$10 billion exits Solana in a week; here’s why

![]() Cryptocurrency Sep 2, 2024 Share

Cryptocurrency Sep 2, 2024 Share

The price action that followed the employment report at the edge between July and August made both the stock and cryptocurrency markets appear like something of a house of cards.

In fact, despite the recovery that followed the initial bloodbath, many assets remain depressed compared to their earlier 2024 highs, with prominent altcoins reeling in particular.

Though discussion in the crypto community has been mostly focused on Ethereum (ETH) and, to an even greater extent, Bitcoin (BTC) first following its rise back above $60,000 and then the drop toward $58,000, few major digital assets have had as a weak an August as Solana (SOL).

Picks for you

Greg Abbott's net worth revealed: How rich is the hardline conservative governor of Texas? 6 hours ago Buy alert: Dogecoin technical analysis reveals imminent DOGE rally 8 hours ago 2 Bitcoin price catalysts that will make breaking $100,000 'a minimum expectation' 8 hours ago Brian Kemp’s net worth revealed: How rich is the Governor of Georgia? 8 hours ago

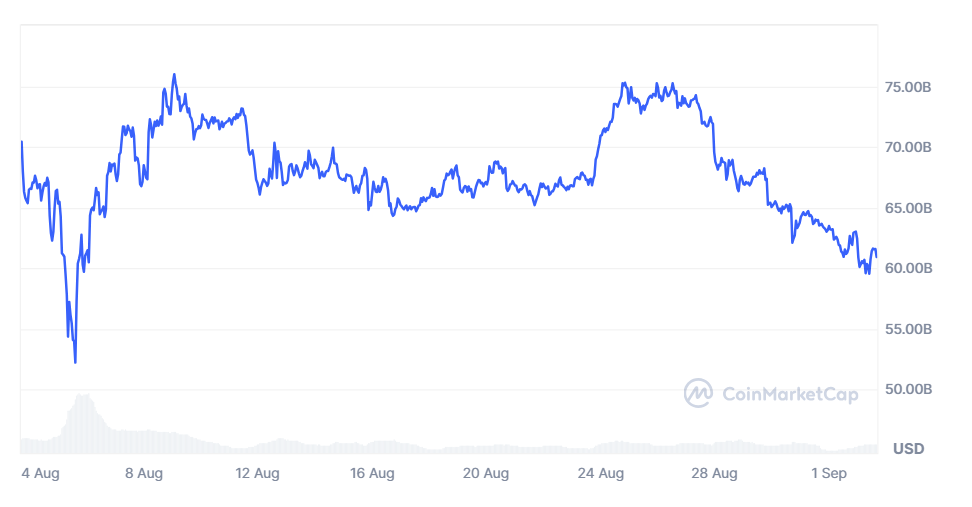

$10 billion wiped from Solana’s market cap in just 30 days

Indeed, the fifth-largest cryptocurrency by market capitalization – SOL – has shed almost exactly $10 billion in the last 30 days, and as much as $15 billion if its fall from August highs is considered.

SOL 30-day market cap chart. Source: CoinMarketCap

SOL 30-day market cap chart. Source: CoinMarketCap

Despite the magnitude of the downward move, its root causes are far harder to explain than one might expect and likely stem from a storm of separate yet connected factors.

To begin with, Solana’s fortunes have always been closely linked to the strength of its community and its ecosystem. Their 2024 increase in size has not necessarily led to an increase in resilience.

For example, the emergence of multiple new meme coins – DogWiffHat (WIFF) perhaps being the most prominent example – has helped SOL during the strong bull run in March but has only ramped up the selling pressure in more recent months.

Such a setup has made it difficult for SOL to cross above its 20-day exponential moving average (EMA) and its 50-day simple moving average (SMA) – and, indeed, Solana has remained below both in the last 30 days – further reinforcing the bearish sentiment.

The popular token is also likely affected by the broader trends in the crypto market, with the latest development likely to have some spillover effects on other digital assets, such as the arrest of Telegram’s Pavel Durov and the associated drop of Toncoin (TON).

The recent fortunes of Bitcoin, which itself lost more than $100 billion from its market cap in the last 30 days, has probably had an even greater impact as the world’s oldest cryptocurrency tends to dictate the direction of the entire market.

Solana likely to continue its downfall in the coming months

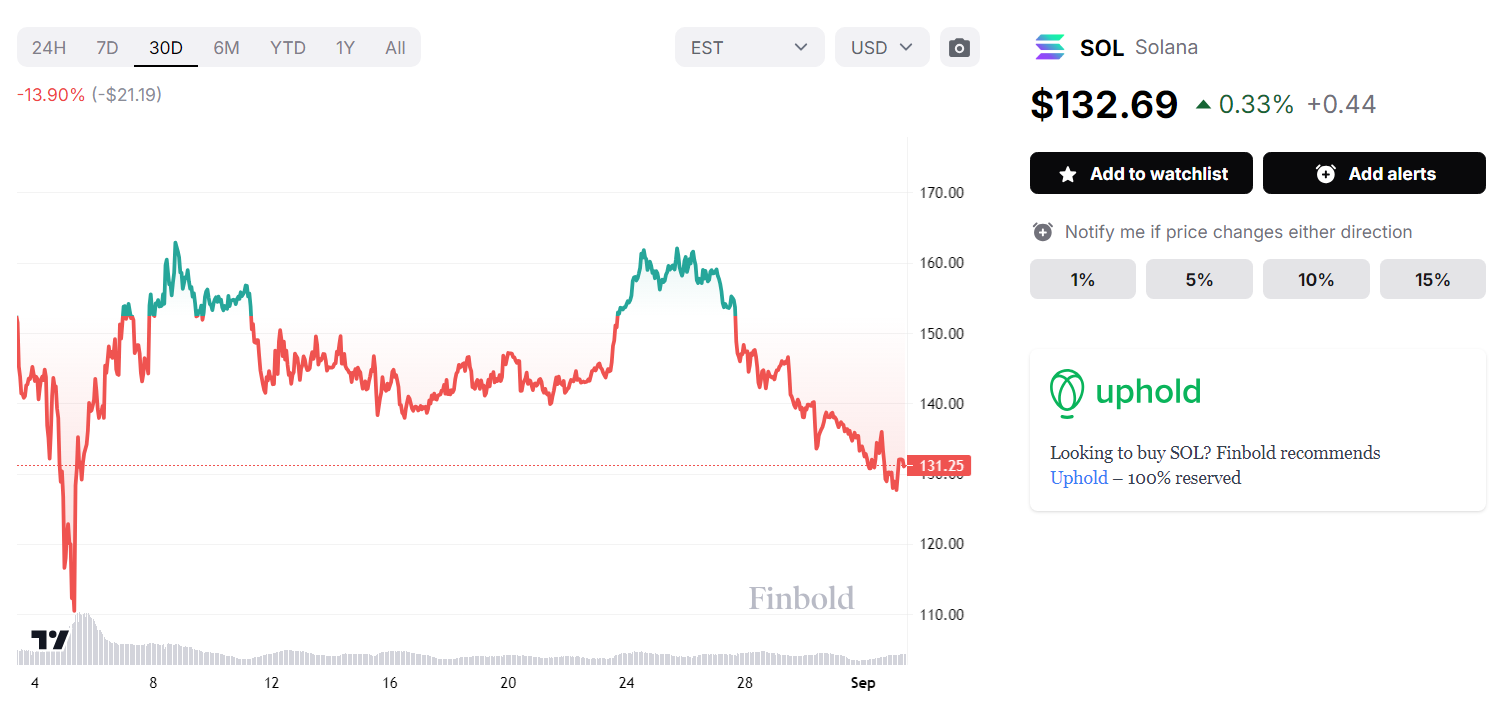

Finally, in addition to the last 30 days of trading seeing SOL’s market cap drop by $10 billion and its price fall 13.90% to $132.69, multiple experts believe there is further downside ahead.

SOL 30-day price chart. Source: Finbold

SOL 30-day price chart. Source: Finbold

Scient, for example, made an X post on the final day of August, explaining that they believe Solana is in the throws of a protracted bear pennant – a bear pennant that will lead to a further bearish breakout within the upcoming four to six weeks after the current period of price consolidation.

$SOL IS IN THIS MASSIVE 6-MONTH-LONG BEAR PENNANT.

— One of the cleanest HTF bear pennants I have ever seen.

+-4/6weeks, the next downtrend leg will resume. pic.twitter.com/3P5wbDVtX1

— Scient (@Crypto_Scient) August 31, 2024

Another prominent analyst, the crypto strategist Benjamin Cowen, argued that much of the altcoin market will repeat the same pattern as in 2019 – another year that saw the Federal Reserve loosen its policy.

According to Cowen, after altcoins saw massive gains earlier in 2024 – and, indeed, Solana’s late 2023 and early 2024 rallies saw it rocket from $20 to $200 – they are set to plummet.

Could Solana make a September comeback?

Still, whatever the future might hold, Solana is still somewhat above the true danger levels as it has more room to drop before it begins scarily testing its general support zone between $118.89 and $126.37 while, should it break above its nearest resistance at $133.86, it could gain at least some bullish momentum.

Finally, despite some analysts seeing altcoin dropping further in the wake of the FED loosening its policy, interest rate reductions are generally viewed as positive for risk assets and could lead to Solana and other cryptocurrencies getting unexpectedly revitalized.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.