ChatGPT picks 2 altcoins to buy and add to your crypto portfolio in March

![]() Cryptocurrency Mar 6, 2025 Share

Cryptocurrency Mar 6, 2025 Share

The cryptocurrency market staged a sharp recovery, bouncing back from a steep sell-off sparked by Trump’s announcement of 25% tariffs on U.S. imports from Canada and Mexico.

The downturn wiped out $460 billion from the total crypto market capitalization and triggered $985 million in liquidations. However, the market rebounded as Bitcoin (BTC) surged to $92,700 following Trump’s decision to postpone new tariffs on automobiles from Canada and Mexico for one month.

With market volatility still in play, investors are actively searching for cryptocurrencies with strong growth potential to add to their portfolios.

Picks for you

WhiteBIT partners up with Bequant to work on institutional crypto trading solutions 12 mins ago DeepSeek AI says Cardano (ADA) will hit this target by March 31,2025 16 hours ago 2 overbought cryptocurrencies to avoid buying now 17 hours ago Robert Kiyosaki blasts Bitcoin sellers after market crash 18 hours ago

Against this backdrop, Finbold analyzed market trends and consulted ChatGPT-4o to identify two altcoins that could offer promising opportunities in the current landscape.

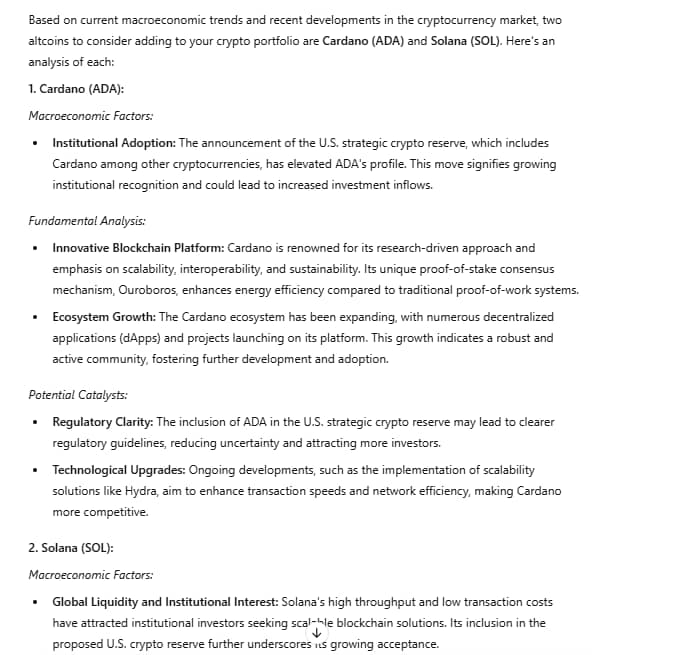

ChatGPT’s top two altcoin picks for March. Source: ChatGPT/Finbold

ChatGPT’s top two altcoin picks for March. Source: ChatGPT/Finbold

Cardano (ADA)

Cardano (ADA) is gaining momentum, trading at $0.945 with a weekly gain of over 41% following U.S. President Donald Trump’s announcement of the U.S. Strategic Crypto Reserve. The move, which includes ADA as one of its assets, has sparked expectations of greater institutional adoption and long-term price stability.

ADA one-week price chart. Source: Finbold

ADA one-week price chart. Source: Finbold

Market reaction has been swift, with whale investors accumulating over 420 million ADA tokens, a sign of confidence in its long-term potential.

On-chain activity has also surged, with Total Value Locked (TVL) jumping from $323 million on March 2 to $445 million by March 6, indicating strong capital inflows. Daily transactions have also risen sharply, from 34,400 on March 1 to 58,600 on March 4, further indicating growing network adoption.

Adding to the bullish sentiment, the SEC’s acknowledgment of Grayscale’s Cardano ETF filing has positioned ADA for increased institutional exposure. A decision is expected by August 2025, and if approved, the ETF could bring significant capital inflows and further integrate Cardano into the broader financial system.

Looking ahead, Charles Hoskinson’s 2025 vision for Cardano—integrating Bitcoin DeFi, scaling with Leios, and expanding interoperability via Chainlink (LINK) and stablecoins, could significantly enhance network adoption and utility.

Solana (SOL)

Solana (SOL) is maintaining steady momentum, trading at $149.08 with a weekly gain of over 6%, following President Trump’s announcement of a Strategic Crypto Reserve. The inclusion of SOL as one of its key assets has raised expectations of long-term price stability and increased institutional adoption.

Solana one-week price chart. Source: Finbold

Solana one-week price chart. Source: Finbold

Investor sentiment remains bullish, with ETF anticipation driving interest. The SEC is reviewing multiple Solana ETF applications, including those from 21Shares, Bitwise, VanEck, and Canary Capital’s Solana Trust.

The recent SEC acknowledgment of Grayscale’s Solana ETF filing has fueled expectations for broader approvals. If greenlit, a Solana ETF could significantly boost trading volume and make SOL more accessible to institutional investors.

Despite concerns over large token unlocks, Solana has remained remarkably stable, showing no significant volatility following recent supply releases. With these factors in play, Solana remains a compelling buy for traders looking to capitalize on its long-term potential.

Featured image via Shutterstock