BlackRock reveals the only 2 cryptos worth buying

![]() Cryptocurrency Jan 2, 2025 Share

Cryptocurrency Jan 2, 2025 Share

As of January 2, 2024, BlackRock, the world’s largest asset manager, has revealed a heavy concentration in Bitcoin (BTC) and Ethereum (ETH), deeming them the only cryptocurrencies worth investing in.

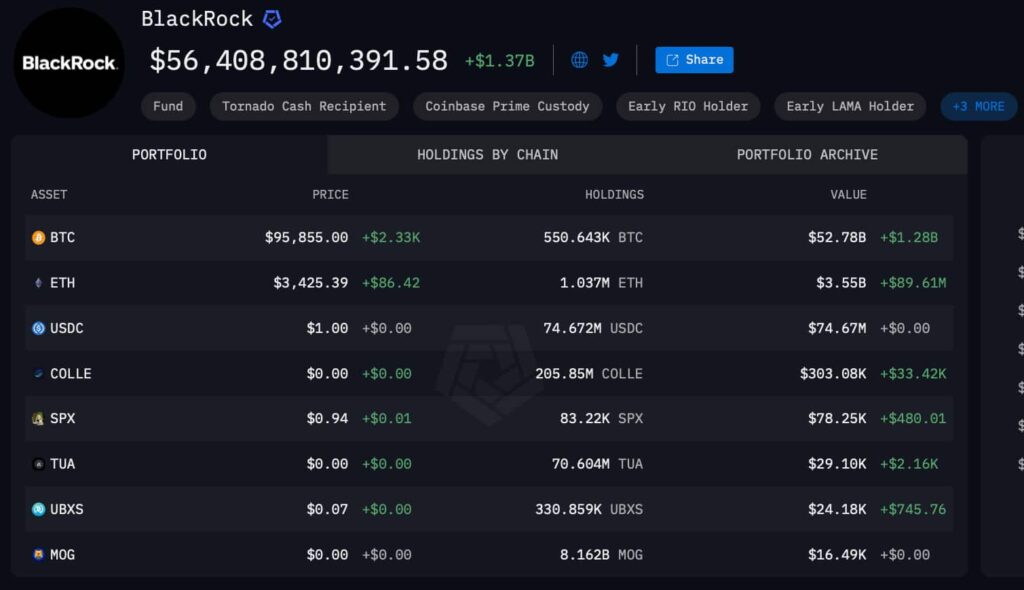

With a staggering $56.41 billion allocated to its cryptocurrency portfolio, Bitcoin and Ethereum dominate, accounting for over 99% of the portfolio’s value.

Dominance of Bitcoin and Ethereum in BlackRock’s strategy

Bitcoin leads the pack with 550,643 BTC holdings, valued at $52.78 billion at a current price of $95,855 per coin, representing a gain of $1.28 billion (+2.48%), as per data retrieved by Finbold from Arkham Intel.

Picks for you

3 Solana games to watch and play in 2025 19 hours ago Michael Saylor was wrong about Ethereum; There is a 'second best' 21 hours ago The next big wave: 2 new cryptos set to dominate in 2025 23 hours ago Here’s how much Andrew Tate’s crypto crashed in 2024 1 day ago

Ethereum follows with 1.037 million ETH worth $3.55 billion, priced at $3,425 per token, and an increase of $89.61 million (+2.59%). These two assets form the bedrock of BlackRock’s cryptocurrency approach, reflecting the company’s faith in their long-term potential.

BlackRock’s crypto portfolio. Source: Arkham Intel

BlackRock’s crypto portfolio. Source: Arkham Intel

The rest of BlackRock’s portfolio includes smaller exploratory holdings in stablecoin USDC, valued at $74.67 million, and alternative tokens such as COLLE ($303,080), SPX ($78,250), TUA ($29,100), UBXS ($24,180), and MOG ($16,490).

BlackRock’s shift in stance and the success of Bitcoin ETF

BlackRock’s transition from skepticism to adoption in the cryptocurrency space has been transformative. Initially hesitant, the firm launched its Bitcoin ETF after receiving SEC approval, following Grayscale’s legal battle with the SEC over a similar product.

BlackRock’s Bitcoin fund became a historic success, surpassing $50 billion in assets under management (AUM) within just 11 months—a feat Bloomberg has credited with driving Bitcoin’s price above $100,000 earlier this year.

The fund’s unparalleled performance has sparked speculation that its AUM could surpass gold ETFs in the coming years, signaling a seismic shift in institutional interest from traditional to digital assets.

Nate Geraci, CEO of ETF Store, predicted that unless Bitcoin’s price plummets in 2025, BlackRock’s Bitcoin ETF (IBIT) could overtake SPDR Gold Shares, the world’s largest gold ETF.

Limited Interest beyond Bitcoin and Ethereum

Earlier this year, Robert Mitchnick of BlackRock noted that there is “very little interest” in other cryptocurrencies among their investors, indicating that the growth potential for altcoins may remain constrained.

While Bitcoin and Ethereum dominate BlackRock’s crypto strategy, the broader market is evolving. Firms like Franklin Templeton and VanEck explore blockchain projects like Solana (SOL), there is optimism that altcoins could gain traction through future ETF approvals.

Franklin Templeton has been vocal in its support for Solana, calling it one of the most promising blockchain projects. Meanwhile, ETF filings for XRP by WisdomTree, Bitwise, and Canary Capital highlight growing institutional interest in expanding crypto offerings beyond the two heavyweights.

Solana’s futures-based ETF applications and the growing interest in XRP ETFs suggest a diversification trend in the institutional landscape. Analysts like Eric Balchunas of Bloomberg believe that the approval of futures-based ETFs could pave the way for spot ETFs, providing altcoins like Solana and XRP with institutional exposure.

Featured image via Shutterstock