Did Peter Schiff just turn bullish on Bitcoin?

![]() Cryptocurrency Nov 14, 2024 Share

Cryptocurrency Nov 14, 2024 Share

In online spaces, the U.S. economist Peter Schiff is mostly known as an ardent supporter of gold and a major Bitcoin (BTC) skeptic.

BTC’s most recent bull run, however, led Schiff to make a highly unusual X post in which he apparently promotes investments in the cryptocurrency as a way to fix Social Security.

In the post, Schiff postulated that Social Security should seek to purchase about 25% of the total Bitcoin supply, thus driving the coin ‘to the moon’ and increasing the trust fund’s worth to approximately $100 trillion.

Picks for you

Will Americans be wiped out? U.S. household debt rockets to $17.9 trillion now stands at 60% GDP 39 mins ago Why Gold price is crashing 2 hours ago Elise Stefanik’s net worth revealed: How rich is Trump’s nominee for the US Ambassador to the United Nations? 3 hours ago Blockchain for Good Alliance hosts the Web3 Oscar event in Bangkok 4 hours ago

This would ensure that the fund can fully offset its 75-year forward-looking estimated unfunded liability of $23 trillion.

In the post, Schiff also explained that Social Security should then take inspiration from cryptocurrency investors and ‘hodl.’

I'm finally coming around. #Bitcoin fixes Social Security. I've got the plan:

The Social Security Trust Fund now owns about $2.7 trillion in Treasuries. It should sell all of those Treasuries and buy Bitcoin. This buying will surely send Bitcoin to the moon, especially since a…

— Peter Schiff (@PeterSchiff) November 13, 2024

How would Social Security pay benefits if it ‘hodling’ Bitcoin?

The issue of actually paying out the benefits would be solved by the government declaring Bitcoin a reserve currency, thus enabling the fund to receive cash from the Fed by providing the cryptocurrency as collateral.

This approach would, according to Schiff, also have the added benefit of lowering the national debt burden as the government would not need to pay interest on BTC in the same way it does for bonds.

Does Peter Schiff now really support Bitcoin investments?

The final line of the X post, however, serves as the decisive blow for all those who thought Schiff truly turned bullish on Bitcoin. Specifically, the economist then proposed that the government use BTC to solve ‘everything else’ with the cryptocurrency and lamented that Satoshi Nakamoto did not invent the ‘cure-all’ sooner.

Indeed, the post’s tone is sarcastic, with the implication, in truth, being that Schiff still sees Bitcoin as little more than snake oil.

Some of the economist’s other recent posts – equally sarcastic but, perhaps, more earnest – do much to illuminate the ongoing skepticism. For example, on November 13, Peter Schiff declared that there is now a use case for Bitcoin as penny stock companies can ‘to pump up the price of the stocks they want to dump.’

I was wrong. #Bitcoin has utility after all. It's the perfect tool for penny stock promoters to use to pump up the price of the stocks they want to dump. All they have to do is announce that they will issue more shares to buy Bitcoin. It's now officially the Dot-Bitcoin bubble!

— Peter Schiff (@PeterSchiff) November 12, 2024

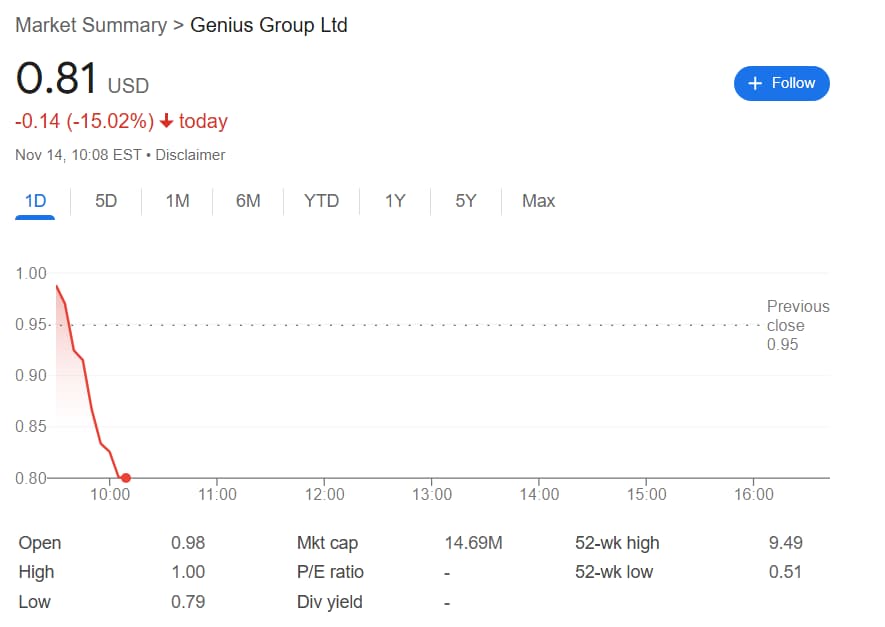

He cited the recent example of Genius Group Limited (NYSEAMERICAN: GNS) – a company that saw its stock price rocket after it announced plans to sell $120 million worth of shares to buy BTC. It is worth pointing out that the GNS rally was short-lived, and the share price is down 15.02% in the initial hours of Thursday trading.

GNS stock 1-day price chart. Source: Google

GNS stock 1-day price chart. Source: Google

Is Peter Schiff wrong about Bitcoin?

Though Peter Schiff remains unconvinced, he has been wrong about Bitcoin in the past and may soon be proven wrong about yet another bearish prediction: that the cryptocurrency will never reach a price of $100,000 per coin.

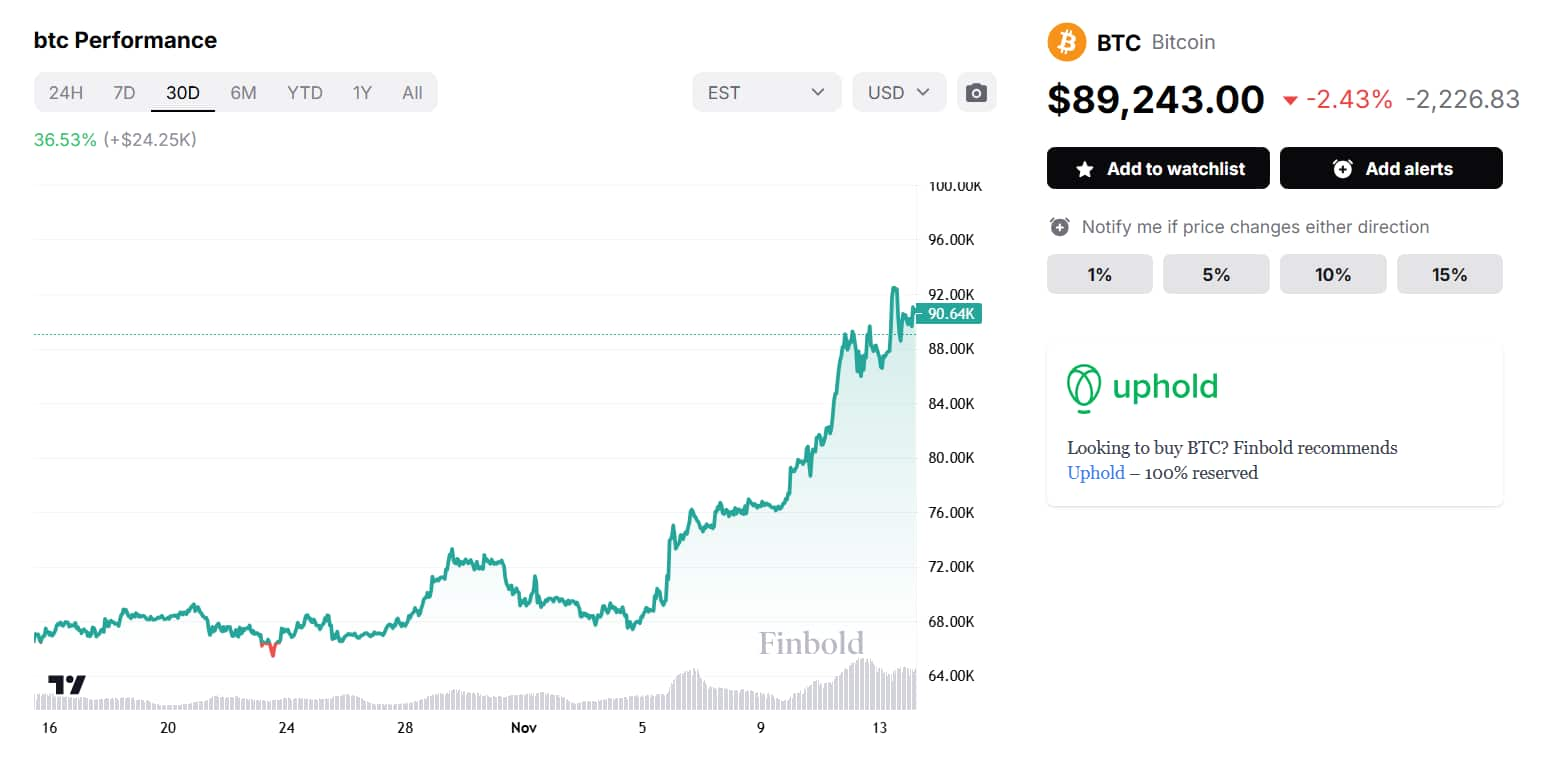

The world’s premier cryptocurrency has been on a particularly strong rally ever since Donald Trump was declared winner of the 2024 presidential election and is up 36.53% in the last 30 days to BTC price today of $89,243.

Though the rally has not been entirely smooth and has rejected several key resistance levels along the way – the most recent relevant points being first at about $90,000 and $93,000 – it appears poised for a further surge and, potentially, a rise to the long-awaited $100,000.

Featured image via Peter Schiff YouTube.