2 overbought cryptocurrencies to avoid trading next week

![]() Cryptocurrency Apr 20, 2025 Share

Cryptocurrency Apr 20, 2025 Share

The cryptocurrency market remains subdued at the moment, with no notable catalysts present to push prices in either direction.

However, Bittensor (TAO) and Artificial Superintelligence Alliance (FET) are operating in the overbought zone, making them susceptible to a possible significant reversal.

Indeed, these assets have shown short-term rallies that may tempt traders into chasing green candles. Still, the overbought conditions often precede a stall or pullback.

Notably, these conditions are highlighted by the Relative Strength Index (RSI) readings. The RSI measures recent price momentum on a scale of 0 to 100. A reading above 70 signals overbought conditions, suggesting a potential slowdown or pullback.

While not a guaranteed reversal, it often serves as a warning for traders to proceed cautiously or consider taking profits.

Artificial Superintelligence Alliance

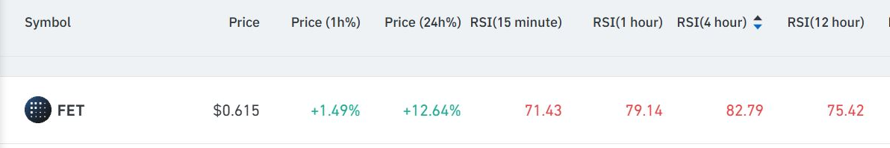

FET, currently trading at $0.615, has surged 12.64% over the past 24 hours. However, its 12-hour RSI is 75.42, well above the overbought threshold of 70.

FET price and RSI chart. Source: Coinglass

FET price and RSI chart. Source: Coinglass

Despite the short-term gains, the high RSI suggests that buying pressure has likely peaked, and a correction may be on the horizon.

FET’s rally aligns with the broader momentum surrounding artificial intelligence (AI) tokens. These assets have seen significant buying interest during the recent market dip, partly spurred by a CoinGecko report highlighting AI as one of the most popular crypto themes.

The report showed that AI tokens had a combined market interest of 24.5%, surpassing meme coins and fueling this short-term rally.

Bittensor

Meanwhile, Bittensor currently has a 12-hour RSI of 75.05, which also signals a potential slowdown in momentum.

Despite a 9.47% gain over the past 24 hours, the elevated RSI suggests the recent rally may be losing steam.

TAO price and RSI chart. Source: Coinglass

TAO price and RSI chart. Source: Coinglass

Similar to FET, TAO’s surge follows renewed interest in AI-related tokens. However, with momentum indicators flashing warnings, traders may want to wait for a pullback or clearer confirmation before entering new positions.

While technical indicators point to a cautionary picture, fundamentals around both assets suggest they may continue gaining momentum in the short term.

As it stands, AI tokens are benefitting from renewed enthusiasm sparked by Nvidia (NASDAQ: NVDA) CEO Jensen Huang’s visit to Beijing, where he reaffirmed the company’s commitment to the Chinese market despite U.S. export bans on its H20 chip. The move reassured investors and boosted confidence in the broader AI sector.

Nevertheless, beyond both technicals and fundamentals, the next trajectory for FET and TAO will also depend on the direction of the broader crypto market.

Featured image via Shutterstock