Wall Street banking giant sets Bitcoin’s price for end of 2025

![]() Cryptocurrency Jul 26, 2025 Share

Cryptocurrency Jul 26, 2025 Share

Wall Street banking giant Citi (NYSE: C) is projecting a bullish outlook for Bitcoin (BTC) by the end of 2025, with its base-case target set at $135,000.

According to the bank’s valuation framework, the flagship digital currency could reach $135,000 while a more optimistic outlook sees Bitcoin surging to $199,000.

The updated forecast is guided by Citi’s refined model, which emphasizes three main price drivers, including user adoption, macroeconomic conditions, and inflows into spot Bitcoin ETFs.

To this end, Citi analysts Alex Saunders and Nathaniel Rupert noted that the core valuation begins with a 20% increase in user growth under a linear network model, supporting a price near $75,000.

Macroeconomic headwinds, such as weak equity markets and underperforming gold, are expected to shave off about $3,200.

Impact of ETFs on Bitcoin’s price

However, Citi anticipates around $15 billion in net ETF inflows, which could add approximately $63,000 to the model, bringing the base-case forecast to $135,000.

In its most conservative scenario, Citi expects Bitcoin to drop to $64,000 by year-end if equity markets remain under pressure and ETF inflows fall short.

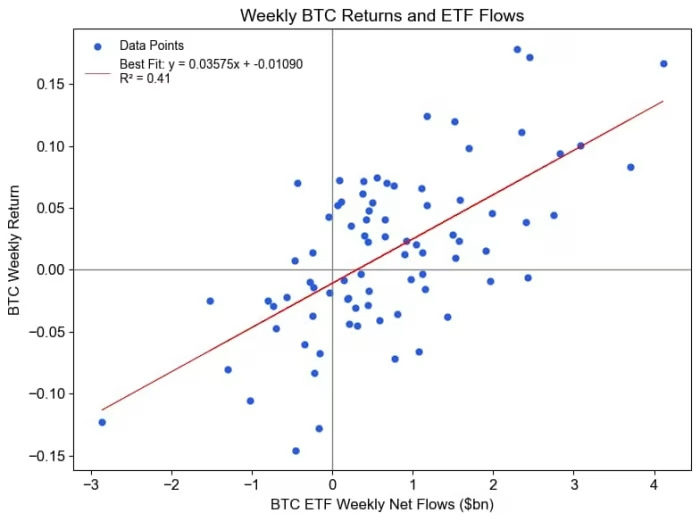

Citi’s analysis also indicated that ETF flows now account for over 40% of BTC’s price movements, making them a central component of the bank’s valuation model.

Weekly Bitcoin returns and ETF flows. Source: Citi

Weekly Bitcoin returns and ETF flows. Source: Citi

The analysts highlighted a strong correlation between ETF net flows and BTC returns, estimating that every $1 billion in weekly inflows adds about 3.6% to Bitcoin’s price.

“Since launch, 41% of Bitcoin return variation can be explained by flows alone (the relationship is just as strong even accounting for equity returns). So far this year, we have seen just over $19 billion of flows, including $5.5 billion month-to-date. We expect flows to continue for the rest of the year,” Citi noted.

The outlook also emphasized crypto’s growing role in traditional finance. In this case, Bitcoin is now included in major indices, such as the S&P 500 and Russell, with rising institutional exposure bolstering its influence across broader markets.

Bitcoin price analysis

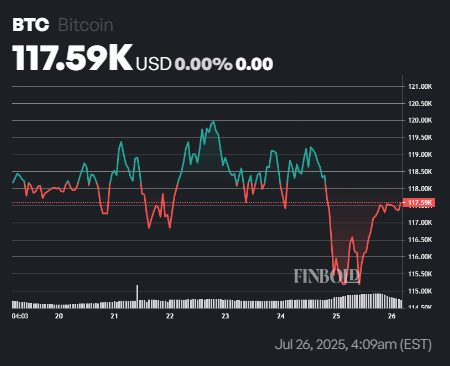

Meanwhile, Bitcoin continues to hold above the $115,000 support zone after a retracement from its record high of $123,000. At press time, BTC was trading at $117,594, up over 2% in the past 24 hours, though down 0.6% for the week.

Bitcoin seven-day price chart. Source: Finbold

Bitcoin seven-day price chart. Source: Finbold

To maintain the path toward $130,000, bulls must defend the $115,000 level, as a breakdown below it could trigger a sustained decline.

Featured image via Shutterstock