- Bitcoin slipped under $102,000 briefly on Friday, derivatives market records over $300 million in long liquidations.

- On-chain data shows Bitcoin traders took over $23 billion in profits this week, signaling a rise in selling pressure.

- JPMorgan insiders say the bank is set to accept BTC ETFs as collateral for loans.

- Bullish catalysts, such as Strategy’s announcement of the STRD stock IPO to raise nearly $100 million to buy BTC, fail to push BTC higher.

Bitcoin (BTC) tumbled to a low of $101,095 on Friday amid volatility in the market. The effect of the tussle between United States (US) President Donald Trump and Tesla Chief Elon Musk negatively influenced the NASDAQ and Tesla’s stock price on Thursday, although both are recovering on Friday. The spat between the two likely influenced the decline in crypto market cap, down 4% in the past 24 hours.

Bitcoin traders have turned fearful today, from neutral on Thursday. The crypto Fear and Greed Index reads 45 on Friday, while on Thursday and last week the values ranged between 57 and 60, implying a neutral sentiment among market participants.

As traders turn cautious and volatility rises, derivatives exchanges recorded a large volume of liquidations.

Bitcoin bear thesis: Large volume profit-taking, long liquidations

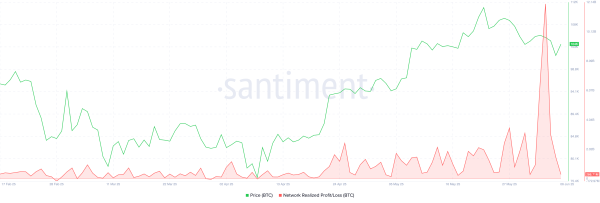

Bitcoin holders took over $23 billion in profits between Monday, June 2 and Thursday, June 5,, according to Santiment data. The large positive spike in the Network Realized Profit/Loss metric corresponds to the dip in BTC price.

Large volume profit-taking is typically associated with further correction in the token’s price.

Bitcoin NPL chart | Source: Santiment

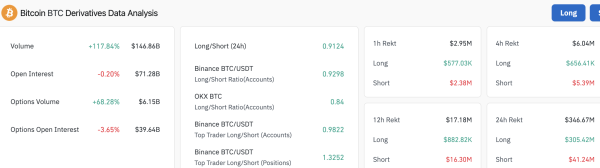

Derivatives data from Coinglass shows over $305 million in long positions were liquidated in the last 24 hours, against $41 million in short positions. The long/short ratio, a metric that compares bullish bets against bearish ones, reads 0.91. A value less than one signals higher bearish bets, supporting a thesis of further price decline.

Bitcoin derivatives data analysis | Source: Coinglass

Bitcoin ETF to be accepted as collateral for loans: JPMorgan insiders

A Bloomberg report published earlier this week on June 4 shows that insiders at JPMorgan say the banking giant is set to offer loans against Bitcoin ETF collateral.

JPMorgan’s wealth management clients could soon use BlackRock’s iShares Bitcoin Trust (IBIT) as collateral to obtain loans. According to the report, clients’ holdings in crypto ETFs will be counted toward their net worth and liquidity calculations for loans.

Strategy announces nearly $100 million for Bitcoin purchase and working capital

Strategy announced its Initial Public Offering (IPO) of Stride Preferred Stock (STRD) to raise approximately $979.7 million to use for general corporate purposes like working capital and the acquisition of Bitcoin, per the release.

The bullish development failed to catalyze gains in BTC price and the largest crypto extended its consolidation.

Bitcoin could re-test support at $100,000

Bitcoin is currently consolidating under resistance at $106,000. The BTC/USDT daily price chart shows the likelihood of a nearly 4% correction and a retest of milestone $100,000, a key support level for the crypto.

A nearly 3% increase could see BTC test resistance at $106,794, the upper boundary of a Fair Value Gap (FVG) on the BTC/USDT daily price chart.

The Relative Strength Index (RSI) reads 50, neutral and Moving Average Convergence Divergence (MACD) shows red histogram bars flashing under the neutral line.

In the event of further decline in Bitcoin price, $97,732 could act as support.

BTC/USDT daily price chart | Source: TradingView

Conversely, a daily candlestick close above $106,794 could pave the way for Bitcoin to climb towards the $111,980 level, the previous all-time high.