DeepSeek AI picks 2 altcoins to make you a millionaire by 2030

![]() Cryptocurrency Feb 2, 2025 Share

Cryptocurrency Feb 2, 2025 Share

The emergence of China’s artificial intelligence (AI) model, DeepSeek, has caused turmoil in both the stock and cryptocurrency markets, alongside the technology sector.

Notably, the tool’s rise to prominence has been driven by its perceived ability to perform at high levels compared to competitors at a fraction of the cost.

To explore the tool’s potential, Finbold tasked the AI model with identifying two altcoins that can make investors millionaires by 2030. Below are the tool’s selections.

Picks for you

AI predicts Bitcoin price for February 28, 2025 4 hours ago Dogecoin set for 'steep price correction ahead,' warns expert 7 hours ago R.Kiyosaki explains how to get rich with Trump's tariffs 23 hours ago Bitcoin's 'megaphone pattern' breaks out; Is $270,000 next? 1 day ago

Chainlink (LINK)

According to DeepSeek, Chainlink’s (LINK) potential lies in its role in the decentralized oracles space, a critical component of the DeFi sector.

The model noted that Chainlink’s expansion into tokenized real-world assets, cross-chain interoperability, and even blockchain gaming, coupled with strategic partnerships, highlights its broadening influence, likely to trigger price growth.

Some of the partnerships include Usual, a decentralized stablecoin protocol, adopting the Chainlink Standard to enhance the liquidity and utility of its native $USD0++ and $USD0 tokens.

It also pointed out that Chainlink’s revenue model, where projects pay fees in LINK, could lead to sustained demand for the token as blockchain usage proliferates.

At the same time, DeepSeek noted that despite the competition, Chainlink’s established position might see it through the next wave of blockchain adoption, potentially offering a 20- to 50-fold return from its current price.

Meanwhile, the token’s potential growth also lies in the possibility of increased institutional capital inflow, especially with the possible launch of a related exchange-traded fund (ETF).

In this regard, Tuttle Capital Management has filed with the Securities and Exchange Commission (SEC) to propose the first ETF tied to Chainlink.

As of press time, LINK was trading at $22.11, dropping nearly 10% in the last 24 hours. The token is down 13% on the weekly chart, aligning with the general market sentiment.

LINK seven-day price chart. Source: Finbold

LINK seven-day price chart. Source: Finbold

Fetch.ai (FET)

AI-focused Fetch.ai (FET) was DeepSeek’s second pick, noting that its potential for growth lies in its underlying role of automating tasks, from supply chain management to energy trading.

The tool highlighted Fetch.ai’s strategic partnerships with companies like Bosch and Deutsche Telekom and its involvement in the “Artificial Superintelligence Alliance” through a merger with SingularityNET and Ocean Protocol as key milestones for its growth.

At the same time, DeepSeek noted that with a relatively low market cap, FET has room to grow immensely if the integration of AI with blockchain technology becomes commonplace.

Conversely, the AI tool noted that Chainlink’s growth could be hampered by competition and regulatory uncertainties, which are significant hurdles.

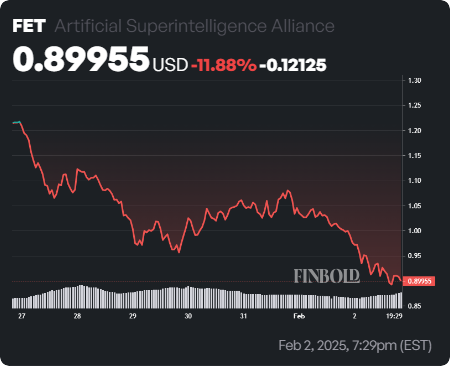

As of press time, FET was valued at $0.89, dropping 10% in the last 24 hours.

FET seven-day price chart. Source: Finbold

FET seven-day price chart. Source: Finbold

In summary, DeepSeek cautioned that while LINK and FET hold strong fundamentals, no investment is a sure path to riches. It recommended that a long-term hold strategy with expected volatility is the best approach to such investments.

Featured image via Shutterstock