As the Crypto Fear and Greed Index plunges to 35, market sentiment reflects growing fear and uncertainty. Bitcoin struggles to find strong footing near the $97,000 mark, battling against a pullback of 1.08% over the past 24 hours.

With a market valuation still under $2 trillion, Bitcoin’s momentum remains weak. While a potential morning star pattern hints at a bullish comeback, the sudden halt in institutional support warns of a deeper correction.

Will a turnaround in institutional demand propel BTC price back to the $106,000 mark?

Bitcoin at $97k Aims For A Comeback

In the daily chart, Bitcoin’s price decline tests a crucial local support trendline. With a doji candlestick formed yesterday, today’s intraday recovery of 1.13% hints at a morning star reversal.

Bitcoin Price Chart

Bitcoin Price Chart

Currently, the BTC price consolidates between the 50-day and 100-day EMA lines, keeping traders cautious. However, the previous pullback has triggered a bearish trend in the MACD and signal lines.

Thus, the momentum indicator presents a sell signal, despite Bitcoin sitting at a key support level. This generally contradicts the buy at support, sell at resistance strategy.

For now, the morning star pattern strengthens the chances of a bullish reversal rally, which could drive a broader market recovery.

Ascending Triangle Formation: Bullish Breakout or Breakdown?

On a larger scale, the local support trendline forms an ascending triangle pattern, with the overhead ceiling at $106,000. If the BTC price maintains support within this pattern, it could see a short-term market recovery.

In such a case, Bitcoin could test the overhead resistance, projecting an upside potential of nearly 10%. However, if bulls fail to sustain dominance at this support level, the BTC price could witness a major crash.

The immediate support for Bitcoin stands at $91,000, and a closing below this level would significantly increase downside risks.

Institutional Activity: ETF Flows Reveal Mixed Sentiment

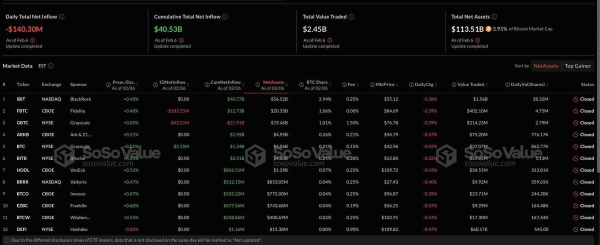

On February 6, the daily total net inflow of U.S. Bitcoin spot ETFs remained negative. Grayscale BTC Mini Trust was the only buyer, with an inflow of $5.15 million.

BTC ETF

BTC ETF

However, the major selling came from Fidelity, offloading $103.25 million, while Grayscale BTC Trust sold $42.21 million. This reveals a diverging viewpoint between Grayscale Mini BTC Trust and Grayscale BTC Trust.

Currently, Grayscale BTC Trust has a cumulative net outflow of $21.91 billion, reflecting continued selling pressure. Meanwhile, the largest Bitcoin ETF, BlackRock, with a total net asset value of $56.252 billion, maintained a neutral stance with zero net flow.