Bears were wrong: Crypto adds $800 billion market cap in two months

![]() Cryptocurrency Nov 10, 2024 Share

Cryptocurrency Nov 10, 2024 Share

Cryptocurrency bulls and bears have shared their insights and built their positions during a slightly bearish seven-month consolidation phase. Cryptocurrencies have now proved the bears wrong, adding over $800 billion in capitalization in two months, starting a bull market.

Finbold looked at TradingView’s Crypto Total Market Cap Index (TOTAL) on November 10, currently marking a $2.667 trillion capitalization.

TOTAL had been in a seven-month downtrend range, touching the range’s bottom for the last time in early September. Since then, the crypto market has added over $800 billion in capitalization, up over 40% in two months.

Picks for you

Is Bitcoin's $100,000 target becoming realistic amid strong bullish catalysts 30 mins ago Bitcoin key price levels to watch as bullish bias is confirmed 55 mins ago Why gold beating stocks' might not be a good sign,' according to strategist 3 hours ago Buy signal for two strong cryptocurrencies this week 18 hours ago

Notably, the highest inflow occurred in the last five days, adding over $465 billion. This happened after testing the range’s top as support for the second time, which was previously a resistance. TOTAL broke out of the downtrend in mid-October as “Uptober” was playing out.

Crypto Total Market Cap Index (TOTAL) daily chart. Source: TradingView / Finbold / Vini Barbosa

Crypto Total Market Cap Index (TOTAL) daily chart. Source: TradingView / Finbold / Vini Barbosa

Beware: Short squeeze first, long squeeze second

The weekend has already seen significant volatility after Bitcoin (BTC) reached a price target of $77,500, as Finbold forecasted. With that, the market registered nearly $400 million in liquidations from short and long positions in the last 24 hours.

In particular, $290 million was liquidated in a short squeeze, punishing the bears, while $105 million was of long liquidations. Bitcoin had the largest single liquidation of $13.10 million and a total of $105 million liquidated.

Liquidation Heatmap and Total Liquidations in 24 hours. Source: CoinGlass / Finbold

Liquidation Heatmap and Total Liquidations in 24 hours. Source: CoinGlass / Finbold

The move has punished bears like Credible Crypto, who were eagerly shorting Bitcoin and altcoins since early October.

Give me a bounce so I can short this "altseason" to the ground. $BTC

— CrediBULL Crypto (@CredibleCrypto) October 3, 2024

However, the same analyst, CrypNuevo, who predicted $77,500 as this weekend’s price target now warns of a potential long squeeze. This, in his analysis, would be an overdue corrective movement to clear the excessive amount of longs before the market can continue its move upwards.

“Not sure if we’ll revisit the upside box, but I’m feeling pretty confident that we’ll get a (shallow) pullback from around that zone. If we look at the delta liquidations now, longs are at a risky level.”

– CrypNuevo

Bitcoin could retrace in a long squeeze before next rally

CrypNuevo warned of a “Today’s short squeeze before the long squeeze” on Saturday. Yet, he was wrong about how high Bitcoin could go before the pullback, as BTC neared the $80,000 level.

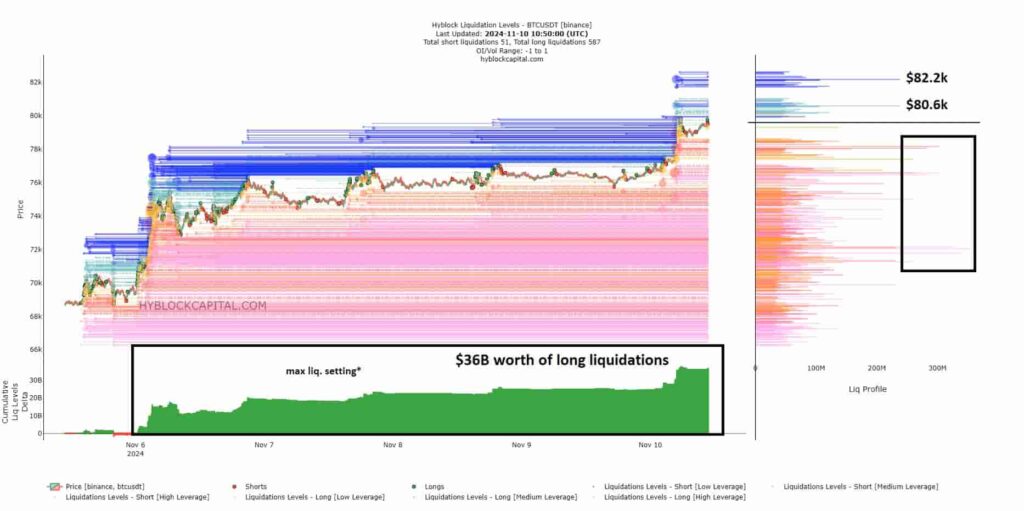

On Sunday, he doubled down the retracement prediction now that the market accumulates over $36 billion worth of long liquidations. These liquidations were below $30 billion on Saturday, evidencing how the bulls have become overconfident with the rally. This overconfidence was what punished bears in the last month, as warned in a comment for Credible Crypto.

Liquidation levels for BTC/USDT (Binance). Source: Hyblock Capital / CrypNuevo

Liquidation levels for BTC/USDT (Binance). Source: Hyblock Capital / CrypNuevo

As previously shared, the trader does not plan to open shorts here. Instead, CrypNuevo said he would use the pullback to open more longs, including in altcoins with high growth potential. Other analysts have also shown a bullish bias on altcoins, predicting Bitcoin’s dominance (BTC.D) will peak and drop soon.

Finbold reported some of these “altseason” ideas before, including a trading plan to prepare for a bull market. Nevertheless, traders and investors must remain cautious and avoid being caught by the fear of missing out (FOMO).