ChatGPT says Cardano (ADA) will hit this target by Q1 2025

![]() Cryptocurrency Feb 11, 2025 Share

Cryptocurrency Feb 11, 2025 Share

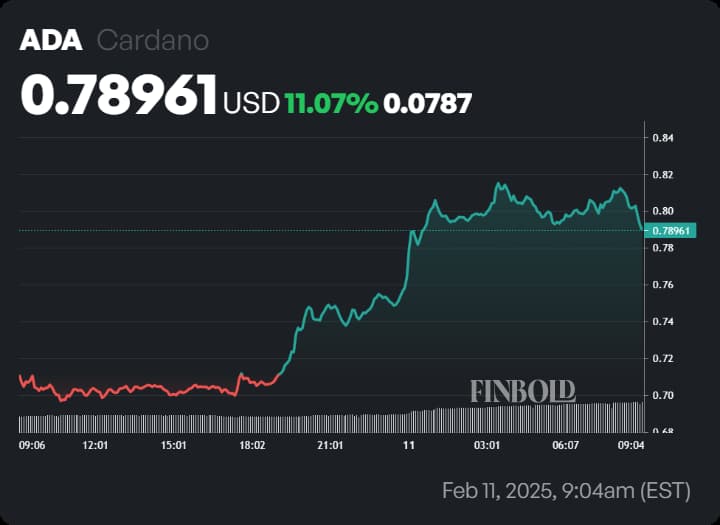

After a sluggish start to 2025, Cardano (ADA) has staged a sharp rebound. The cryptocurrency had slipped 6% year-to-date, struggling to regain momentum after failing to reclaim the $1 mark since January 20.

However, it has now surged 11% in a day, trading at $0.789 at press time, as speculation around a potential Cardano exchange-traded fund (ETF) gathers steam.

Cardano one-day price chart. Source: Finbold

Cardano one-day price chart. Source: Finbold

As optimism around a possible ETF approval grows, analysts and traders are closely watching ADA’s next move. To assess its prospects, Finbold analyzed market data and consulted OpenAI’s advanced ChatGPT-4o model for insights into the asset’s potential trajectory in early 2025.

Picks for you

S&P 500's ‘massive rally starting’; Is 6,600 next? 1 second ago Gold price alert: Key levels to watch right now 43 mins ago We asked DeepSeek AI what will be XRP price end of 2025 1 hour ago Nexo Card now available in Switzerland and Andorra 3 hours ago

Key factors driving Cardano’s price

Ongoing discussions over a Cardano ETF remain a major catalyst for ADA’s price action. NYSE Arca has filed a 19b-4 form with the U.S. Securities and Exchange Commission (SEC), proposing a rule change to list and trade shares of the Grayscale Cardano Trust.

According to ChatGPT-4o, an approval could significantly boost institutional demand, offering a regulated pathway for major investors to gain exposure to ADA.

If given the green light, this would mark Grayscale’s first standalone Cardano investment product, potentially accelerating mainstream adoption and increasing market inflows.

However, the AI model warns that regulatory delays or rejections could trigger a pullback, as market sentiment shifts in response to evolving expectations.

ChatGPT outlook on ADA. Source: ChatGPT/Finbold

ChatGPT outlook on ADA. Source: ChatGPT/Finbold

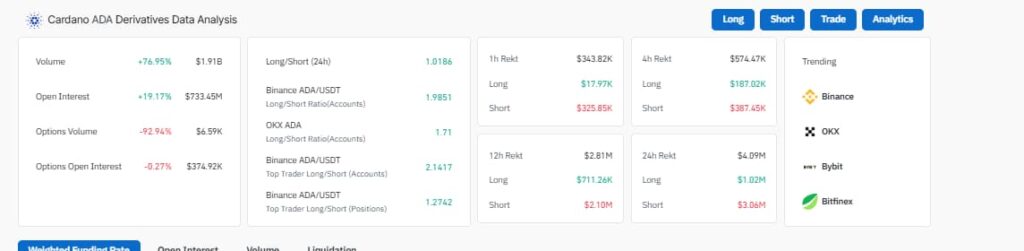

Derivative data paints a mixed picture

When provided with additional derivative data, the AI model notes a cautiously bullish outlook for ADA. Trading volume has surged 76.95% to $1.91 billion, while open interest has climbed 19.17% to $733.45 million, signaling growing market participation.

ADA derivatives data. Source: CoinGlass

ADA derivatives data. Source: CoinGlass

Binance’s long/short ratio at 2.1417 and a wave of short liquidations suggest a potential short squeeze, further supporting bullish sentiment.

However, a sharp 92.94% drop in options volume and $2.81 million in long liquidations over the past 12 hours highlights lingering uncertainty, as observed by the AI model.

While momentum appears to favor further gains, ADA must defend key support levels and avoid excessive long liquidations to confirm a sustained breakout.

Adding to the technical picture, analyst Ali Martinez observed that ADA is currently testing a key support zone between $0.67 and $0.81. A decisive hold above this range could pave the way for a strong rebound, setting the stage for further upside if buyers maintain control.

ChatGPT’s Q1 2025 price prediction for ADA

By factoring in both derivatives data and current market momentum, ChatGPT-4o projects ADA could sustain its upward trajectory provided ETF optimism holds and key technical levels remain intact.

The AI model observed that a sustained position above its critical support range, coupled with growing institutional interest, could push ADA toward $1.30 to $1.50 by the end of Q1 2025.

However, regulatory setbacks or an increase in long liquidations could weaken momentum, potentially dragging ADA toward $0.70 or lower if selling pressure intensifies.

This outlook aligns with projections from Rose Premium Signals, which set a mid-term price target of $1.30 for Cardano, with short-term targets of $0.9837 and $1.1619.

Featured image via Shutterstock