Buy signal for two oversold cryptocurrencies this week

![]() Cryptocurrency Jan 13, 2025 Share

Cryptocurrency Jan 13, 2025 Share

The cryptocurrency market remains under pressure as macroeconomic uncertainties weigh on investor sentiment. In this context, two cryptocurrencies appear to be trading at notable discounts, presenting potential entry points despite the broader market downturn.

Bitcoin (BTC), the largest cryptocurrency by market capitalization, has dropped 3.37% in the past 24 hours, trading at $91,808, following stronger-than-expected U.S. jobs data.

The robust labor market has raised concerns that the Federal Reserve may maintain higher interest rates for longer, further tightening liquidity and amplifying market uncertainty.

Picks for you

MicroStrategy adds 2,530 Bitcoin, pushing total holdings to 450,000 BTC 11 hours ago $11.5 trillion BlackRock launches Bitcoin ETF on CBOE Canada 11 hours ago Is Bitcoin price set to plunge below $90k? 13 hours ago Crypto expert says XRP could hit $4 in the ‘next couple of days’ 13 hours ago

This sentiment has weighed heavily on the market, with the global cryptocurrency market capitalization dropping 5.8% in the past 24 hours to $3.32 trillion. Data from CoinGlass reveals that over $740 million in liquidations were recorded during this period, reflecting the intensity of the sell-off.

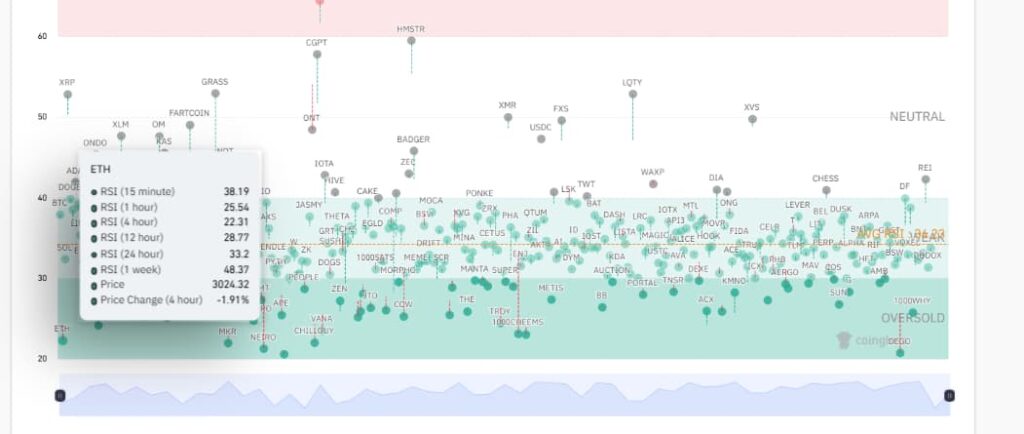

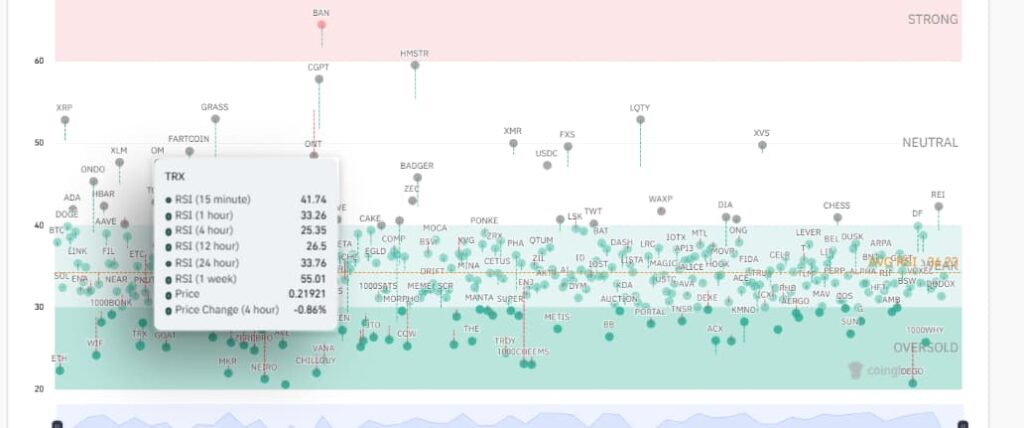

Amid this backdrop, Finbold analyzed the Relative Strength Index (RSI) heatmap from CoinGlass on January 13. With an average 12-hour RSI of 33.7, we identified potential buy opportunities across the sector, even as volatility continues to challenge market stability.

Ethereum (ETH)

Ethereum (ETH) is showing signs of being oversold, presenting a potential buying opportunity for traders and investors focused on short-term gains. The four-hour RSI has dropped to 22.31, while the 12-hour RSI sits at 28.77, both indicating significant selling pressure that appears to be waning.

Meanwhile, the 24-hour RSI of 33.2, though slightly above the oversold threshold, shows undervaluation aligning closely with broader market conditions. Coupled with a 1.91% price decline over the past four hours, ETH seems poised for a potential recovery if market sentiment shifts.

Crypto Market RSI Heatmap, 12-hour chart: ETH. Source: CoinGlass

Crypto Market RSI Heatmap, 12-hour chart: ETH. Source: CoinGlass

However, the one-week RSI of 48.37 highlights a neutral longer-term trend, suggesting the broader market has yet to confirm a decisive bullish reversal.

Traders eyeing short-term gains may see an opportunity to capitalize on current conditions, anticipating a recovery as RSI levels normalize. Long-term investors, on the other hand, may view the current price as an attractive entry point for accumulation, though macroeconomic developments will play a crucial role in shaping Ethereum’s trajectory moving forward.

TRON (TRX)

TRON (TRX) is flashing oversold signals, presenting a potential buying opportunity as technical indicators suggest a rebound may be on the horizon.

The four-hour RSI of 25.35 and the 12-hour RSI of 26.5 firmly place the token in oversold territory, signaling that selling pressure is likely nearing its limit.

Meanwhile, the 24-hour RSI of 33.76, though slightly above the oversold threshold, still points to undervaluation compared to broader market conditions. These metrics indicate that TRX may be primed for a short-term recovery if momentum shifts in its favor.

Crypto Market RSI Heatmap, 12-hour chart: TRX. Source: CoinGlass

Crypto Market RSI Heatmap, 12-hour chart: TRX. Source: CoinGlass

Additionally, TRX’s price has experienced a slight decline of 0.86% over the past 4 hours, reflecting the continuation of selling pressure.

With a one-week RSI of 55.01, TRX retains a neutral outlook in the long term, suggesting room for short-term recovery without overextension.

For traders, the oversold conditions on multiple timeframes provide a compelling opportunity to anticipate a bounce, while long-term investors might see this as a chance to accumulate at discounted levels before momentum picks up.

However, relying solely on RSI as an indicator comes with risks. A broader evaluation, incorporating other technical tools, market trends, and fundamental analysis, is essential for informed decision-making.

While the potential for recovery is evident, a cautious and diversified approach remains key to navigating the unpredictable cryptocurrency landscape.

Featured image via Shutterstock