Bitcoin to hit $130,000 on this date, according to analyst

![]() Cryptocurrency May 17, 2025 Share

Cryptocurrency May 17, 2025 Share

As Bitcoin (BTC) consolidates just below $105,000, an analyst has identified a historical trend that could propel the flagship cryptocurrency to a new all-time high in the coming weeks.

Since bottoming in early April, Bitcoin has moved in a clear $10,000 step-like pattern, first breaking through $74,000, then $84,000, $94,000, and now consolidating near $104,000.

This consistent progression has seen each primary level tested and breached, forming a well-defined upward channel.

According to prominent crypto analyst TradingShot in a TradingView post on May 16, this formation suggests that Bitcoin is trading within an ascending channel, indicating room for continued gains.

Bitcoin price analysis chart. Source: TradingView/TradingShot

Bitcoin price analysis chart. Source: TradingView/TradingShot

If the channel holds, the next potential milestones are $114,000, $124,000, and ultimately $134,000, a key target TradingShot projects for late June or early July.

However, the bullish structure comes with risks. A breakdown below the channel’s lower boundary could trigger a sharp correction, with possible support retests around $94,000 or even $84,000.

Bitcoin’s path to $120,000

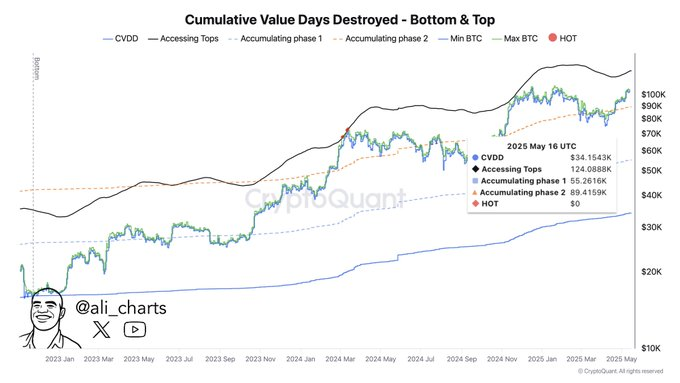

Adding to the bullish sentiment, analyst Ali Martinez noted in a May 17 X post that Bitcoin could aim for a new high near $120,000, provided it maintains support above $90,000.

Martinez’s analysis was based on the “Cumulative Value Days Destroyed” (CVDD) indicator, which signals that Bitcoin is currently in a healthy accumulation phase. Historically, this metric has identified market tops and bottoms, and the current trend suggests a potential blow-off top around $120,000.

Bitcoin Cumulative Value Days Destroyed chart. Source: CryptoQuant

Bitcoin Cumulative Value Days Destroyed chart. Source: CryptoQuant

According to the chart, Bitcoin is now in the final stages of accumulation. The CVDD is $34,153, while major resistance is $124,088. Support remains at $90,000, an area that aligns with key psychological and technical levels.

Amid this optimistic outlook, Bitcoin has recently hovered between $104,000 and $105,000. Analysts believe the asset may be consolidating within a bullish flag, a continuation pattern following its strong surge from $74,400 to $105,900. That rally was fueled by margin liquidations and strong spot demand, backed by billions in BTC ETF inflows.

Bitcoin price analysis

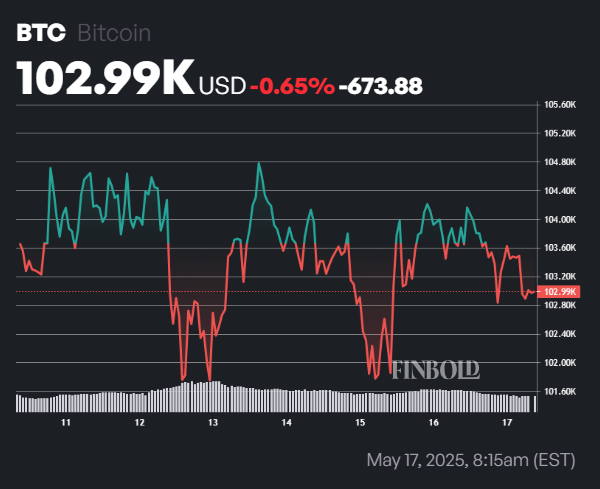

By press time, Bitcoin was trading at $102,977, down about 0.6% on both the daily and weekly charts.

Bitcoin seven-day price chart. Source: Finbold

Bitcoin seven-day price chart. Source: Finbold

Still, BTC remains well above its 50-day simple moving average (SMA) of $90,993 and its 200-day SMA of $86,134, reinforcing strong bullish momentum. The gap between the current price and these moving averages suggests the uptrend remains intact, even if a short-term pullback occurs.

Featured image via Shutterstock