Ethereum’s next move: Key levels to watch as ETH reclaims $3,250 support

![]() Cryptocurrency Nov 24, 2024 Share

Cryptocurrency Nov 24, 2024 Share

Ethereum (ETH) is showing early signs of recovery as it consolidates near the $3,250 mark, reclaiming critical support levels.

Despite lagging behind the broader cryptocurrency market, which has been led by Bitcoin’s (BTC) near-$100,000 rally, ETH is poised for significant momentum as altcoin season gathers steam.

Ethereum key levels to watch

In a recent TradingView analysis, analyst RLinda noted that ETH is signaling an imminent breakout, with key resistance and support levels poised to determine its next direction.

Picks for you

Crypto trader turns $3.3k into $2.5 million in 3 hours 5 hours ago AI predicts Stellar Lumens (XLM) price for year-end 6 hours ago Romania is using blockchain to count presidential electoral votes today 6 hours ago Bitcoin facing correction to $85,000 as $100,000 target derails 6 hours ago  Ethereum price analysis. Source: RLinda/TradingView

Ethereum price analysis. Source: RLinda/TradingView

On the upside, a breakout above the immediate resistance at $3,442 would confirm bullish momentum, with the next target at $3,568.

If this level is breached, ETH could aim for the psychological barrier of $3,750, and during a strong rally, the price could even climb to $4,000, driven by the altcoin season momentum.

On the downside, the immediate support at $3,028 will be critical to maintain the bullish structure, with stronger support at $2,820 acting as a continuation zone. A failure to hold these levels could push ETH lower.

That being said, Ethereum’s trajectory remains closely tied to Bitcoin’s performance, prevailing market sentiment, and external catalysts.

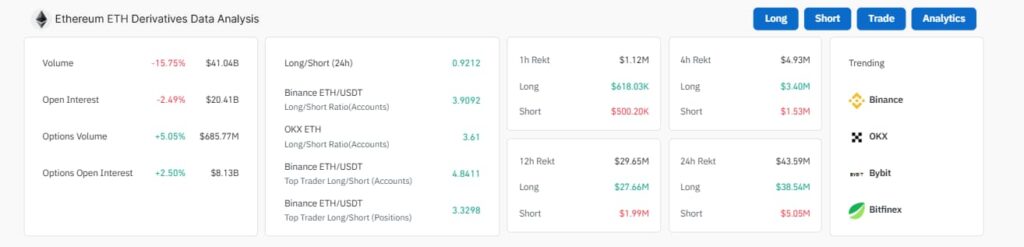

Derivatives data: Optimism despite declines

The Ethereum derivatives data indicates a bullish tilt, supported by key metrics despite a slight decline in overall activity.

While trading volume has dropped by 15.75% to $41.04 billion and open interest has decreased by 2.49% to $20.41 billion, the options market shows growing demand, with options volume rising by 5.05% to $685.77 billion and options open interest increasing by 2.50% to $8.13 billion.

Ethereum derivatives data. Source: CoinGlass

Ethereum derivatives data. Source: CoinGlass

Long positions dominate the market, with the Binance ETH/USDT long/short ratio at 3.9092 and OKX at 3.61, while top traders on Binance exhibit even stronger bullish sentiment, with a long/short ratio of 4.8411 for accounts.

Additionally, substantial short liquidations, totaling $38.54 million in the past 24 hours compared to only $5.05 million in longs, highlight a short squeeze driving bullish momentum. Despite minor declines in volume and open interest, the data suggests traders are optimistic about Ethereum’s upward price potential.

Analysts like Alan Santana have interpreted the recent price surge as a potential indicator of the start of a new bull market, with Ethereum projected to climb as high as $8,000 in the coming months.

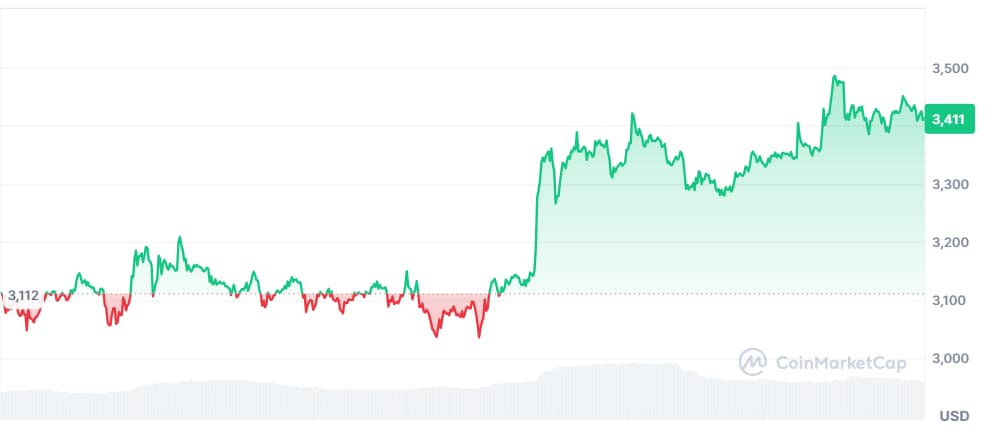

Ethereum price analysis

Ethereum is currently trading at $3,315, marking a 3% dip over the last 24 hours but maintaining a solid 7% gain for the week.

Ethereum seven-day price chart. Source: CoinMarketCap

Ethereum seven-day price chart. Source: CoinMarketCap

This recent resilience comes amid a significant shift in market sentiment, driven by renewed interest in U.S.-based spot Ethereum ETFs.

According to data from SoSoValue, these ETFs saw a net inflow of $91.21 million on Friday, their first positive inflow since November 13, signaling a potential revival in institutional confidence.

Institutional players and whales have also contributed to Ethereum’s bullish outlook. Analyst Ali Martinez noted a remarkable accumulation of 430,000 ETH, worth approximately $1.4 billion, over the past two weeks. This surge in large-scale buying reflects growing confidence among major investors, positioning Ethereum for further price appreciation.

AI-driven forecasts further strengthen the optimism, projecting Ethereum’s year-end price to range between $3,800 and $4,200. The combination of ETF inflows and whale activity has set the stage for a potentially sustained rally, leaving investors hopeful that the current momentum will propel Ethereum to new highs as the altcoin season gathers steam.

Featured image via Shutterstock