Peter Diamandis is the founder of X Prize and Singularity University, a high tech business incubator with a focus on how AI is shaping the future.

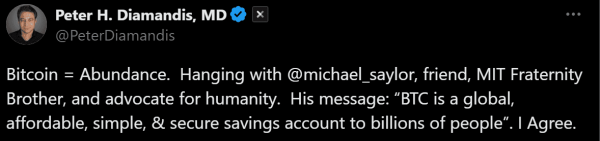

On Sunday, Diamandis asked the question to his 262K+ followers on X. Many of the answers were very illuminating.

One replier pointed out that Bitcoin has never failed to do what it promises. That’s because it has never failed in 15 years to execute a new block of transactions every ten minutes on average. It has also never been hacked at the base blockchain layer.

“Bitcoin has never failed in doing what it’s built to do. Price is just a measure of adoption. Period,” the commentator wrote. “It can’t fail because the world is in need of real money, and there’s no second best,” another one said.

The Origins of ‘Too Big to Fail’

The phrase “too big to fail” came into common usage during the 2008 financial crisis. The government ultimately stepped in to bail out a number of U.S. banks and financial companies with toxic balance sheets.

Originally, Congress appropriated $700 billion for the Troubled Asset Relief Program (TARP). But by the time Washington finished bailing out Wall Street, cost overruns ran into the trillion-dollar threshold.

At the time, bailing out private banks with public money was a controversial issue. Opponents said true capitalism would let them fail and didn’t think it was fair to make taxpayers foot the bill for corporate mismanagement.

However, proponents of the TARP bailout argued that the banks were “too big to fail.” In other words, their importance to the economy was too great to allow the disruptions that would go along with letting them go out of business.

Is Bitcoin Too Big to Fail?

So anything too big to fail used to mean that it would get a bailout from the government if it needed one. In this case Diamandis probably meant: Will Bitcoin ever even need a bailout?

Of course, there would be no way for the government to bailout Bitcoin, as the cryptocurrency is not a company or individual. It’s a decentralized database of accounts and transactions run by an open-source, peer-to-peer Internet network.

However, this question is a great starting point for exploring the difference between Bitcoin and corporate banks.

Free markets use the Internet to “bail out” Bitcoin every time the price gets so low that market participants cannot resist buying some for the profit incentive if it goes back up again.

An immense community of long-term holders with high-conviction in bitcoin’s value proposition buy BTC and hold on for dear life. It’s a practice that has paid off. The realized capitalization of long-term holders’ BTC recently surpassed $10 billion for the first time.

Cryptocurrency critics love to boast when bitcoin’s price periodically goes through a massive correction, but it has never seemed to be in danger of going out of business entirely.