MicroStrategy outpaces S&P 500 and tech giants with Bitcoin strategy

![]() Stocks Oct 15, 2024 Share

Stocks Oct 15, 2024 Share

MicroStrategy (NASDAQ: MSTR), the largest corporate holder of Bitcoin (BTC), has emerged as one of the top-performing stocks in the S&P 500, thanks to its aggressive Bitcoin-focused strategy.

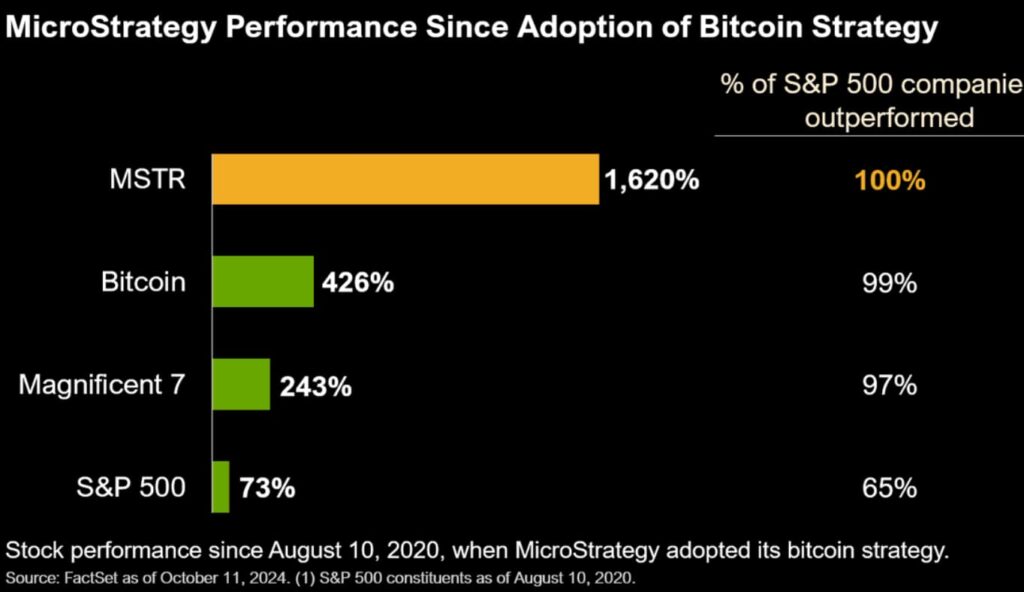

Since adopting Bitcoin as its primary treasury reserve asset in August 2020, MicroStrategy’s stock has skyrocketed by an impressive 1,620%, significantly outperforming Bitcoin, the Magnificent Seven, and major tech companies.

A recent performance analysis shows that the company has outpaced notable names such as Nvidia (NASDAQ: NVDA) and Arista Networks, which posted gains of 1,107% and 650%, respectively.

Picks for you

Donald Trump’s crypto launch faces issues on day one — What’s happening? 3 hours ago R. Kiyosaki advises how to 'survive and thrive' in US high inflation 6 hours ago Sui ‘infrastructure partner’ to dump $20 million more amid selling spree 6 hours ago dYdX announces Donald Trump Prediction Market perpetuals 8 hours ago  MicroStrategy performance since adoption of Bitcoin strategy. Source: Michael Saylor/ X

MicroStrategy performance since adoption of Bitcoin strategy. Source: Michael Saylor/ X

By comparison, Bitcoin itself increased by 426% during the same period, while the broader S&P 500 returned a modest 73%.

Bitcoin acquisition strategy: The driving force

MicroStrategy’s meteoric rise can be attributed to Michael Saylor’s bold decision in 2020 to convert a significant portion of the company’s cash reserves into Bitcoin.

Today, the company holds 252,220 Bitcoins, valued at over $15 billion, representing approximately 1.2% of Bitcoin’s total supply, according to Bitcoin Treasuries.

Saylor’s strategy of using debt and equity instruments, such as at-the-market (ATM) equity offerings and convertible senior notes, has allowed MicroStrategy to steadily increase its Bitcoin holdings.

According to MSTR-Tracker, the company’s net asset value (NAV) premium to its Bitcoin holdings has reached a three-year high of 270%.

The company’s NAV premium, which measures the difference between its market value and the value of its Bitcoin holdings, stands at 2.474x. This indicates that investors believe owning MSTR stock offers greater value than holding Bitcoin directly.

Currently, the stock trades at around $1931, with a one-month gain of 60%.

MSTR five-day price chart. Source: Google Finance

MSTR five-day price chart. Source: Google Finance

Despite some volatility due to Bitcoin price fluctuations, market confidence in MicroStrategy’s strategy remains robust, with many investors betting on the company’s long-term potential as a prospective “Bitcoin bank,” that has further driven its stock price momentum.

Bitcoin correlation and risks ahead

Despite these impressive gains, some analysts are expressing concerns about the sustainability of MicroStrategy’s stock performance.

Analysts caution that if Bitcoin faces a downturn, potentially triggered by rising inflationary pressures or broader market volatility, MicroStrategy’s stock could experience significant declines.

The tight correlation between MSTR and Bitcoin makes it particularly susceptible to any negative movements in the crypto market.

The company’s MSTR/BTC price ratio, currently at 0.00308, underscores how much its stock performance is tied to Bitcoin’s value.

However, the rise of Bitcoin ETFs and increasing institutional adoption offer a potential buffer, mitigating downside risks for MicroStrategy.

With Bitcoin recently trading around $67,058, companies like MicroStrategy, Coinbase (NASDAQ: COIN), and Marathon Digital (NASDAQ: MARA) have benefited from the broader market rally, further strengthening their market position.

While MicroStrategy’s bold Bitcoin strategy has propelled it to the forefront of stock market performance, investors should approach it with caution.

The company’s heavy reliance on Bitcoin makes its stock highly susceptible to the volatile nature of the cryptocurrency market.

While the potential for long-term gains remains, the road ahead is fraught with uncertainty, and investors must weigh the rewards against the significant risks associated with such a concentrated bet on a single, highly volatile asset.