USDC rises in popularity as MiCA regulations disrupt USDT volumes

![]() Cryptocurrency Jul 8, 2025 Share

Cryptocurrency Jul 8, 2025 Share

The first half of 2025 has seen some profound shifts in the European crypto market shaped by evolving regulation, network innovation, and merchant behavior.

As a recent H1 2025 crypto payments report by CoinGate suggests, the swift rise of the USD Coin (USDC), largely propelled by the EU’s Markets in Crypto-Assets (MiCA) regulation, is at the center of this transformation.

With the introduction of MiCA in late March, Tether (USDT) began vanishing from the payment rails in Europe due to regulatory uncertainty, allowing USDC to step in.

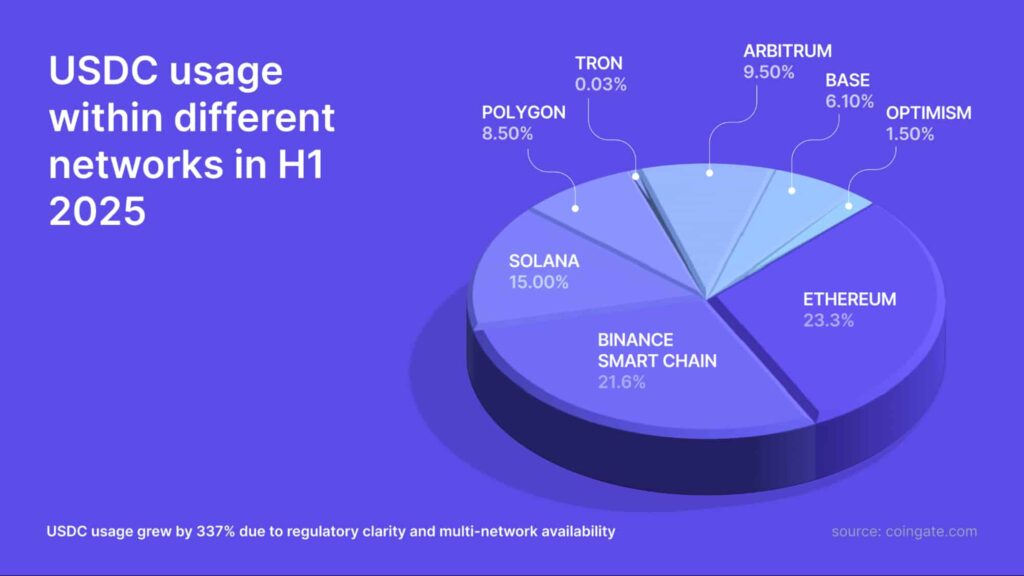

Indeed, MiCA-compliant and bolstered by multi-chain availability, USDC saw its transaction volume jump 337% year-over-year and now sits among the five most-used assets on CoinGate.

Are stablecoins becoming mainstream?

CoinGate’s data suggests that crypto payments are not merely surviving the new regulatory developments but evolving and gaining more mainstream ground.

Sure, the impact of the MiCA’s framework was immediate, causing businesses and users alike to reconsider USDT as their go-to token. However, rather than derailing the market completely, the new regulatory standards allowed alternatives like USDC to flourish.

Of course, infrastructure and blockchain innovation have also played a key role. For instance, the rapid rise of Layer-2 (L2) solutions has made transactions faster and more affordable, encouraging further adoption.

Likewise, a growing number of merchants and businesses are now choosing to hold crypto assets rather than immediately converting them to fiat, implying that companies are now more likely to see cryptocurrencies as treasury assets rather than volatile tokens with no practical or hedging use.

The data thus suggests that stablecoins could play an even greater role as regulatory structures mature and fiat-backed tokens make their way into the market.

The growth of USDC

According to CoinGate’s report, USDC accounted for 27.3% of all stablecoin transactions on the platform by H1 2025, compared to just 2.5% a year prior.

What’s more, 68% of merchants chose USDC for their crypto payouts due to its regulatory compliance and versatility.

More notably, however, nearly 41% of CoinGate’s merchants opted to settle transactions in crypto rather than converting into fiat, marking a 14% jump from last year.

Likewise, more and more merchants are choosing to hold their assets strategically.

Rising blockchains

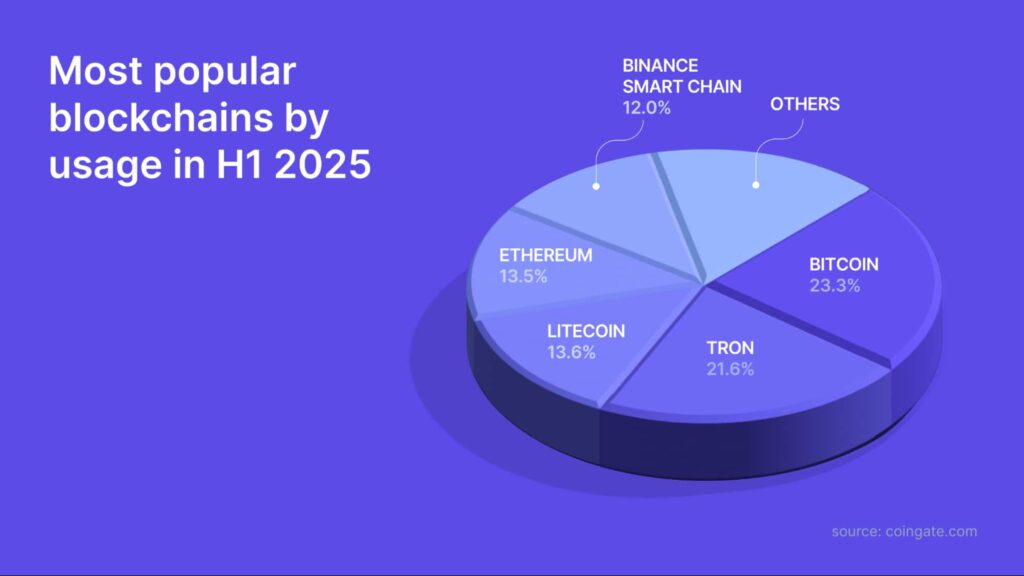

Bitcoin (BTC) has likewise been performing well, accounting for 23.3% of all transactions in the first half of 2025.

The numbers mark a notable shift, especially in light of TRON’s (TRX) declining popularity.

Indeed, while TRON had previously dominated thanks to its connection to Tether, regulatory pressure mounting against USDT led to its market share dropping to 21.6%.

Litecoin (LTC) maintains a stable 13.6% share of network activity, with Ethereum (ETH) close behind with 13.5%.

Binance Smart Chain (BSC) rounded out the top five with 12% thanks to its reputation for affordability and ease of use.

The diversification of the crypto payment sector

Layer-2 networks are also rapidly gaining traction, led by Polygon (MATIC), which saw a 117% increase in transactions compared to 2024.

Again, the growth is largely the result of the surge in USDC usage, with a rising number of users seeking more regulatory-friendly alternatives to Tether.

Base, Coinbase’s L2 chain launched in February 2025, has been particularly impactful, with 59% of its transaction volume involving USDC.

Arbitrum (ARB), another L2 network, has also made gains, with more than 9% of all USDC transactions now flowing through it.

Solana (SOL) and Optimism (OP) are also quietly expanding their reach, suggesting the crypto payment landscape is no longer dominated by a few blockchains. Instead, it’s diversifying, with users and merchants alike exploring faster, cheaper, and more MiCA-compliant options.

Featured image via Shutterstock