OpenAI’s o1 predicts Bitcoin (BTC) price for the end of 2024

![]() Cryptocurrency Sep 13, 2024 Share

Cryptocurrency Sep 13, 2024 Share

OpenAI, the leading company in artificial intelligence (AI) development, just launched its most advanced model, the o1, on September 12. Looking to test the AI’s capabilities and gather insights on the cryptocurrency market, Finbold asked o1 for a Bitcoin (BTC) price prediction for the end of 2024.

In a bullish forecast, OpenAI’s o1 believes Bitcoin could “experience significant upward momentum,” pushing prices above its all-time high (ATH). The conservative BTC price prediction goes within the range of $80,000 to $100,000 by the end of 2024.

However, the AI has a bearish case for Bitcoin, potentially holding it between $60,000 and $70,000. This would happen amid “adverse regulatory actions, macroeconomic downturns, or persistent negative sentiment,” o1 wrote, which could suppress BTC’s price.

Picks for you

Web3 gaming platform Upland extends partnership with NFLPA 47 mins ago John James' net worth revealed: How rich is the U.S. representative from Michigan? 3 hours ago How much Bitcoin does MicroStrategy own? 3 hours ago Jake Auchincloss’ net worth revealed: How rich is the US Representative for Massachusetts? 4 hours ago

“Based on the factors outlined, my prediction is that Bitcoin could reach approximately $90,000 by the end of 2024. This estimate assumes a positive market response to the halving event, continued institutional adoption through spot ETFs, and a stable macroeconomic environment. However, it’s important to recognize the high volatility in cryptocurrency markets and the potential for unforeseen events to significantly impact prices.”

– OpenAI’s o1 model, via NanoGPT‘s API

OpenAI’s o1 Bitcoin price prediction for the end of 2024. Source: NanoGPT / Finbold

OpenAI’s o1 Bitcoin price prediction for the end of 2024. Source: NanoGPT / Finbold

Bitcoin (BTC) price analysis

Right now, Bitcoin trades around the $58,000 price level, accumulating 119% growth year-over-year (YoY) since September 13, 2023. Conversely, the chart displays a six-month downtrend, with lower highs and lower lows since the $73,800 ATH in March.

Bitcoin must break out of this downtrend to regain the previous six months’ gains and fight for higher ground.

Bitcoin (BTC) YoY price chart on September 13, 2024. Source: Finbold

Bitcoin (BTC) YoY price chart on September 13, 2024. Source: Finbold

Finbold has reported different analyses from prominent trading experts, most of whom are bullish for the end of 2024. In particular, Credible Crypto celebrated BTC reaching his downside target below $54,000, saying Bitcoin’s “full bull gear” can start.

“Well, my downside target on $BTC has been hit, and the original idea shared below looks to have played out despite us not getting any relief in between. I’m hoping this means we can kick into full bull gear sooner than expected.”

– Credible Crypto

Interestingly, we also reported Cryptorphic’s target at $93,000 shared in a TradingView idea, urging investors to “stay strong.” This is a similar Bitcoin price prediction as the one from OpenAI’s o1, validating both forecasts.

Bitcoin’s bullish fundamental case

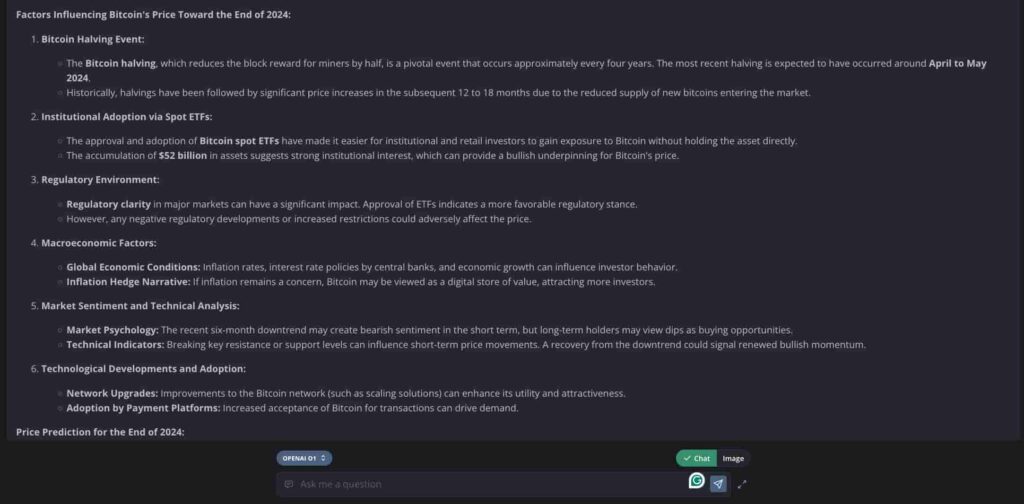

Notably, OpenAI’s flagship artificial intelligence model’s bullish prediction for Bitcoin fundaments itself in six characteristics.

The first two mentions are the Bitcoin halving event from April, impacting BTC’s linear supply pressure, and Bitcoin spot ETFs. While the second addresses demand, o1 also mentions the regulatory environment and macroeconomic factors as core fundamentals to watch. On the macroeconomic note, the cryptocurrency market currently awaits for the Federal Reserve’s first interest rate cut, as Finbold reported.

Moreover, BTC will depend on market sentiment and technical analysis to thrive, as well as technological development and adoption. OpenAI’s o1 also provided insights on Nvidia’s (NASDAQ: NVDA) stock price, which Finbold published this Friday.

OpenAI’s o1 Bitcoin fundamentals for the bullish case. Source: NanoGPT / Finbold

OpenAI’s o1 Bitcoin fundamentals for the bullish case. Source: NanoGPT / Finbold

As the factors align for the last quarter of the year, investors and traders should closely monitor these aspects. Nevertheless, volatility can still hit in the short term, potentially causing losses to leveraged positions.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.