AI sets date when Ethereum will trade at $4,000

![]() Cryptocurrency Jul 14, 2025 Share

Cryptocurrency Jul 14, 2025 Share

Ethereum (ETH) is riding a wave of institutional demand and protocol upgrades, with nearly $1 billion in inflows to ETH investment products last week, according to CoinShares.

However, technical warning signs and ecosystem concentration are tempering short-term enthusiasm.

Accordingly, artificial intelligence (AI) predicts that ETH is likely to remain in the neutral-to-bullish phase in the coming months, with a potential for a $4,000 price.

Will Ethereum hit $4,000?

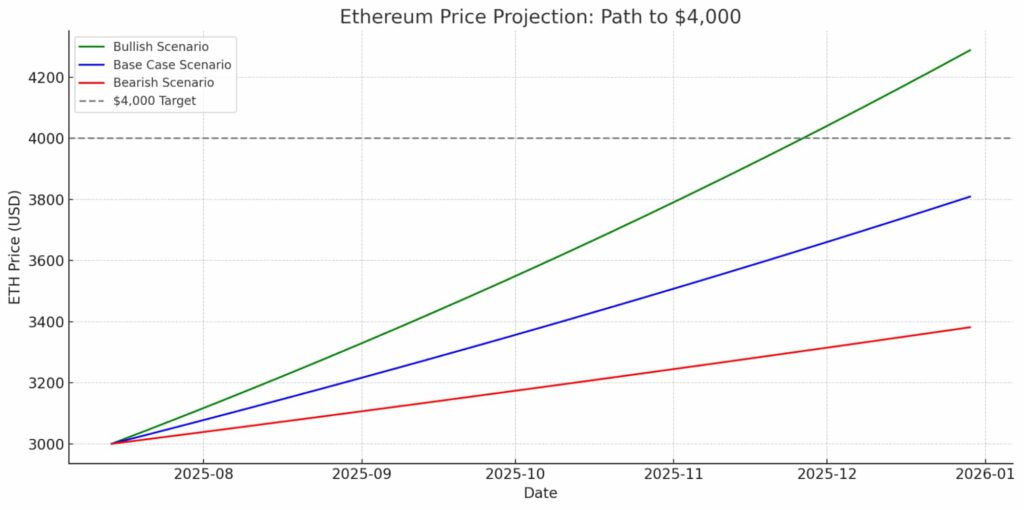

To see when Ethereum might hit $4,000, Finbold consulted OpenAI’s ChatGPT, which estimated that the number could be reached sometime in early September 2025 in the most bullish scenario.

ETH price prediction. Source: ChatGPT and Finbold

ETH price prediction. Source: ChatGPT and Finbold

While Ethereum has certainly gained a lot of momentum, ChatGPT’s prediction hinges on continued institutional inflows and broader macroeconomic developments.

That is, the $4,000 mark could become a reality if exchange-traded fund (ETF) inflows continue at the current pace of roughly $1 billion per week.

Ideal macroeconomic conditions would likewise have to be met, including potential Federal Reserve rate pauses or cuts.

A more moderate outlook, therefore, sees the cryptocurrency consolidating in a $3,000–$3,300 range through August before continuing on the upward trend in later months.

However, a bearish scenario is always likely as well, and the algorithm predicts the climb could be delayed into early 2026 if renewed inflation concerns or regulatory bottlenecks become an issue.

Ethereum price analysis

At press time, Ethereum was trading at $3,041.35, up 1.78% in the past 24 hours.

ETH 24-hour price chart. Source: Finbold

ETH 24-hour price chart. Source: Finbold

The upward momentum was largely generated by ETFs, which saw roughly $908 million in inflows last week, according to CoinMarketCap.

In the meantime, the rally was further supported by Sharplink Gaming’s (NASDASQ:SBET) $463 million ETH purchase and a growing number of altcoin ETF filings.

From a technical standpoint, Ethereum is showing bullish momentum as well, the moving average convergence divergence (MACD) confirming a positive crossover and the relative strength index (RSI) of 71.54 signaling overbought conditions without yet flashing red.

Featured image via Shutterstock