2 cryptocurrencies to reach $100 billion market cap in Q4 2024

![]() Cryptocurrency Sep 8, 2024 Share

Cryptocurrency Sep 8, 2024 Share

Cryptocurrencies experienced massive losses this week as the “September Effect” started playing out in finance markets. According to renowned cryptocurrency analysts, this recent crash could have been the last shake-out before the 2024 crypto bull run.

In this context, Finbold turned to market data to identify good projects with solid growth potential for the last quarter. For that, we looked into leading cryptocurrencies that could reach the $100 billion capitalization mark in Q4 2024.

Essentially, the market cap is one of the most used benchmarks and value indicators by cryptocurrency investors. This is because digital assets can have very different economics and supply dynamics, requiring a common ground for fundamental analyses.

Picks for you

Brace yourself: Bitcoin could crash to $31,000 soon 3 hours ago ‘September Effect is in full bloom’ as ‘US jobs disappoint,’ warns finance expert 3 hours ago 'Stay strong': Here's what it takes for Bitcoin to reach $93,000 6 hours ago Meta AI builds ideal portfolio for the 2024 crypto bull run 23 hours ago

Solana (SOL) could reach a $100 billion market cap in Q4 2024

First, Solana (SOL) surges as the most likely candidate to join – before the year ends – Bitcoin (BTC), Ethereum (ETH), and Tether USD (USDT) among cryptocurrencies with more than $100 billion market cap.

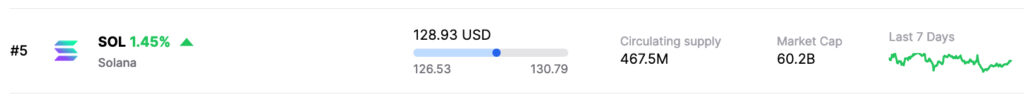

As of this writing, its native token, SOL, trades at $129, with a $60.20 billion capitalization. For Solana to reach this 2024 crypto bull run target, it would require a 66% increase in value.

Solana (SOL) market data. Source: Finbold

Solana (SOL) market data. Source: Finbold

However, Solana is known for having one of the largest linear supply inflations in the industry. This characteristic will increase the current circulating supply of 467.5 million SOL, contributing to the market cap.

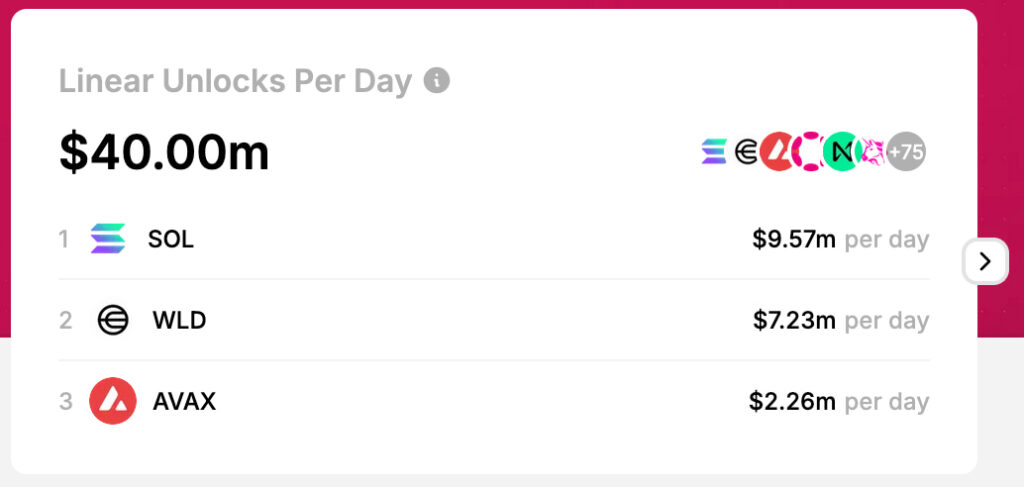

In particular, Solana’s circulating supply is expected to increase by 7.42 million SOL in the following 100 days. This is considering a daily emission of approximately 74,200 SOL, according to data from TokenUnlocksApp.

Linear unlocks per day. Source: TokenUnlocksApp

Linear unlocks per day. Source: TokenUnlocksApp

Therefore, Solana will need to trade above $210 by the end of 2024 to have a $100 billion market cap. If this happens, SOL will reward today’s investors with over 60% gains.

Circle USD stablecoin (USDC) in the 2024 crypto bull run

Another cryptocurrency with a high potential of attracting more demand and, thus, market value is the stablecoin Circle USD (USDC). The USDT alternative has gained market share and adoption throughout the years, intensifying in an expected 2024 crypto bull run.

Right now, USDC is a $35 billion coin running in dozens of blockchains. Each USDC is programmed always to follow the U.S. dollar price, but the market cap can still increase.

Every time someone exchanges U.S. dollars for USDC with Circle, the company issues new tokens and makes them circulate. Hence, having a growing market cap, following a growing circulating supply as demand increases.

Circle USD (USDC) market data. Source: Finbold

Circle USD (USDC) market data. Source: Finbold

Overall, analysts use stablecoins capitalization as a way to measure how much money from traditional finance is entering crypto. In a bull run, USDC, USDT, and other stablecoins’ capitalization is expected to grow as capital inflows to the space.

USDC reaching a $100 billion market cap in the 2024 crypto bull run is not only possible but likely. This would represent a three times growth for this asset alone, which has been approaching the USDT popularity and liquidity.

With that, other cryptocurrencies should benefit amid investors’ reallocation from the stablecoin to build their ideal portfolios, as Finbold suggested.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.