Bybit derivatives report highlights bullish turn in crypto market sentiment

![]() Cryptocurrency Apr 28, 2025 Share

Cryptocurrency Apr 28, 2025 Share

On April 25, Bybit, the second-largest cryptocurrency exchange in the world in terms of trading volume, released its latest weekly cryptocurrency derivatives report in collaboration with analytics firm Block Scholes.

Despite showing signs of decoupling from U.S. equities earlier, the relief rally caused by President Trump’s positive comments regarding the trade war with China caused leading cryptocurrency Bitcoin (BTC) to resume trading in tandem with the stock market.

However, despite a mostly positive series of events, a closer look at the datapoints collected by Bybit paints a slightly more nuanced picture.

Derivatives report shows increased open interest— but Bitcoin puts are outpacing calls

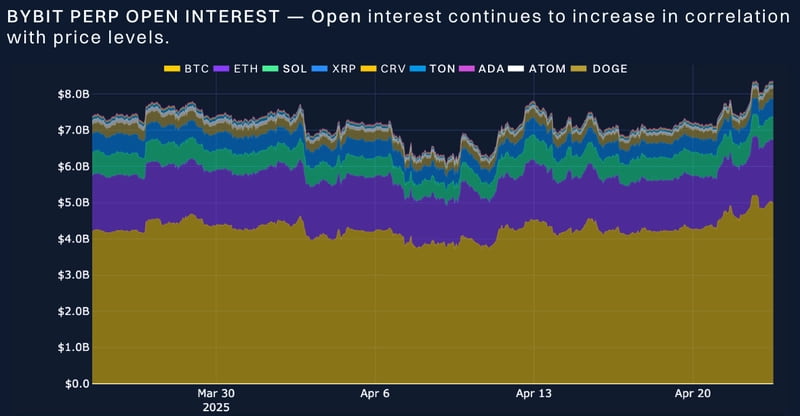

Per the April 25 derivatives report, cryptocurrency perpetual open interest reached levels above $8 billion in the closing days of April, representing a 1-month high in terms of outstanding derivatives contracts.

Cryptocurrency perpetual contracts open interest chart. Sources: Bybit, Block Scholes

Cryptocurrency perpetual contracts open interest chart. Sources: Bybit, Block Scholes

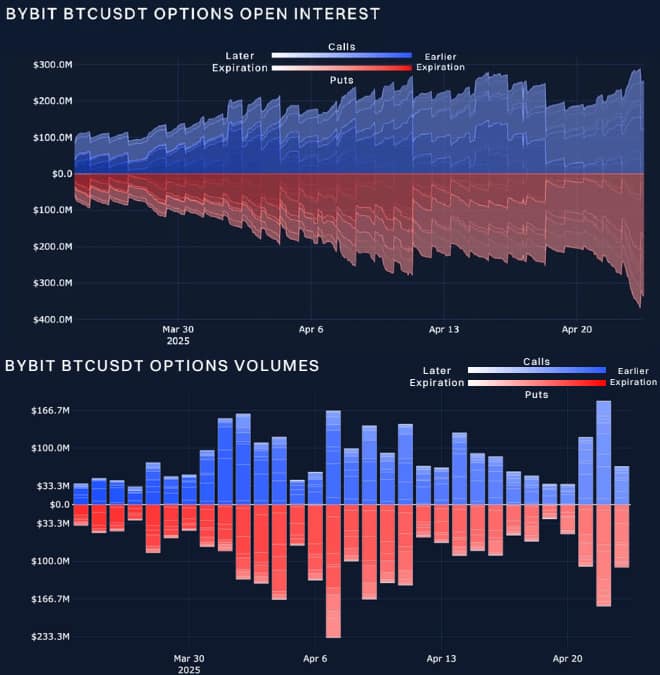

In addition, the relief rally has coincided with a marked increase in Bitcoin options open interest. While options volume has been relatively even, open interest in puts has outpaced open interest in calls by a notable margin.

BTCUSDT options open interest and volume charts. Sources: Bybit, Block Scholes

BTCUSDT options open interest and volume charts. Sources: Bybit, Block Scholes

With that being said, at present, it is unclear whether this indicates an uptick in bearish sentiment or increased hedging.

Featured image from Shutterstock