Bitcoin sets for a $138,000 record high but expects major pullback

![]() Cryptocurrency Nov 19, 2024 Share

Cryptocurrency Nov 19, 2024 Share

Historical price patterns suggest that Bitcoin (BTC) might be preparing for a record-high target before a potential pullback.

Indeed, Bitcoin is consolidating above the $90,000 mark, with the markets anticipating a push toward the $100,000 level, which is highly expected to clock by January.

According to observations made by crypto trading expert Ali Martinez, Bitcoin could rise to $138,000 in the current cycle before facing a significant correction, as noted in X post on November 19.

Picks for you

io.net joins Zero1 Labs to advance decentralized artificial intelligence 5 seconds ago Goldman Sachs predicts Gold price hitting $3,000 in 2025 19 mins ago Dogecoin on track for a 100% rally to $0.82, analysts predict 27 mins ago Bitcoin euphoria is here: Analyst sets roadmap for ‘euphoric phase’ 31 mins ago  Bitcoin price analysis chart. Source: TradingView/Ali_charts

Bitcoin price analysis chart. Source: TradingView/Ali_charts

Martinez compared Bitcoin’s price behavior to previous bull markets and highlighted historical patterns. During the 2017 bull run, Bitcoin surged 156% above its previous all-time high before a steep correction of 39%. Similarly, in 2020, the leading cryptocurrency recorded a 121% rally before enduring a 32% pullback.

In an initial analysis, Martinez observed that Bitcoin seems to replicate the patterns observed in its last two bull markets. According to the analysis, Bitcoin has spent the past week in a consolidation phase after breaching its previous all-time high, hinting at a possible upward rally.

“After surpassing its previous all-time high, $BTC has been consolidating for a week. If history repeats, we could see another breakout in the next day or two, targeting ~$150,000, followed by a ~30% correction,” he said.

Bitcoin price analysis chart. Source: TradingView/Ali_charts

Bitcoin price analysis chart. Source: TradingView/Ali_charts

Bitcoin forms rare golden cross

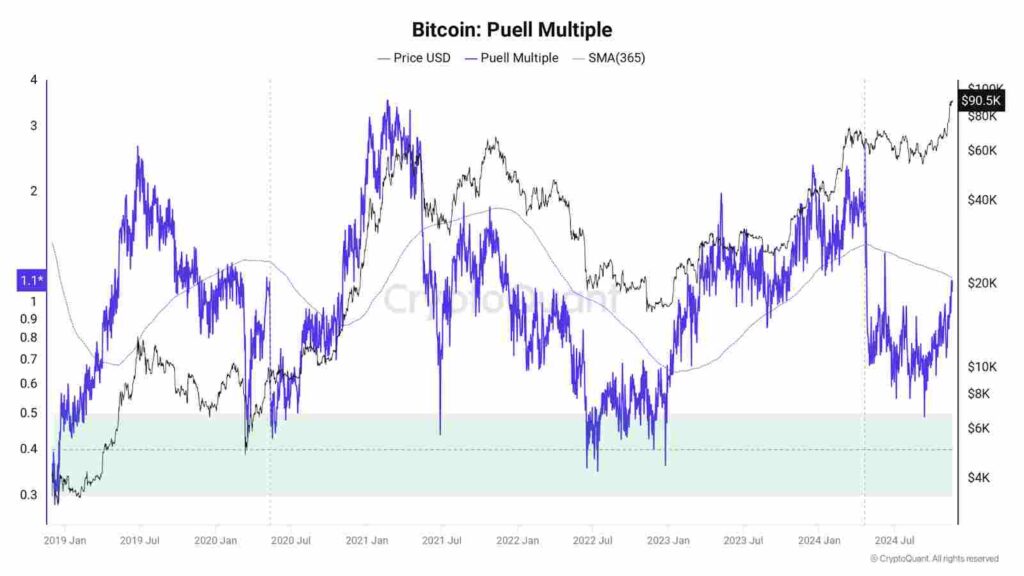

At the same time, onchain elements are signaling further momentum for Bitcoin. In this case, analysis by CryptoQuant pointed to a rare ‘golden cross’ in Bitcoin’s Puell Multiple, signaling a potential 90% price surge for the cryptocurrency.

This metric, which evaluates Bitcoin’s market cycles from a mining profitability perspective, crossed its 365-day moving average on November 18, an event that has occurred only three times in the past five years.

According to CryptoQuant’s analysis, these previous crossovers resulted in significant price rallies for Bitcoin.

Bitcoin peull multiple chart. Source: CryptoQuant

Bitcoin peull multiple chart. Source: CryptoQuant

Most of the market anticipates that Bitcoin’s continued consolidation above the $90,000 mark is building momentum for a $100,000 record high as markets continue to price in the Donald Trump win.

Notably, Trump, known for his pro-cryptocurrency stance, continues to signal that he will fulfill his promises of making the United States a digital assets hub. To this end, reports indicate that Trump has met with key leaders in the crypto world.

The latest development indicates that Coinbase CEO Brian Armstrong met with Trump, and the two individuals said they had discussed “personnel appointments for his second administration.”

Bitcoin price analysis

By press time, Bitcoin was trading at $91,826, gaining about 0.1% in the last 24 hours. In the past week, BTC has been up over 6%.

Bitcoin seven-day price chart. Source: Finbold

Bitcoin seven-day price chart. Source: Finbold

In summary, technical indicators suggest Bitcoin is well-positioned to sustain bullish momentum toward $100,000 but must hold the $90,000 support. However, investors should remain cautious, as historical patterns hint at a possible correction.

Featured image via Shutterstock