Crypto.com launches Contracts for Differences on its app

![]() Cryptocurrency Sep 27, 2024 Share

Cryptocurrency Sep 27, 2024 Share

Not long after adding PayPal (NASDAQ: PYPL) as a payment method to its network, Crypto.com introduced CFDs (Contracts for Differences), a new cryptocurrency derivatives trading feature for its app, with the goal of increasing trading opportunities for more than 40 crypto assets.

Indeed, CFDs, which emulate trading an underlying asset without requiring the user to hold it, instead providing exposure to its price action so they can forecast if it will climb or decline – and profit if their predictions are correct – are already available in certain regions, the company said on September 26.

Specifically, CFD trading is currently available 24/7 in the Crypto.com app in jurisdictions such as Barbados, Chile, Egypt, El Salvador, Ghana, India, Kenya, Mexico, Philippines, Vietnam, and others, while the United States, United Kingdom, and the European Union countries are waiting their turn.

Picks for you

GraFun launches new meme coin launchpad on BNB chain with over 3.8 million pre-registrations 6 seconds ago Here’s why silver could reach $50, according to analyst 5 mins ago R. Kiyosaki reveals surprising asset to become ‘new gold’ 1 hour ago Gold at $3,000? Hedge funds bet big on ‘Cold War 2.0' 2 hours ago

Advantages of CFDs

According to the Crypto.com team, “CFDs allow for leverage, letting you get more from your capital as you only have to deposit a fraction of your position’s value to trade.” They also facilitate trading portfolio diversification and seamless, real-time, and mobile-native trading.

“You can go long or short with up to 20x leverage for CFDs in the Crypto.com App, and there are contracts for over 40 different cryptocurrencies available – the most offered anywhere.”

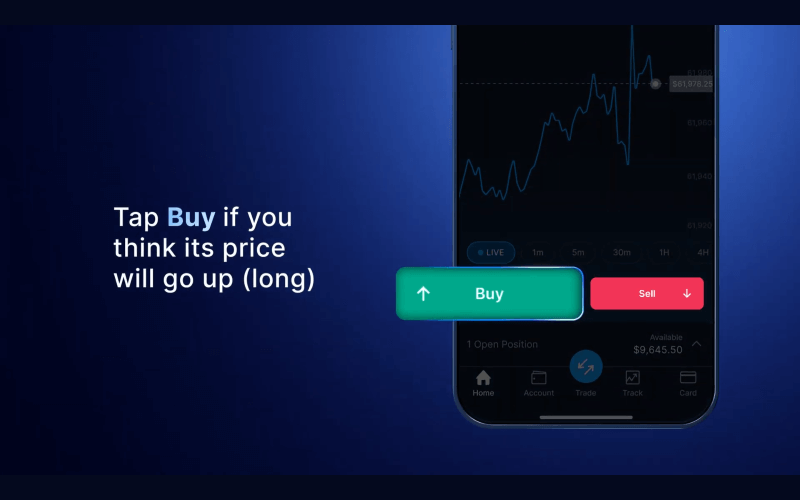

To start using CFDs, users only need to add funds to their CFD Wallet, select the underlying asset, tap ‘Buy’ if they think the price will go up (long), or ‘Sell’ if they think it will go down (short), input their desired contract quantity, and tap ‘Place Order’ to confirm their position, which they can check on the price chart.

CFD trading instructions. Source: Crypto.com

CFD trading instructions. Source: Crypto.com

For instance, users who believe the price of Bitcoin (BTC) will rise can buy a BTC CFD as they would buy 1 BTC, which means they are trading the price movements and not the assets themselves. Furthermore, they only need to deposit a fraction of their position’s full value to trade on leverage. However, the company warns that:

“While trading with leverage amplifies your potential profit, it can be risky as your potential losses are also amplified. Both profit and loss are calculated on your full position size, not just the deposit amount.”

Crypto.com’s rapid growth

Meanwhile, the recent development is the latest in the string of new improvements on the platform, which also partnered with PayPal in late August to allow users in the U.S. to link their PayPal accounts with their Crypto.com wallets, enabling easier trading of crypto assets directly through the platform.

More recently, the company secured a Payment Service Provider License from the Central Bank of Bahrain, in what was its latest milestone in global regulatory compliance and licensure, allowing it to broaden its offerings of e-money and fiat-based payment services across the region.