BlackRock sells Bitcoin for the second time since BTC ETF launch — What’s next?

![]() Cryptocurrency Aug 30, 2024 Share

Cryptocurrency Aug 30, 2024 Share

BlackRock‘s (NYSE: BLK) iShares Bitcoin Trust (IBIT) has shown remarkable resilience amid Bitcoin (BTC) outflows from other exchange-traded funds (ETFs). However, the IBIT ETF registered its second-ever outflow on August 28, raising concerns among Bitcoin investors as a bearish indicator.

Notably, the two-only outflows from IBIT were significantly small compared to all the inflows since its launch in January. On April 30, the iShares Bitcoin Trust sold $38.68 million worth of BTC for the first time.

In this most recent activity, BlackRock sold an even smaller amount of 227.62 BTC, worth $13.43 million. Despite immediate concerns about a more bearish outlook, the finance giant has shown a bullish bias toward the leading cryptocurrency.

Picks for you

Elon Musk warns of investment risk in Brazil, USD/BRL chart reacts 10 mins ago AI sets Dogecoin price for end of 2024 after Elon Musk wins $258 billion lawsuit 3 hours ago Bitcoin price prediction as Trump plans to make U.S. ‘crypto capital of the planet’ 4 hours ago Elon Musk warns 'America is in the fast lane to bankruptcy' – Here's why 4 hours ago  IBIT: Total Bitcoin Spot ETF Net Inflow (USD). Source: CoinGlass

IBIT: Total Bitcoin Spot ETF Net Inflow (USD). Source: CoinGlass

How much Bitcoin does BlackRock’s ETF still hold?

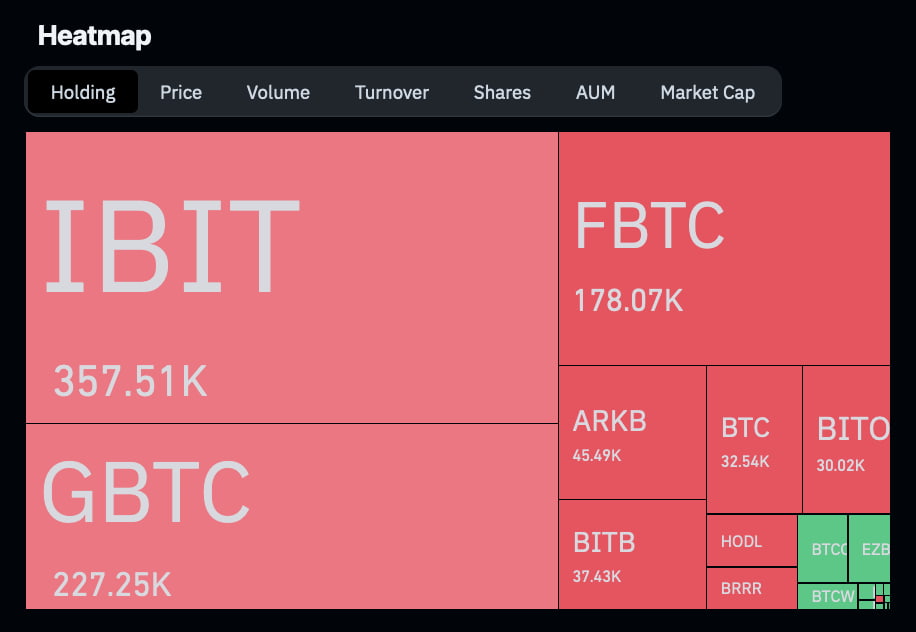

On that note, the iShares Bitcoin Trust, by BlackRock, is one of the market’s most popular and capitalized Bitcoin ETFs. According to data from Coinglass, the fund currently holds 357,510 BTC, being the biggest holder, already surpassing Grayscale’s GBTC.

Bitcoin ETFs holding heatmap. Source: CoinGlass

Bitcoin ETFs holding heatmap. Source: CoinGlass

This recent outflow equals a tiny share of 0.06% of these holdings. Therefore, the most shocking aspect of Blackock’s selling activity is that the company stood out by not registering any outflows since May, despite most ETFs selling amid a notable downtrend and weak momentum.

Bitcoin (BTC) price analysis

As of this writing, Bitcoin trades at $59,595, just below a key psychological level, in a visible downtrend with lower highs and lower lows. The 30-day exponential moving average (30-EMA) acts as resistance at $60,677, but the downtrend line is harder to break.

Interestingly, BlackRock’s first ETF outflow happened in a local BTC crash, followed by another losing day. Both the first and the most recent outflows happened near the month’s closing, suggesting a possible pattern could form.

Bitcoin (BTC) daily price chart. Source: TradingView / Finbold

Bitcoin (BTC) daily price chart. Source: TradingView / Finbold

Meanwhile, trading experts and analysts have been warning of further downside potential for Bitcoin, as Finbold reported on different occasions. Namely, Ben Walther monitored short-time frames, while Alan Santana forecasted the biggest crash as “trouble is approaching.”

Bitcoin must hold strong above the 365-day EMA support at around $53,446 to keep its long-term bullish outlook. To gather insights, investors will closely watch further developments and BlackRock’s movements with the iShares Bitcoin Trust (IBIT) moving forward.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.