ChatGPT builds a $1,000 crypto portfolio for 2025

![]() Cryptocurrency Dec 27, 2024 Share

Cryptocurrency Dec 27, 2024 Share

The wider cryptocurrency market entered a bull run following the conclusion of the United States presidential election in November. However, the surge hit its first speed bump quite quickly — in mid-December, the Federal Reserve announced that it would put fewer rate cuts in place in 2025 than was originally expected.

Bitcoin (BTC) saw prices crash from an all-time high (ATH) of roughly $106,000 to just $92,000, and altcoins predictably followed suit. December 20 turned out to be the worst day, with as much as $310 billion exiting the market. However, by press time, the price of Bitcoin had recovered to $96,551.

While analysts mostly remain bullish, there is an increasing number of voices that are now predicting a short-term correction. With these new developments in mind, Finbold has consulted OpenAI’s most advanced large language model (LLM) to construct a $1,000 cryptocurrency portfolio for the coming year.

Picks for you

Bitcoin adds $1.1 trillion in 2024 28 mins ago Will Wall Street adopt the Bitcoin standard? The ‘BTC treasury operations virus is spreading’ 3 hours ago Analysts warn Bitcoin will crash to $60,000 4 hours ago Cardano adds nearly 100,000 smart contracts in 2024 5 hours ago

Blue-chip cryptocurrencies (70%)

A vast majority of GPT’s proposed portfolio is dedicated to blue-chip cryptocurrencies — namely, Bitcoin and Ethereum (ETH). With an initial balance of $1,000, the AI model would invest $700 in two flagship digital assets.

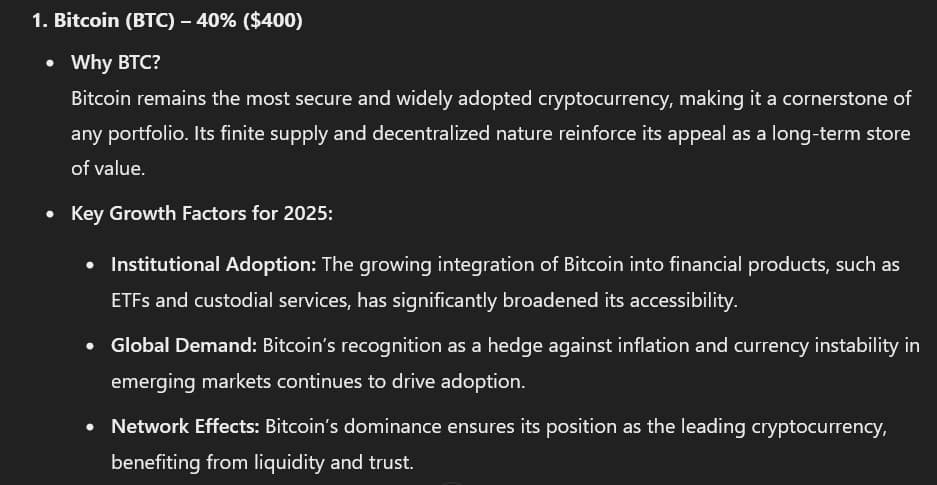

In the case of Bitcoin, which accounts for 40% of the entire portfolio, ChatGPT cited increasing institutional adoption, widespread global demand, and increasingly recognized utility as a store of value and hedge against inflation as bullish catalysts.

ChatGPT’s reasoning for picking BTC. Source: OpenAI

ChatGPT’s reasoning for picking BTC. Source: OpenAI

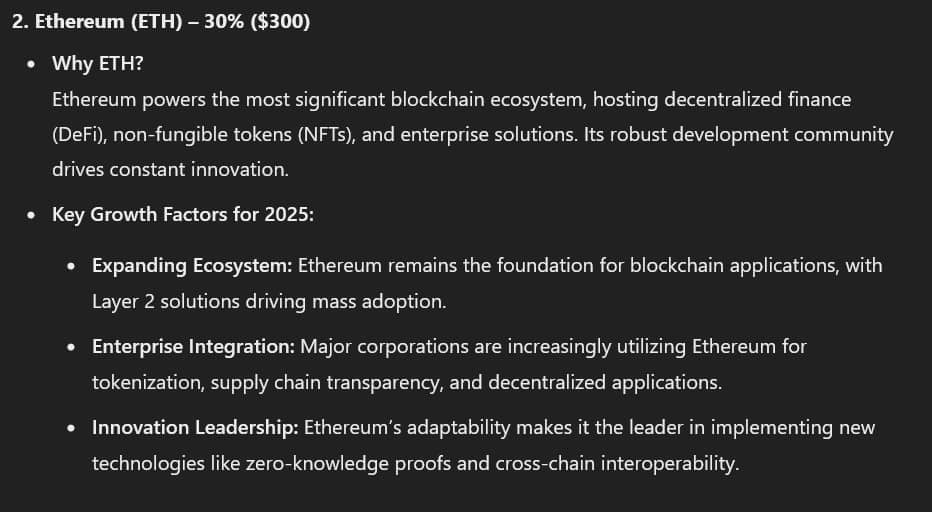

On the other hand, 30% of the portfolio was allocated to Ethereum, owing to its already dominant and expanding ecosystem, widespread adoption by enterprises, and robust development community.

ChatGPT’s reasoning for picking ETH. Source: OpenAI

ChatGPT’s reasoning for picking ETH. Source: OpenAI

High-potential altcoins (25%)

Surprisingly enough, ChatGPT only allocated a quarter of the portfolio — 25%, to altcoins. Readers should note that a wide variety of cryptocurrency analysts, such as Michaël van de Poppe, predict that altcoins will outperform BTC in 2025.

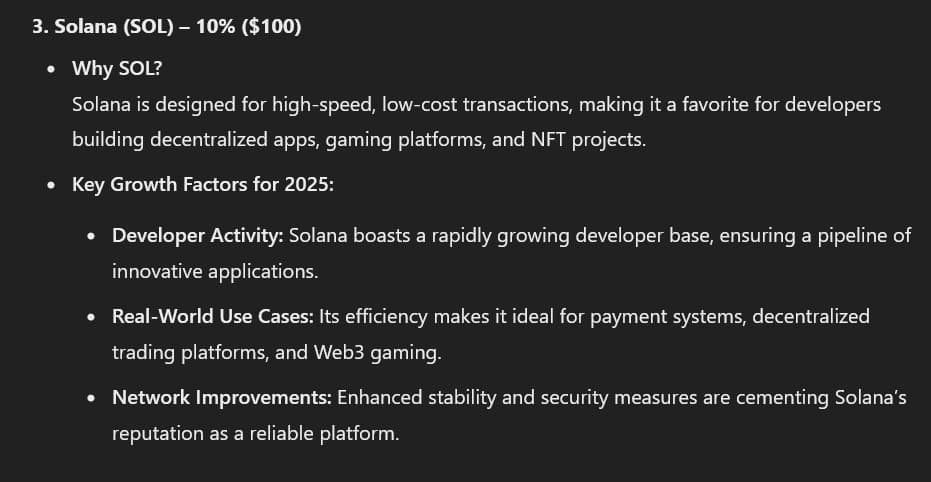

The AI model set a 10% allocation for Solana (SOL). An active and rapidly growing developer base, fast and affordable transactions, and a wide variety of use cases were singled out as tailwinds.

ChatGPT’s reasoning for picking SOL. Source: OpenAI

ChatGPT’s reasoning for picking SOL. Source: OpenAI

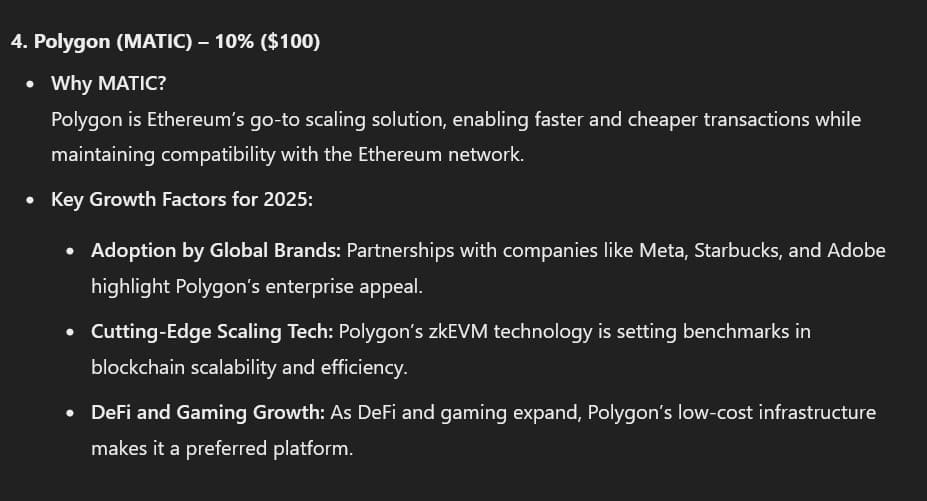

Up next, Polygon (MATIC) accounts for the same proportion of ChatGPT’s portfolio, at 10%. As Ethereum’s go-to scaling solution, Polygon is uniquely positioned to benefit from the rise of one of the cryptocurrency market’s most notable listings and has already secured numerous strategic partnerships with major enterprises.

ChatGPT’s reasoning for picking MATIC. Source: OpenAI

ChatGPT’s reasoning for picking MATIC. Source: OpenAI

Finally, Arbitrum (ARB) represents 5% of the AI model’s portfolio — OpenAI’s model reflected on the project’s dominant position among Layer 2 networks and continuing expansion in the DeFI space as key drivers for growth in 2025.

ChatGPT’s reasoning for picking ARB. Source: OpenAI

ChatGPT’s reasoning for picking ARB. Source: OpenAI

Stablecoins (5%)

Last but not least, ChatGPT suggested that investors should set aside 5% of their portfolio for stablecoins — preferably Tether (USDT) or USD coin (USDC).

Unlike the other assets that were picked, the role of these stablecoins is not to secure returns — rather, this allocation is meant to provide a degree of stability to the portfolio, as well as the option to take advantage of any opportunities that might pop up over the course of 2025.

ChatGPT’s reasoning for picking stablecoins. Source: OpenAI

ChatGPT’s reasoning for picking stablecoins. Source: OpenAI

As interesting as the AI model’s outputs are — they can certainly provide some degree of insight, investors should remember that the responses given by ChatGPT cannot serve as a suitable substitute for due diligence and personal research.

Perhaps more importantly, ChatGPT cannot account for personal circumstances — and while this portfolio does appear to be broadly applicable, readers should always be wary of ‘one size fits all’ solutions when it comes to investing.

Featured image via Shutterstock