Bitcoin “bull-trap” alert: Is the path to $100,000 still open for BTC?

![]() Cryptocurrency Nov 2, 2024 Share

Cryptocurrency Nov 2, 2024 Share

Bitcoin’s (BTC) recent price action has raised red flags for investors as it briefly surpassed the critical $70,000 resistance level, only to retreat shortly after.

This aligns with a classic “bull-trap” pattern, a situation where buyers are lured into what appears to be a breakout, only to face a sharp reversal.

The current price movement suggests that this might indeed be the case, casting doubt on the likelihood of Bitcoin reaching the $100,000 target in the near term.

Picks for you

US Treasury bonds on the rise and this is 'absolutely terrifying,' warns analyst 43 mins ago Ripple prepares for what could be the largest XRP dump in 7 years 4 hours ago AI sets date when Bitcoin will hit $100,000 5 hours ago 2 cryptocurrencies to reach 100 billion market cap by year-end 20 hours ago

The $70,000 resistance and bearish indicators

In a recent TradingView post on November 2, analyst Alan Santana highlighted the psychological and technical significance of the $70,000 level.

This price point marked the onset of a major bearish trend last August, establishing it as a strong resistance level.

Bitcoin price analysis chart. Source: Alan Santana/TradingView

Bitcoin price analysis chart. Source: Alan Santana/TradingView

While surpassing this threshold could have signaled a more sustained rally, Bitcoin’s inability to hold above it has created what appears to be a failed breakout,a telltale sign of a bull trap.

The observed candlestick pattern further supports this interpretation. BTC formed a Doji candle, characterized by a narrow opening and closing price with long shadows. An intraday high of $71,611 was sharply rejected, with BTC closing below its opening. This behavior typically signals a reversal, strengthening the bear case.

“After exactly three days above this level, Bitcoin is now back below it. This move ended up either as a failed breakout or simply a bull-trap, makes no difference how we call it.”- he said

Furthermore, technical indicators such as the RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence) show signs of weakening momentum, which further supports the bearish outlook.

Broader market context and external pressures

Bitcoin’s price trajectory faces a blend of macroeconomic pressures and potential catalysts.

On the bearish side, a strong U.S. Dollar Index (DXY) has weighed on Bitcoin, as investors often gravitate toward the dollar as a safe haven. Additionally, approaching U.S. elections have introduced caution in the market, with increased altcoin selling pressure further challenging Bitcoin’s rally.

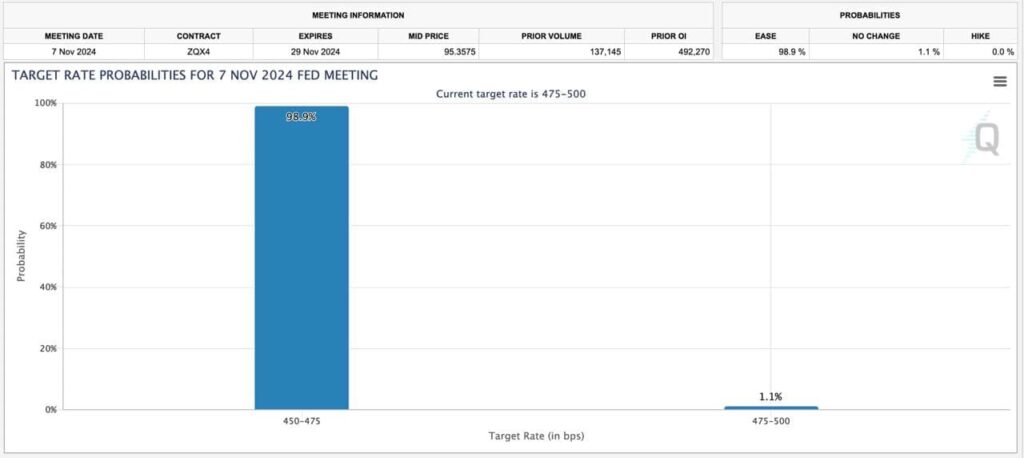

However, some factors could still support Bitcoin’s ascent. U.S. job data showed a slowdown in payroll growth, sparking expectations for a 25-basis-point rate cut at the next FOMC meeting, with a second cut potentially in December.

Odds of 0% vs. 25% BPS cut in November. Source: CME Group

Odds of 0% vs. 25% BPS cut in November. Source: CME Group

Lower interest rates typically boost risk assets, including Bitcoin, and could revive bullish omentum.

Moreover, institutional demand remains strong, with BlackRock’s IBIT ETF (NASDAQ: IBIT) ETF seeing significant inflows, a sign of robust interest from large investors.

Will Bitcoin still reach $100,000?

While recent setbacks have dimmed the immediate outlook, Bitcoin’s path to $100,000 isn’t completely closed.

For Bitcoin to regain a bullish trajectory, it would need to decisively break and hold above the $70,000 resistance. This would likely set the stage for higher resistance levels and possibly a rally toward six figures.

Moreover, a recent analysis by TradingShot suggests that Bitcoin’s current price movement presents a strategic buying opportunity, with some AI models even forecasting that Bitcoin could reach $100,000 by mid-2025, assuming favorable market conditions and macroeconomic support.

In conclusion, although Bitcoin’s path to $100,000 remains open, caution is advised in the short term as the market navigates uncertainty.

Investors should prepare for potential downside risks while staying attuned to the possibility of a renewed rally if Bitcoin regains control above key resistance thresholds.