BlackRock just sold $20 million of this cryptocurrency

![]() Cryptocurrency Jun 21, 2025 Share

Cryptocurrency Jun 21, 2025 Share

BlackRock (NYSE: BLK), the world’s largest asset manager, has sold a significant amount of Ethereum (ETH), marking a notable change from its recent pattern of steady buying.

Specifically, on June 20, BlackRock’s spot Ethereum ETF (ETHA) saw an outflow of $19.7 million, the first after 30 days of continuous inflows.

This was also the biggest single-day outflow among all Ethereum ETFs, leading to a net market outflow of $11.3 million. Grayscale helped to balance this with an inflow of $6.6 million.

6/20 BlackRock ETH ETF $ETHA net flow -8,140 ETH ($-19.71 million)

(FIRST OUTFLOW IN LAST 30 TRADING DAYS, SINCE MAY 7TH)

Volume traded: $0.4 billion https://t.co/MS4ZPOhPR1 pic.twitter.com/S5t8q3k7lI— Trader T (@thepfund) June 21, 2025

Despite this drop, BlackRock still leads the Ethereum ETF market, with over $5.2 billion in total inflows since the fund launched.

This recent action contrasts with ETHA’s earlier strong performance, which included days with inflows over $100 million. So far, Ethereum ETFs have raised about $9.5 billion, with BlackRock, Fidelity, and Grayscale leading the charge.

The outflow from BlackRock may point to short-term caution from institutional investors. This comes as the cryptocurrency market experiences more volatility due to ongoing geopolitical issues in the Middle East.

ETH price analysis

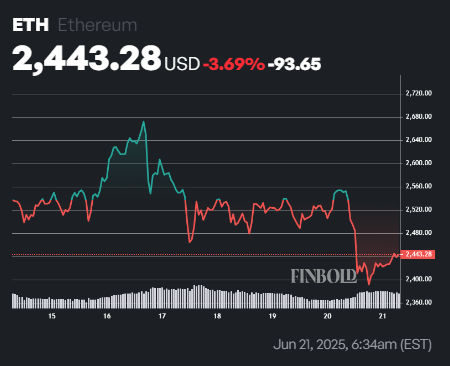

At press time, Ethereum was trading at $2,442.95, down 4% in the past 24 hours and 3.7% for the week.

ETH seven-day price chart. Source: Finbold

ETH seven-day price chart. Source: Finbold

Looking ahead, crypto trading analyst RLinda pointed out in a June 21 post on X that Ethereum closed Friday’s session on a weak note, testing the important $2,391 support level.

She cautioned that continued pressure around this level could lead to a breakdown, potentially pushing ETH to around $2,323.

ETH price analysis chart. Source: TradingView

ETH price analysis chart. Source: TradingView

Currently, Ethereum is trading below its 50-day simple moving average (SMA) of $2,497.15, but it remains above the 200-day SMA of $2,377.48. This suggests a mildly positive long-term trend, although the short-term momentum seems weak.

Meanwhile, the 14-day Relative Strength Index (RSI) is at 43, placing Ethereum in neutral territory, not yet oversold or overbought.

Featured image via Shutterstock