Ripple stablecoin burn rate skyrockets

![]() Cryptocurrency Apr 24, 2025 Share

Cryptocurrency Apr 24, 2025 Share

Summary

⚈ 12 million RLUSD were burned on April 22 in a record transaction.

⚈ The burn was part of a cross-chain transfer from XRP Ledger to Ethereum.

⚈ RLUSD supply moved for liquidity reasons, not due to a deflationary mechanism change.

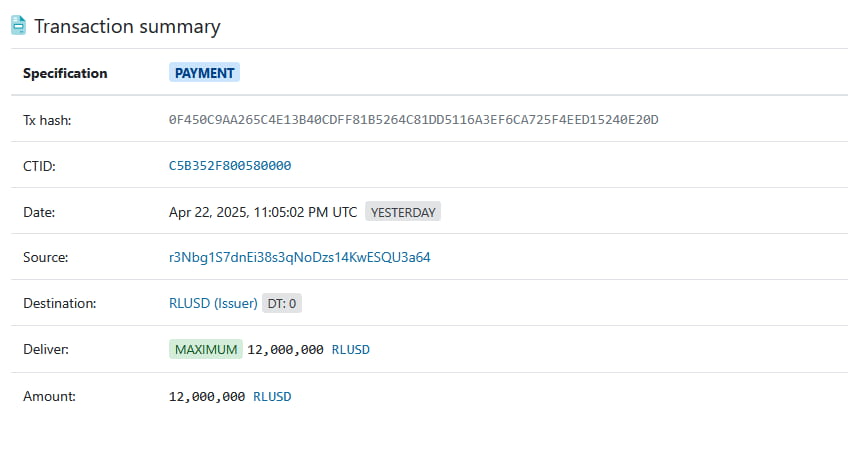

At 11:05 PM UTC on April 22, the largest Ripple USD (RLUSD) burn thus far occurred.

To be precise, data retrieved by Finbold from Xrpscan shows that 12,000,000 units of the Ripple stablecoin were burned.

Ripple stablecoin burn transaction details. Source: Xrpscan

Ripple stablecoin burn transaction details. Source: Xrpscan

RLUSD uses the same burn mechanism that XRP does — a small fee, to the tune of 0.00001 units of the token, is permanently removed from circulation.

Obviously, this burn is a stark departure from that. However, this doesn’t mean that the Ripple stablecoin has switched to a new model of supply management.

What really happened with the Ripple stablecoin burn

A short, succinct, and simple explanation was given by pseudonymous XRP dUNL validator Vet in an April 23 X post. Namely, RLUSD is minted to provide liquidity on customer requests — conversely, it is also burned in the same manner.

This is the largest burn of $RLUSD on the XRP Ledger since the launch of RLUSD.

🔹Minting issues RLUSD on customer request

-> liquidity on ramp to the XRPL.🔹Burning redeems RLUSD on customer request

-> liquidity off ramp from the XRPL.tldr – someone off ramped 12M USD out. https://t.co/lrtwFbqFrk

— Vet (@Vet_X0) April 22, 2025

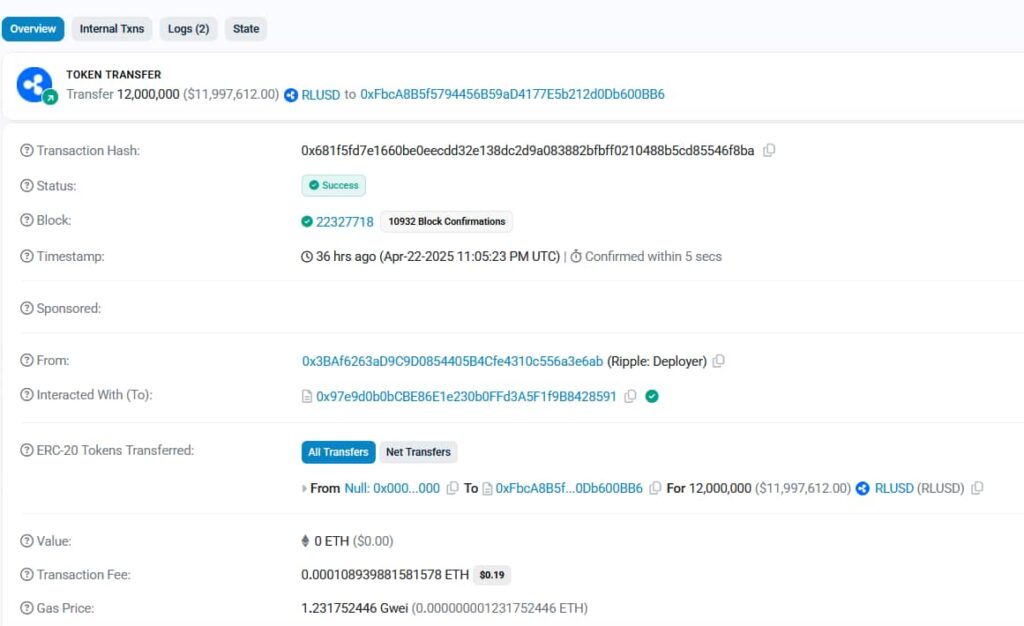

Shortly after, 12,000,000 RLUSD were minted. However, those newly minted tokens were on the Ethereum (ETH) blockchain, unlike the previous batch, which was on the XRP ledger.

RLUSD reminted on the Ethereum blockchain. Source: Etherscan

RLUSD reminted on the Ethereum blockchain. Source: Etherscan

In essence, a user with a large holding of tokens decided to transfer their Ripple stablecoins from one network to another — and the “burn” was more of a liquidity bridge.

While RLUSD has not introduced a new deflationary mechanism, supply and demand dynamics are generally not as important as they usually are with stablecoins, which are not a preferred speculative investment. With everything said and done, however, the largest cross-chain transfer since the Ripple stablecoin’s launch still represents both a significant milestone.

Featured image from Shutterstock