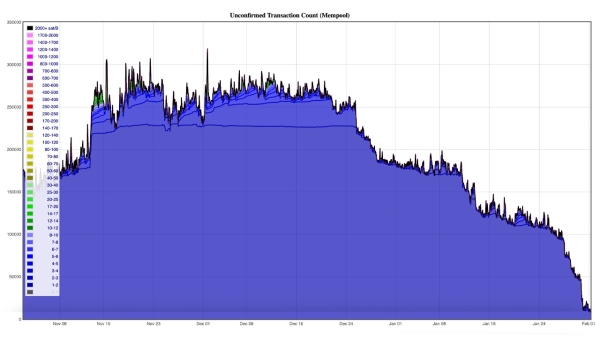

According to the latest statistics, following the first week of January, the number of unconfirmed transactions in the mempool has plummeted from slightly more than 200,000 to the current 7,723—a low not seen since 2022.

Bitcoin Blockchain Activity Dips—Mempool at Lowest Level Since 2022

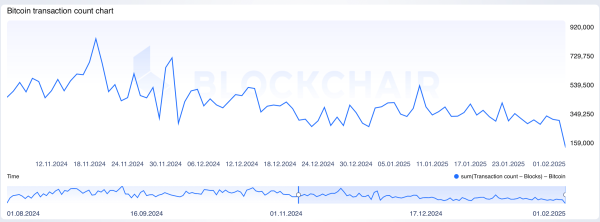

Transfer activity on the Bitcoin blockchain has diminished markedly since Nov. 19, 2024, when miners processed roughly 810,805 transactions on that specific day. Since then, confirmed transfers have consistently lowered, dropping below the 400,000 mark over the past week, and yesterday, 328,684 transactions were processed—a reduction of 59.46% in transfer activity compared to Nov. 19.

This diminished activity has resulted in a notable fall in onchain fees, while at the same time, miners have succeeded in reducing the mempool of unconfirmed transfers to its lowest level since 2022. This is a pronounced contrast to the period in September 2023 when unconfirmed transfers exceeded the 600,000 range.

“Johoe’s Bitcoin Mempool Statistics” indicate that on Jan. 8, 2025, the backlog comprised just over 200,000 transactions, and presently, this has dwindled to a modest 7,723 remaining queued at the time of writing. Since Dec. 19, 2024, the average onchain fee has also declined, with bitinfocharts.com reporting at press time an average fee of 0.000015 BTC or $1.57 per transaction.

Conversely, mempool.space indicates that users are paying considerably less—approximately 2 satoshis per virtual byte (sat/vB)—which corresponds to $0.29 per transfer for a high-priority send. According to mempool.space data, transfers below 3 sat/vB are being confirmed in the very next block at 8 a.m. Eastern Time on Feb.1, 2025.

The current conditions are far from optimal for bitcoin miners, who continue to endure diminished revenue following the fourth halving in April 2024. Although bitcoin prices remain above the $100,000 mark, the hashprice has only increased by a modest quarter relative to its previous level.

This suggests that for miners to regain favorable positions, both bitcoin prices must climb and onchain activity should rise. Without an uptick in activity, miners may face challenges in securing adequate incentives to maintain chain security.