Bitcoin whale’s selloff triggers market meltdown; Is this the beginning of the end?

![]() Cryptocurrency Jul 25, 2025 Share

Cryptocurrency Jul 25, 2025 Share

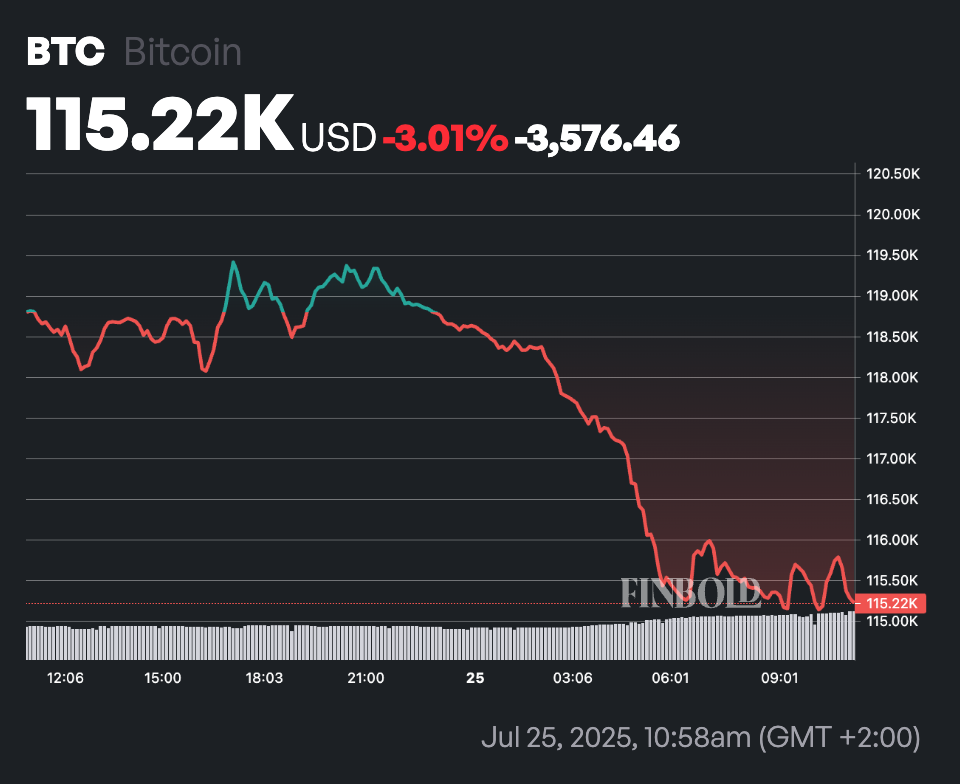

Bitcoin (BTC) dropped below $115,220 on Friday, down 3.01% in the last 24 hours, as the cryptocurrency faces pressure from massive whale movements that crypto analyst Crypto Patel describes as a potential “major distribution event.”

BTC 24-hour price chart. Source: Finbold

BTC 24-hour price chart. Source: Finbold

Using Arkham data, the analysis reveals that a major Bitcoin OG with 80,009 BTC (~$9.6 billion) has been systematically moving large amounts of Bitcoin through Galaxy Digital.

The whale’s timeline

The massive sell-off began on July 15, when the whale sent 9,000 BTC ($1.06 billion) to Galaxy Digital, followed by another 7,843 BTC ($927 million), totaling 16,843 BTC ($2 billion) moved to Galaxy on that day alone.

Galaxy Digital immediately began depositing the Bitcoin to exchanges, with 2,000 BTC ($236 million) going to Binance and Bybit platforms.

Later, on July 15, an additional 40,009 BTC ($4.68 billion) was transferred to Galaxy Digital.

On July 17, the whale transferred another 40,192 BTC ($4.77 billion) to a new wallet address (bc1qs4) before sending the entire amount to Galaxy Digital on July 18.

The selling pressure culminated in 30,109 Bitcoin, worth approximately $3.5 billion, being sent to exchanges and other wallets in just the last 24 hours.

Broader macro factors

The whale selling comes at a particularly sensitive time for Bitcoin markets, with multiple early holders becoming active. In addition to this massive distribution, other dormant wallets have recently awakened, including a 14.5-year-old wallet containing $468 million worth of Bitcoin.

Traders are closely monitoring the Federal Reserve’s upcoming policy meeting scheduled for July 30, where the central bank is expected to maintain current interest rates, though market participants will focus on official commentary regarding future monetary policy direction.

Coinciding with the Fed meeting, White House crypto adviser Bo Hines announced this week that the President’s Digital Asset Working Group has completed its long-awaited 180-day crypto policy report, scheduled for public release on July 30.

The report, required by a January executive order, is anticipated to provide details on the quantity of seized Bitcoin held by the U.S. government and outline potential management strategies for these holdings. Beyond the Bitcoin reserve framework, the working group is expected to propose a comprehensive regulatory structure for digital assets.

Featured image via Shutterstock.