Over $3 billion in Bitcoin shorts risk of liquidation if BTC hits $100,000

![]() Cryptocurrency May 2, 2025 Share

Cryptocurrency May 2, 2025 Share

Summary

⚈ Bitcoin trading near $97,000 puts $3.36 billion in shorts at liquidation risk.

⚈ A 3.14% BTC price rise to $100,000 would trigger mass short liquidations.

⚈ A 3.07% drop to $93,973 would also threaten $3.36 billion in long positions.

Bitcoin’s (BTC) move to the upside could put crypto bears in quite a tough position if the cryptocurrency’s present rally continues.

The leading digital asset was trading at $96,950 at press time on May 2, having seen a 2.64% increase in price over the past week.

BTC price 1-week chart. Source: Finbold

BTC price 1-week chart. Source: Finbold

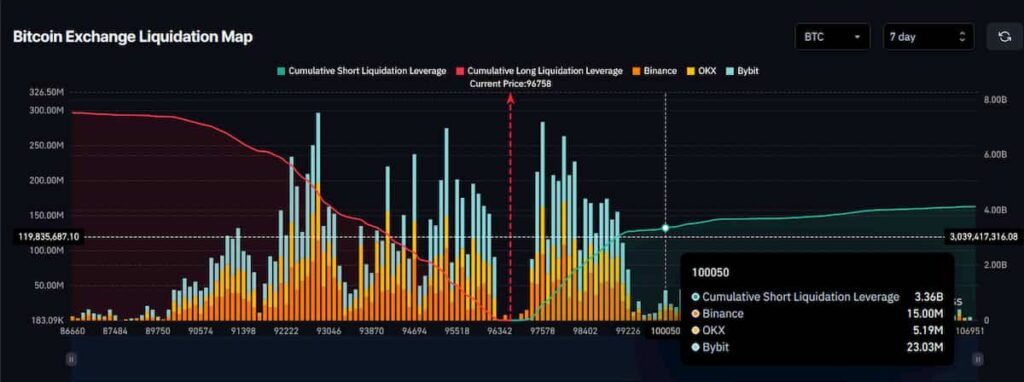

Some $3.36 billion in Bitcoin short positions are at risk of liquidation if BTC prices reach $100,000, according to data analyzed and retrieved by Finbold from market intelligence platform CoinGlass.

Bitcoin exchange liquidation map. Source: CoinGlass

Bitcoin exchange liquidation map. Source: CoinGlass

A 3.14% increase in BTC price could cause $3.36 billion in Bitcoin shorts to be liquidated

So, what are the key levels to watch as Bitcoin approaches a retest of the $100,000 threshold? At present, the next level of resistance is $97,828, just 0.9% above current prices — a retest of that level is imminent, unless a major bearish catalyst emerges in very short order. A surge to $100,000 would entail a 3.14% increase from the price the digital asset is trading at currently.

Readers should note, however, that this is more of a reflection of the extent of leveraged trading, rather than a large-scale miscalculation on the part of bearish cryptocurrency traders.

If an equivalent move to the downside were to occur, the extent of Bitcoin long position liquidations would be similar. To be precise, a 3.07% drop, which would see BTC trading at a price of $93,973, would entail roughly the same amount of capital — $3.36 billion, at risk.

Featured image via Shutterstock