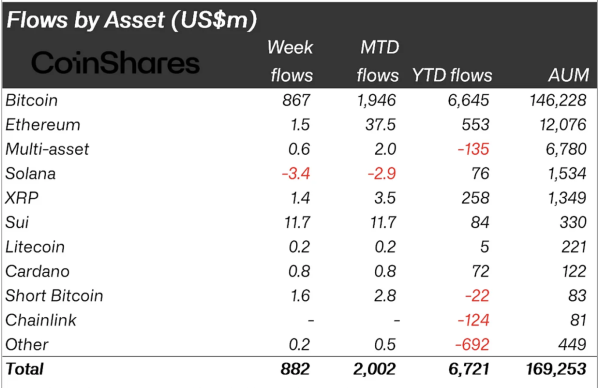

Digital asset investment products recorded $882 million in inflows last week, marking the fourth consecutive week of gains, according to the latest report from CoinShares. This strongest weekly inflow since early March brings total year-to-date (YTD) inflows to $6.7 billion. This figure is nearing the February peak of $7.3 billion proving renewed institutional interest in the crypto market.

The trend reflects growing confidence in the sector, driven by rising market prices and increased adoption of exchange-traded products tied to digital assets. Last week’s performance represents the strongest weekly inflow since early March.

Bitcoin ETFs Rake In Vast Majority of New Institutional Crypto Investment

Bitcoin led all digital assets with $867 million in inflows, accounting for the vast majority of the week’s total. Since the launch of U.S.-listed spot Bitcoin ETFs in January 2024, these products have attracted a cumulative $62.9 billion net inflows.

Related: U.S. ETF Inflows Top $47 Billion as IBIT, Tech, and Europe Funds Lead May Surge

This surpasses the previous $61.6 billion set in February and highlights continued institutional appetite for Bitcoin exposure. While Bitcoin remains the dominant asset, short-Bitcoin investment products saw only minor $1.5 million in outflows, suggesting investor sentiment remains largely bullish on BTC.

Ethereum Lags in Institutional Appeal; Sui Outpaces Solana in Altcoin Inflows

Ethereum investment products, however, brought in just $1.5 million in inflows last week. Despite a notable price rally for ETH in recent days, Ethereum has not yet drawn the same level of institutional attention as Bitcoin.

Among other altcoins, Sui saw the highest inflows among other altcoins, drawing $11.7 million last week. This pushed its YTD inflows to $84 million, overtaking Solana, now at $76 million for the year.

Solana, Avalanche, and Chainlink saw either negligible gains or slight outflows. These mixed results suggest that while some investors diversify, others consolidate positions in Bitcoin and select emerging projects.

US Dominates Global Crypto Investment Flows; Macro Factors Cited

Regionally, the United States led with $840 million in inflows. Germany followed with $44.5 million, while Australia contributed $10.2 million. Meanwhile, Canada and Hong Kong posted modest outflows of $8 million and $4.3 million, respectively.

Related: US Spot Bitcoin ETFs See Largest Inflows Since January as BTC Reached $94,000

CoinShares attributes the inflows to macroeconomic factors, including a rise in global M2 money supply and mounting stagflation concerns in the U.S. These conditions have made digital assets more attractive as alternative stores of value. Adding to this institutional confidence, several U.S. states have recently approved Bitcoin as a strategic reserve asset.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.