Bitcoin (BTC) is poised for a potentially game-changing fourth quarter. This happens as historical patterns and expert predictions indicate a significant bull run on the horizon.

Despite recent fluctuations and an unclear trend, analysts are optimistic about strong performance in the last months of 2024, paving the way for considerable gains in the years ahead.

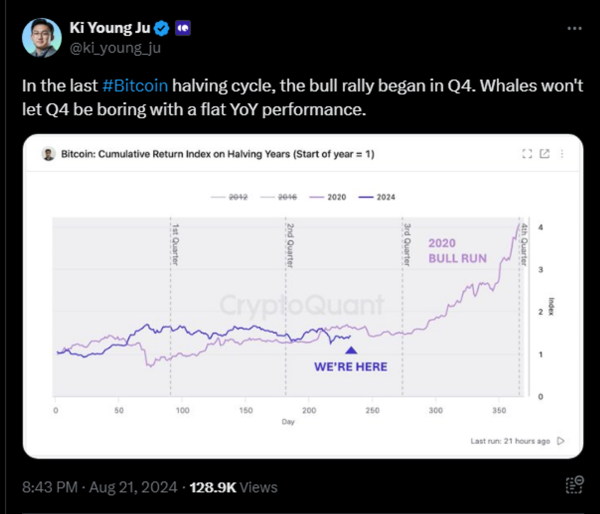

Historically, Bitcoin’s price during halving cycles has consistently demonstrated a robust rally in Q4.

Ki Young Ju, CEO of CryptoQuant, highlights this trend on X, noting that previous cycles saw Bitcoin prices surge as the year ended. Ju expects a repeat of this pattern, forecasting a robust finish to 2024.

Source: Ki Young Ju X

Source: Ki Young Ju X

Currently trading around $61,000, Bitcoin is poised for potential growth. Ju’s analysis, in line with historical data, indicates that Q4 could be a pivotal time for a bullish breakout.

Analysts’ Forecasts Strong Q4 for Bitcoin

As reported by The Coin Republic, Ali Martinez on X pointed out on August 19 that “it’s been 119 days since the 2024 Bitcoin halving.” Historical trends show that Bitcoin often reaches a market peak approximately 530 days after a halving.

It’s been 119 days since the 2024 #Bitcoin halving. In the last two cycles, $BTC hit a market top around 530 days post-halving.

If history repeats, we’re still in the early stages of this cycle! pic.twitter.com/Yxxo7DLfsg

— Ali (@ali_charts) August 19, 2024

If this trend continues, Martinez suggests that Bitcoin might be entering the early phases of a parabolic run, with significant movements anticipated later this year.

CryptoCon, another prominent analyst, shares this optimistic outlook. As reported by The Coin Republic, CryptoCon has updated its November 28th Cycles Theory. It suggests that the current market activity is part of a larger trend that could lead to ATH.

I’ve made many improvements to the November 28th Cycles Theory since I created it in January 2023, but the original model’s idea remains intact.

Some people are calling for a #Bitcoin top or a recession, but I think the best is still yet to come.

The March 2024 local high has… pic.twitter.com/FR1MzhJrtp

— CryptoCon (@CryptoCon_) August 19, 2024

Despite recent market fluctuations, CryptoCon predicts that the peak could occur in late 2025, with a possible price target nearing $200,000. This forecast reflects a positive perspective on Bitcoin’s long-term path, setting the stage for a major rally in the months leading up to late 2025.

BTC Price Lacks Clear Direction

Despite the optimistic forecasts, Bitcoin’s present market behavior stands in stark contrast to earlier expectations.

Veteran trader Peter Brandt has recently pointed out that Bitcoin is currently trapped in a descending channel, showing no definitive trend. He observes that the BTC price action is creating a broadening triangle pattern, with no clear direction yet established.

Charts of continuing interest are Bitcoin and Ether.

Weekly and daily graphs continue to form a megaphone or broadening triangle pattern in BTC

No declaration of next trend yet $BTC$ETH will remain defensive unless/until close above 3050 occurs pic.twitter.com/aEESwhX5oC— Peter Brandt (@PeterLBrandt) August 20, 2024

The current market landscape indicates a lack of strong demand from large-volume investors, alongside a gradual recovery from April’s block subsidy halving. Predictions for new all-time highs this year have also diminished, with many forecasts turning out to be inaccurate.

Whales are anticipated to play a big role in influencing Bitcoin’s price movements in Q4. Ki Young Ju highlights that whales are likely to spark market activity, preventing stagnation and fostering a bullish sentiment.

Even with the current volatility and uncertain short-term trends, the overall perspective suggests that Bitcoin might be on the verge of a significant rally.