Santiment Feed suggests Bitcoin can cancel out this rough start to March 2025.

February 2025 was Bitcoin‘s worst month in the past two and a half years, and the asset has struggled unsuccessfully to shake these blues in March 2025. But better days may be ahead, at least according to one leading crypto analytics provider.

Second Half of March to be Better?

After an initial push to $95,000 at the beginning of March on U.S. crypto reserve speculation, Bitcoin is back near its February 2025 lows, currently trading around $81,600.

However, crypto analytics provider Santiment Feed suggests that the leading digital asset could cancel out this rough start with a better showing in the second half of the month.

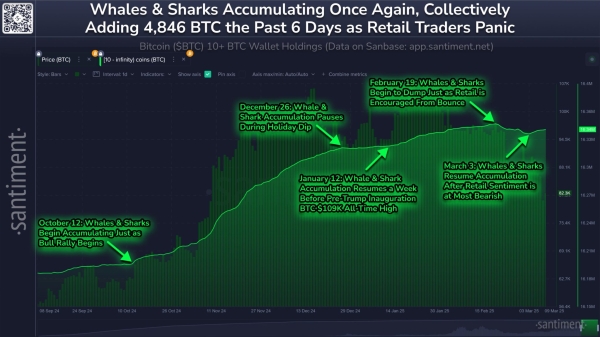

Santiment’s view is rooted in the behavior of Bitcoin sharks and whales. Bitcoin sharks are investors with holdings between 100 BTC and 1,000 BTC. However, whales have holdings above 1,000 BTC.

In an X post on Monday, March 10, the analytics provider revealed that these investors were again accumulating the asset, hinting at a potential rebound in the second half of the month. Specifically, the platform highlighted that they had added 5,000 BTC to their holdings since March 3.

Bitcoin sharks and whales accumulating | Santiment Feed

Bitcoin sharks and whales accumulating | Santiment Feed

The view that this accumulation could influence market performance comes due to the market moving capital these investors control. Indeed, Santiment partly attributes Bitcoin’s recent decline to these investors selling.

Meanwhile, Bitcoin sharks and whales are not the only investor classes to show a bullish shift recently. On Sunday, March 9, prominent analyst Axel Adler Jr. disclosed that long-term holders have shifted from distribution to low accumulation.

“This reduction in supply typically precedes stabilization and a new market cycle, representing a potentially positive market signal,” he wrote.

$95K the Level to Watch?

One thing Bitcoin investors could look for as confirmation of a possible reversal is a break above $95,000.

The price level aligns with the high of a bearish continuation pennant pattern on the daily candlestick chart, recently highlighted by veteran commodities trader Peter Brandt.

Interestingly, Standard Chartered Head of Digital Assets Research Geoffrey Kendrick argued on Friday, March 7, that Bitcoin could break above $95,000 soon “if the tariff noise can slow down for a while.”