AI predicts XLM price for July 31 after 85% spike

![]() Cryptocurrency Jul 13, 2025 Share

Cryptocurrency Jul 13, 2025 Share

Stellar (XLM) is breaking out alongside the broader cryptocurrency market, with an artificial intelligence (AI) model forecasting a potential push past the $0.50 resistance level by the end of July.

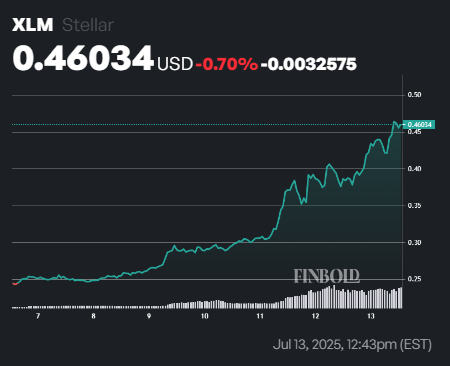

As of press time, XLM was trading at $0.46, up 20% in the past 24 hours and 86% over the last week.

XLM one-week price chart. Source: Finbold

XLM one-week price chart. Source: Finbold

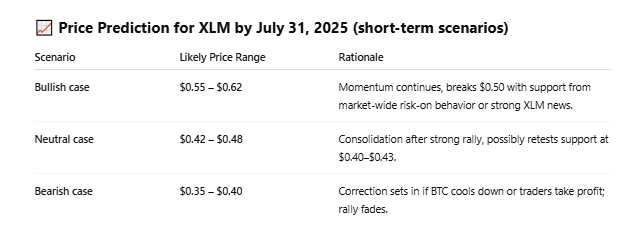

Amid the rally, Finbold consulted OpenAI’s ChatGPT model, which outlined several possible price scenarios for the cross-border payment token.

In a bullish case, driven by continued market strength or positive project developments, XLM could climb to between $0.55 and $0.62. A neutral scenario might see the price consolidate between $0.42 and $0.48, potentially retesting the support level.

However, ChatGPT noted that if momentum fades due to a Bitcoin (BTC) cooldown or profit-taking, XLM could retreat to the $0.35 and $0.40 range.

The AI model’s base case assumes Bitcoin remains above the $115,000 to $119,000 range and that altcoin sentiment stays strong. Under these conditions, XLM could reach $0.55 to $0.58 by the end of the month.

If Bitcoin’s dominance rises or investor risk appetite weakens, XLM may struggle to maintain its current levels and drop toward $0.40.

Technically, the AI model noted that support lies between $0.35 and $0.38, a zone that previously acted as resistance. On the upside, $0.50 remains a key psychological barrier, with further resistance at $0.60 to $0.65 levels last seen in early 2022.

ChatGPT XLM price prediction for July 31. Source: ChatGPT

ChatGPT XLM price prediction for July 31. Source: ChatGPT

Drivers of XLM rally

Overall, XLM’s ongoing strength has been fueled by Bitcoin’s record-breaking surge above $119,000 and renewed interest in altcoins. Beyond the broader rally, a key catalyst was PayPal’s announcement to integrate its stablecoin PYUSD on the Stellar network, pending regulatory approval.

The July 11 announcement triggered a 20.5% intraday volatility spike, pushing XLM from $0.345 to $0.416 as traders priced in future demand and liquidity.

Despite the bullish momentum, the AI model cautions that XLM’s sharp 86% weekly gain could prompt a short-term correction if not supported by strong fundamentals and sustained volume.

Featured image via Shutterstock