Sell-off alert: Ripple to dump 200 million XRP in October

![]() Cryptocurrency Oct 2, 2024 Share

Cryptocurrency Oct 2, 2024 Share

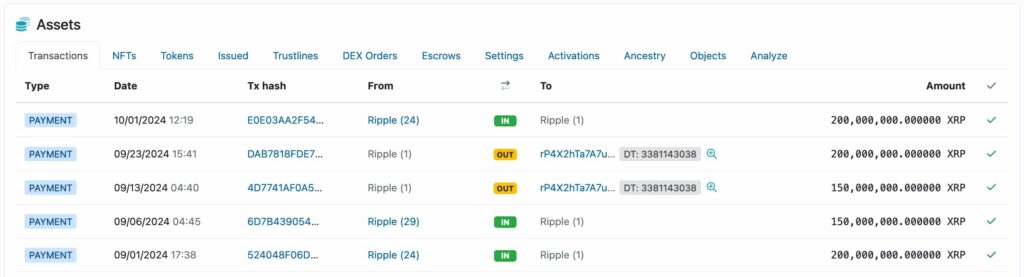

After unlocking another 1 billion XRP from the initial distribution escrows on October 1, Ripple prepares for another monthly sell-off. For this month, traders and investors can initially expect a 200 million XRP sale with a potential negative price impact.

As usual, the company sent 20% of the unlocked amount to the ‘Ripple (1)‘ address, its liquid treasury account. Ripple has been displaying a similar pattern every month since the implementation and first unlock of XRP Ledger’s escrows.

Last month, however, the company sold the usual 200 million tokens, with an additional 150 million XRP. The extra sale made in September was the second-largest dump this year, totaling approximately $200 million worth of the cryptocurrency.

Picks for you

‘Rich Dad’ R. Kiyosaki reveals which investment is recommended by Jesus himself 1 hour ago Gold's path to $3,000 at risk as major pullback looms 19 hours ago Congressman breaks insider trading law twice in a week with $355 million in sales 20 hours ago US authorities fine insider traders $66.8 million in 2024 – report 21 hours ago  rBg2FuZT91C52Nny68houguJ4vt5x1o91m or Ripple (1). Source: XRP Scan / Finbold

rBg2FuZT91C52Nny68houguJ4vt5x1o91m or Ripple (1). Source: XRP Scan / Finbold

Ripple escrows dynamics and the 800 million XRP

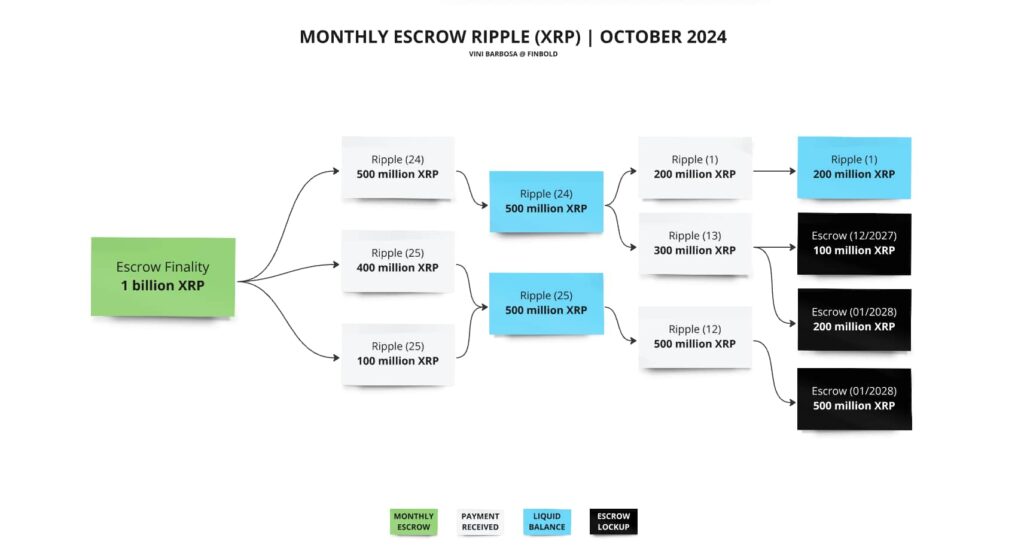

Notably, Ripple unlocked the 1 billion XRP from three escrows at Ripple (24) and Ripple (25). After sending 200 million tokens to Ripple (1) – to sell in October – Ripple (24) transferred and re-locked 300 million on Ripple (13) in two escrows: One for December 2027 with 100 million XRP and the other for January 2028, with 200 million XRP.

Ripple (25), on the other hand, transferred and locked 500 million on Ripple (12), which will unlock in January 2028.

Ripple’s escrow finality in October 2024, XRP’s path. Source: Finbold

Ripple’s escrow finality in October 2024, XRP’s path. Source: Finbold

XRP creators kept 20% of the supply after its creation in 2012, immediately putting it in circulation through strategic sales. Then, 80% of the money was allocated to the creation of Ripple and placed in a treasury for future sales.

In 2017, Ripple implemented the escrow system as the community started demanding more transparency on the ongoing supply inflation.

XRP price analysis

As of this writing, XRP trades at nearly $0.60, with 10% in losses from a peak on September 29. Yet, Ripple’s token has 9% of accumulated gains in the last 30 days after the company’s selling spree last month.

XRP 30-day price chart. Source: Finbold

XRP 30-day price chart. Source: Finbold

The sentiment, in this context, is primarily bullish both from analysts and the community of supporters. Finbold reported that 86% of the XRP community remains optimistic about a potential price surge.

Meanwhile, trading expert Alan Santana believes the token could hit $2 in 2025, according to his technical analysis.

“We have 833 days of accumulation and this is as good as it can get. 833 days of accumulation with more than 1,650 days of higher lows. This is all pointing to a very strong bull-market next. (…) We continue bullish on XRPUSDT. New All-Time High in 2025.”

– Alan Santana

Nevertheless, traders and investors must understand how the increasing supply dynamics require a superior increasing demand to meet these expectations. Ripple will continue to sell its XRP holdings every month while working to bring value to the ecosystem.