Bitcoin reached a new all-time high (ATH) earlier this week, briefly surpassing $108,000. However, the crypto king has since faced a pullback, dropping below $96,000.

While the decline reflects short-term profit-taking, it does not negate the cryptocurrency’s long-term potential, which continues to garner attention.

Bitcoin Is Changing Hands

Mid-term Bitcoin holders, particularly those who have held BTC for six to 12 months, are leading the current profit-taking trend. These investors accumulated during prior cycles and are now seizing the opportunity to lock in gains.

This behavior mirrors the 2015-2018 bull market when the Spent Output Profit Ratio (SOPR) remained below 2.5 for an extended period, eventually giving way to a euphoric rally.

As seen in prior bull markets, heavy profit-taking from these holders is likely to lead to a phase of exhaustion. For Bitcoin to maintain its upward momentum, increased demand and the entry of new buyers are crucial. Without these factors, the bull run could face challenges in sustaining its trajectory.

Bitcoin SOPR. Source: Glassnode

Bitcoin SOPR. Source: Glassnode

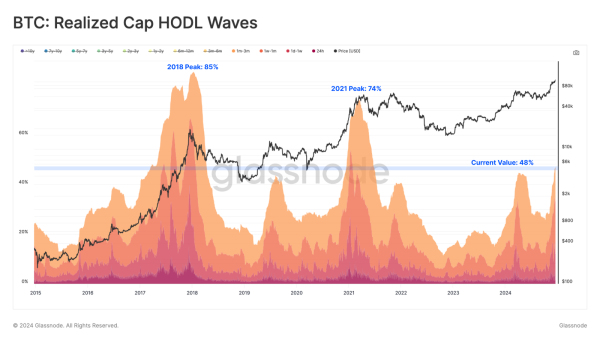

The HODL waves show a noticeable increase in wealth held by recently moved Bitcoin, indicating a rise in demand-side activity. Coins previously held by long-term investors are being distributed to new buyers, demonstrating that fresh capital is entering the market. This trend highlights the growing interest in Bitcoin despite recent price fluctuations.

However, the proportion of wealth held by newer investors has not yet reached levels seen during the peak of prior ATH cycles. While the current metrics show positive signs, Bitcoin’s macro momentum hinges on whether this demand continues to grow. Sustained accumulation by new market participants will be key to driving future price rallies.

Bitcoin HOLD Waves. Source: Glassnode

Bitcoin HOLD Waves. Source: Glassnode

BTC Price Prediction: Recovery Ahead

Bitcoin is expected to find immediate support around $95,000. Currently trading at $95,144, the cryptocurrency could recover if market sentiment stays positive.

The next critical milestone for Bitcoin is flipping $95,668 into support. Achieving this would likely pave the way for a move back above $100,000. Breaking past this psychological barrier would signal renewed confidence and bullish momentum, potentially drawing in additional buyers.

Bitcoin Price Analysis. Source: TradingView

Bitcoin Price Analysis. Source: TradingView

Failure to hold the $95,000 range or increased profit-taking could push Bitcoin lower. In such a scenario, the next significant support level sits at $89,800. A decline to this point could invalidate the bullish thesis, signaling a potential bearish phase for the market.