Billion dollar asset manager files for DOGE and TRUMP ETFs

![]() Cryptocurrency Jan 21, 2025 Share

Cryptocurrency Jan 21, 2025 Share

The election of Donald Trump ignited a strong cryptocurrency bull run in early November of 2024. Trump was largely seen as the pro-crypto candidate of the 2024 election — having promised to open a strategic Bitcoin (BTC) reserve for the United States and even launching his own meme coin on January 17.

However, the exact specifics and policies that Trump will put in place are still unclear. Notably, the President’s inaugural speech and first executive orders avoided the topic of cryptocurrencies entirely — although this has done relatively little to stymie the jubilant bull run.

Retail investors tend to err on the side of optimism — but similar sentiments from institutional investors are a much rarer sight.

Picks for you

2 cryptocurrencies to reach a $10 billion market cap in Q1 2025 6 hours ago Solana or Cardano? We asked AI which is a better buy now that 2025 started 8 hours ago MicroStrategy extends Bitcoin buying to 11th consecutive week as BTC price surges 8 hours ago This bullish pattern hints Dogecoin to target $15, according to trading expert 9 hours ago

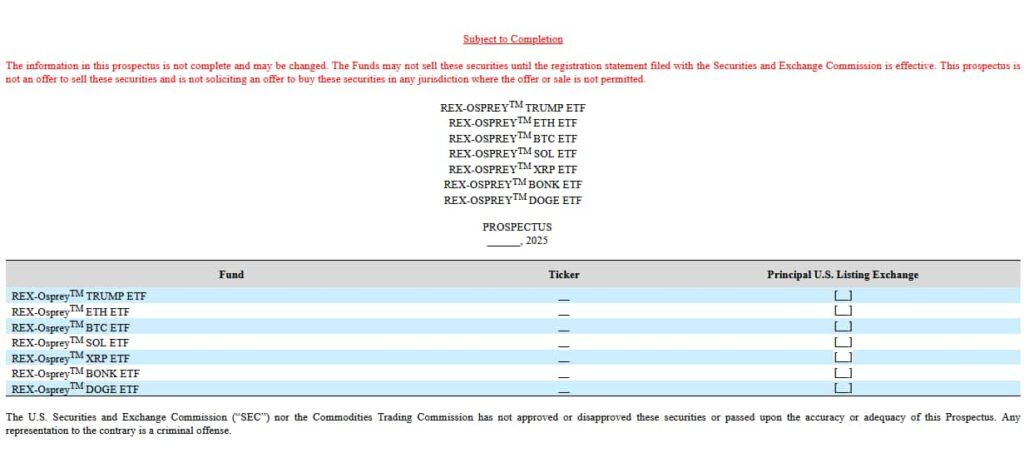

Per a January 21 filing made with the Securities and Exchange Commission (SEC), $1 billion exchange-traded fund (ETF) provider REX shares and Osprey Funds intend to launch 7 new cryptocurrency ETFs.

On its own, that wouldn’t exactly be groundbreaking — except that 2 out of the 7 investment vehicles will be based on meme coins — Dogecoin (DOGE) and Official Trump (TRUMP), in what is likely a first for the wider cryptocurrency market.

Rex Shares and Osprey Funds to open meme coin ETFs

According to the filing, the two companies also want to launch Bitcoin, Ethereum (ETH), Solana (SOL), and XRP exchange-traded funds.

SEC filing detailing the proposed meme coin ETF. Source: SEC

SEC filing detailing the proposed meme coin ETF. Source: SEC

As noted by X user James Seyffart, these new products are filed under the 1940 Act — just like crypto futures ETFs were. In simple terms, this means that they will hold a mix of derivatives, the assets themselves, and include a Cayman subsidiary which will hold the assets.

Notably, these products are filed under the 1940 Act (like crypto futures ETFs). They'll hold a combo of derivatives, the assets, and a cayman subsidiary which will hold the assets. This looks similar to a playbook issuers use in the commodity ETF world to avoid K-1's but idk. pic.twitter.com/rX5sbMeyjw

— James Seyffart (@JSeyff) January 21, 2025

While the idea might appear intriguing at first glance, it remains an open question as to how Rex and Osprey intend to handle the volatility that is inherent in meme coins. ETFs that hold large-cap cryptocurrencies have enjoyed record inflows and a lot of success — but these new investment vehicles might very well be outside of the risk tolerance of most investors.

Featured image via Shutterstock