts Ethereum price for April 30, 2025

![]() Cryptocurrency Apr 8, 2025 Share

Cryptocurrency Apr 8, 2025 Share

Ethereum (ETH), the world’s second-largest cryptocurrency by market capitalization, has had a turbulent start to 2025, plunging over 52% year-to-date to trade at $1,574 at press time.

Although the asset gained nearly 4.5% in the past 24 hours, it remains under sustained selling pressure, marked by a series of lower highs and short-lived rallies that have failed to establish a meaningful trend reversal.

Ethereum one-day price chart. Source: Finbold

Ethereum one-day price chart. Source: Finbold

The latest blow came after President Donald Trump announced sweeping tariff measures, including a 10% blanket tariff on all imports into the United States, set to take effect on April 9.

The announcement triggered a broad sell-off across global markets, wiping out roughly $300 billion from the cryptocurrency market over the weekend. Ethereum, which has underperformed the wider market, was no exception.

While the market has staged a modest rebound, sentiment remains fragile. Ethereum continues to struggle with weak momentum, leaving its near-term direction uncertain.

Finbold AI predicts Ethereum price target for April 30

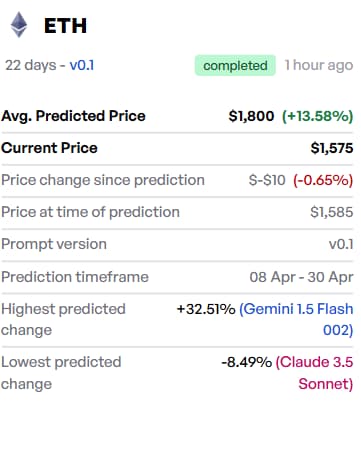

Against this backdrop, Finbold’s AI-powered prediction tool has provided an updated outlook for Ethereum’s price trajectory through April 30, 2025.

Based on technical indicators, macroeconomic signals, and market sentiment, the models point to an average ETH price of $1,800 by the end of the month, suggesting a 13.58% upside from current levels.

Finbold AI ETH price prediction. Source: Finbold

Finbold AI ETH price prediction. Source: Finbold

Despite the generally bullish average, the three AI models offer markedly different views on Ethereum’s short-term outlook.

The most optimistic forecast comes from Gemini 1.5 Flash 002, which sees ETH surging 32.51% to $2,300. The AI model points to slowing downward momentum in the 50-day and 200-day moving averages, suggesting a potential bottoming phase.

The large language model also considers broader sentiment and the possibility of interest rate adjustments, pointing to a cautious but improving outlook.

Meanwhile, GPT-4o projects a 16.37% increase to $1,850, citing a recent death cross, where the 50-day SMA fell below the 200-day SMA, indicating short-term bearishness.

However, it notes that macroeconomic conditions, such as potential interest rate hikes, could exert further downward pressure on the price.

In contrast, Claude 3.5 Sonnet paints a bearish scenario, forecasting an 8.49% decline to $1,450. The model points to persistent weakness below major technical levels and growing caution around rate hikes, which could continue to weigh on ETH in the near term.

Taken together, the stark contrast among the AI forecasts speaks to the uncertainty clouding Ethereum’s short-term direction.

Featured image via Shutterstock